No Time To Be A Hero

It’s almost time to turn the page on 2022… One of the worst years for most investors in history.

You’ve already seen the damage.

Speculative stocks are in a bear market, with many of last year’s most popular tickers down 80% or more.

Bonds were supposed to keep conservative investors safe. But with interest rates rising, these “safe” investments have performed just as badly.

But now we’re turning the page and starting a new year. So should you “double down” and start buying cheap growth stocks that are now trading much lower?

That looks like a terribly dangerous move right now…

Heroes Get Carried Out on Their Shields

My old hedge fund mentor pulled me aside one day as the dot-com bubble was deflating. I had just recommended buying some internet stock that was off sharply from its recent high.

As a young trader, I thought it was a great idea. After all, even a small rebound could give us a nice percentage gain over a short period of time.

Here’s what my boss and mentor told me:

“Zach, that may be a hero’s move. And if you’re RIGHT, you’ll make a lot of money. But remember… most of the time heroes get carried out on their shields.”

That visual is a good reminder to protect your capital as your first priority. And to invest in opportunities only when the potential returns heavily outweigh your risks.

I’m thinking about this phrase today as I review some important charts. Here’s one of the most ominous charts I’m watching in today’s market.

You’re looking at a chart of the ARK Innovation ETF (ARKK), a technology fund chock full of the most speculative names in the market right now.

This fund was one of the most successful plays in 2020.

During the pandemic, speculative stocks soared as individual investors poured money into growth names. And since ARKK invested heavily in those names, the fund itself booked a massive profit.

But today, those profits are evaporating. And investors are getting crushed.

Hero Stocks to Avoid in 2023

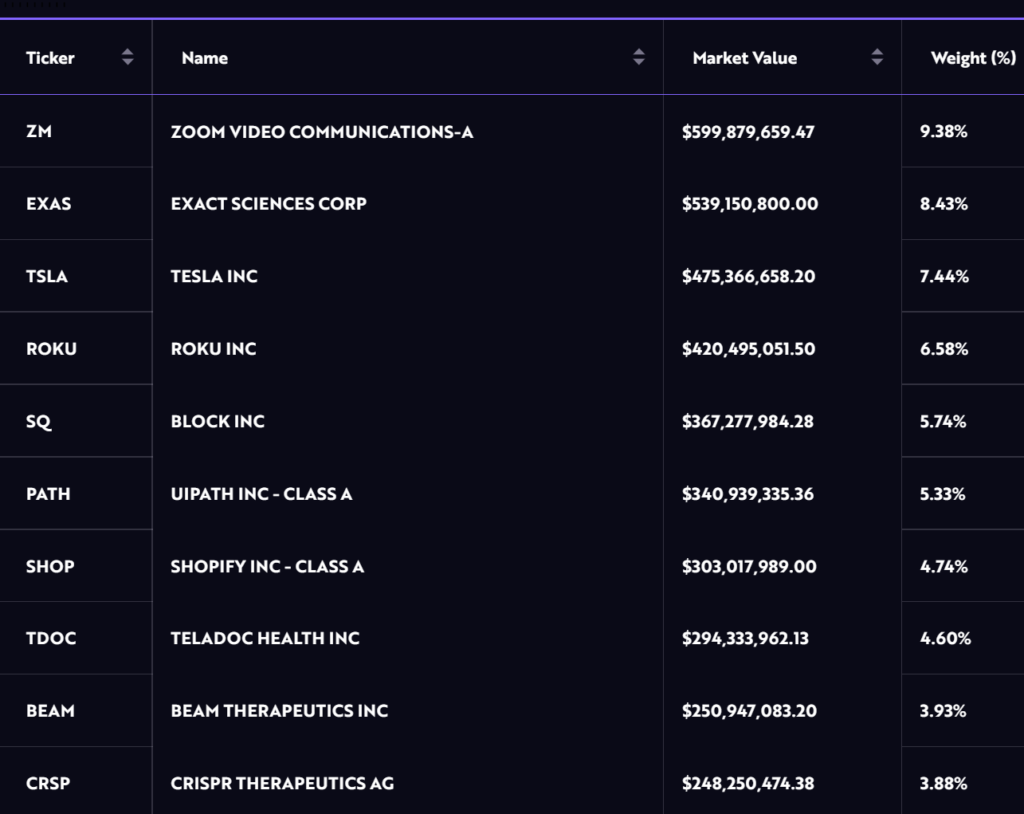

If you look closely at the stocks ARKK is invested in, you’ll see why the fund has performed so badly.

This list is a “who’s who” of speculative stocks with huge risks and relatively low upside potential.

- Zoom’s profits will contract next year and the company faces a tremendous amount of competition.

- Exact Sciences has a $9 billion company value but is losing money. (And will continue to post losses for years to come).

- Tesla trades for 25 times next year’s expected profits and has been in a relentless downtrend.

- Roku will continue to post losses for years and faces extreme competition from established streaming media companies.

- Block carries risk tied to the meltdown in cryptocurrencies, along with competition from many other financial tech plays.

And the list goes on…

Sure, these stocks may get a bear market rally over the next few weeks or months. But they could also lose another 10% to 20% (or more) before a bear market rally materializes.

And if you buy now, you could be stuck with growing losses hoping to just break even on your trade.

Focus on What’s Working

Here’s another of my mentor’s memorable phrases:

“If it’s working, BUY MORE!”

Despite the bear market, there are still plenty of areas that are holding up well.

Energy stocks are still in great shape. And most companies in the industry are growing profits, paying dividends and buying back shares.

This is a great backdrop for investment profits. And there’s plenty of room for these stocks to continue trading higher.

Defense stocks are also trading higher. Military spending continues to be strong, thanks in part to U.S. support of Ukraine.

And I’m watching precious metal prices and mining stocks carefully as well. As the U.S. dollar weakens, prices for gold and silver are trending higher. And mining companies naturally benefit from rising metal prices.

These are just a few of the areas I’m seeing opportunity in right now.

If these areas are “working”, why not invest in the profitable areas that are more reliable. That way you can safely grow your wealth without taking too much risk with speculative technology stocks.

Don’t be a hero this holiday season.

More By This Author:

Don’t Look Now, But Housing Stocks Are Up

For Crude Oil, It’s 1986 All Over Again

What’s Going On With Blackstone?