The Short Put Ladder Strategy Guide

There are numerous options structures an investor can choose. This article will provide an overview of one of these structures, the Short Put Ladder. First, we will give an overview of the position. We will then discuss when it is best to implement them in a portfolio. Let’s get started.

The Basics, What is a Short Put Ladder?

A Short Put Ladder Consists of 3 parts or legs. To create a Short Put Ladder, we must have the following:

- Short 1 in-the-money put.

- Long 1 at-the-money put.

- Long 1 out-of-the-money put.

The Short Call Ladder Visualized

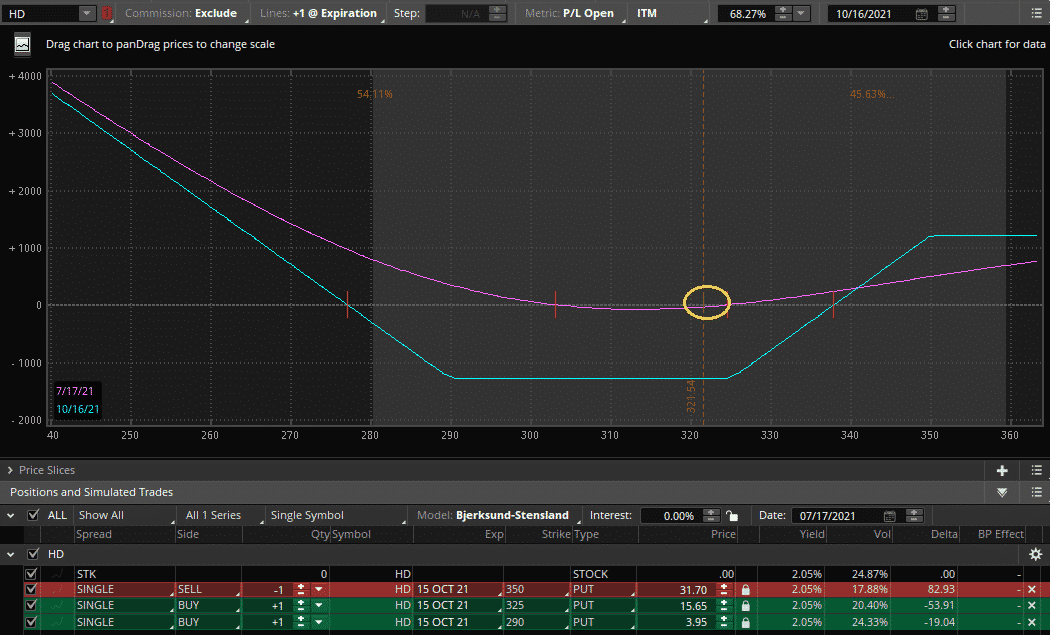

An example is illustrated below using Home Depot (HD). Here we have the structure of a short 350 put, a long 325 put, and a long 290 put.

As we can see, our Short Put Ladder has a risk-defined structure. Our maximum risk on this trade would have Home Depot on expiration trading in the $290-325 range. This would result in a loss of $1,290.

On the upside, we could make 1-1 risk to reward if Home Depot were to move above $350. On the downside, we would have the potential for unlimited profits after our break-even point of $277.

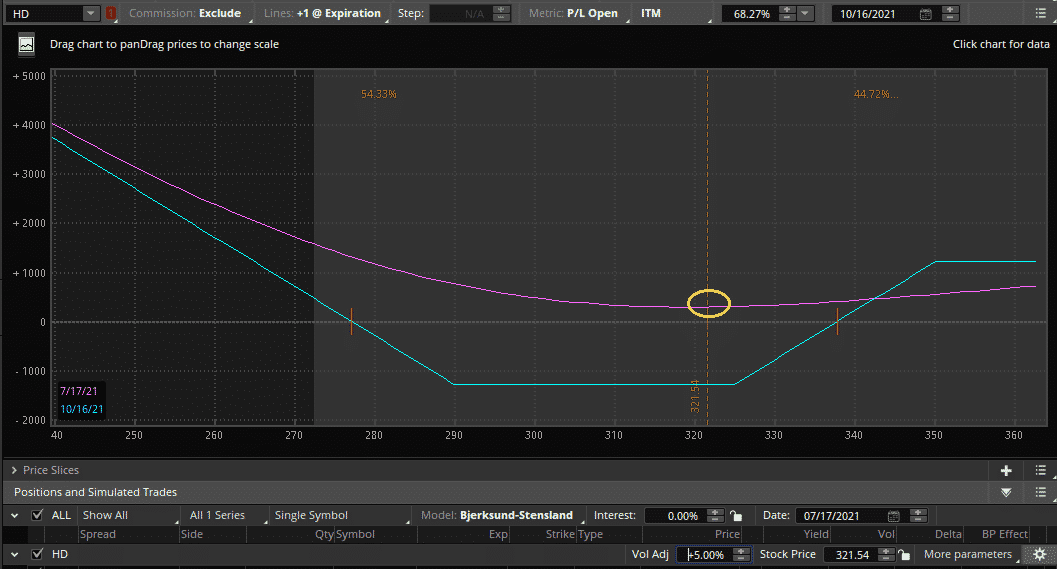

So what are the greek exposures of this structure? Well, most importantly, we are long volatility. To show this, I increased volatility by 5% without changing anything else. The position is up considerably, as shown below.

With only a 5 point increase in volatility, we would already be up over $200. So, what is the catch? Well, a decrease in volatility would cause the opposite effect.

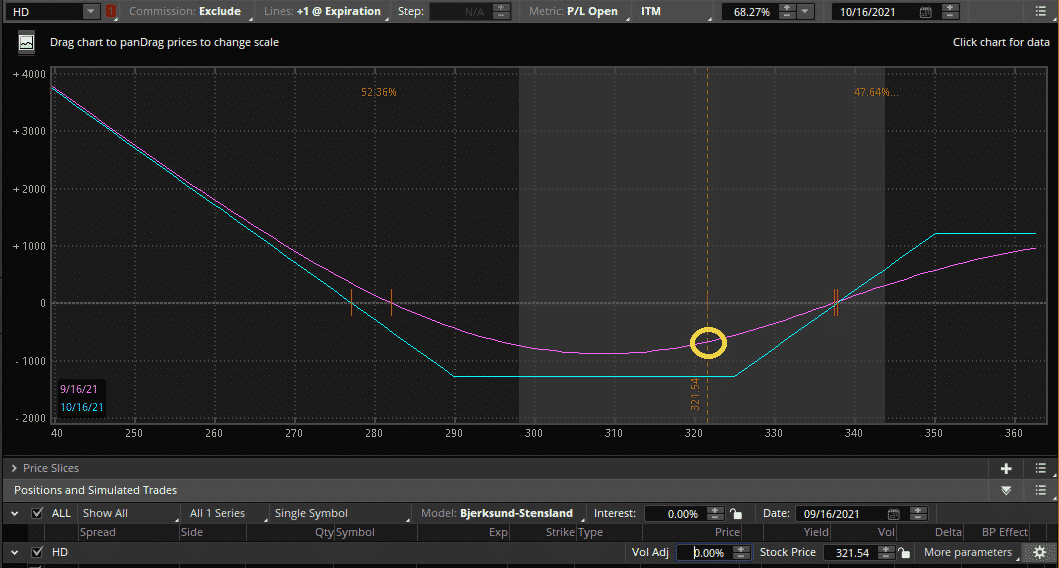

Another downside to this position is theta decay. Here I left volatility unchanged, but moved the position forward a few months. We now only have one month until expiry in the example. We can see below that we are now losing money. Our instantaneous P&L has started to converge upon our blue expiration P&L.

Even though this structure may look visually appealing initially, we have to remember that it can take on a less appealing form as the position evolves. While this is a bad case scenario, it will be a common outcome for Short Put Ladders due to the potential rewards on the trade.

What View am I Expressing with a Short Put Ladder?

As we can see from above, the Short Put Ladder expresses a long volatility view. Though the view itself is more specific, many other structures may express a long volatility view, such as a Straddle or Strangle.

What makes a Short Put Ladder unique? As seen from the position itself, we are expecting a significant move. What we do not expect is for the stock to do nothing or slowly trickle down (towards our maximum loss zone). We believe that the stock could blow to the downside. For this reason, we do not sell an additional put to make a Reverse Iron Condor.

Despite this, we cap our potential gains on the upside. This expresses the view that while we could see a large move up in the security, we do not expect any severe upside move. This view is important as it is very specific. If we do not have this view, a Short Put Ladder may not make sense, and another options structure may be better suited for our view.

For example, if we have no opinion on the skew and feel as though an extreme move to the upside and downside are equally probable, a Long Straddle may make more sense. In contrast, if we feel like a move to the downside will happen and are extremely bearish, a simple Long Put could provide higher returns if we are right.

Tips to Optimize Short Put Ladder Trades

While an individual’s view on the underlying direction is specific to that person, there are a few conditions that generally make Short Put Ladders more effective.

- Low Implied Volatility.

If Implied volatility is low, we can put this trade on for cheaper. We will then also benefit if implied volatility increases. As our long legs will gain more in value as volatility increases, our short leg will lose value.

- Minimal Put Skew.

Put skew causes out-of-the-money put options to trade at higher implied volatility than the same delta call options. This harms us as we are selling lower implied volatility for our in-the-money put and buying higher implied volatility for our out-of-the-money put. Hence minimal put skew or even call skew would be more ideal for this trade.

- Significant Jump Risk.

If a stock has considerable downside risk, a Short Put Ladder can work exceptionally well. A few examples of these stocks would be heavily leveraged REITs or companies in financial distress. These stocks often have steep put skew, making Short Put Ladders less effective and this goes against our second point.

- Liquid Strikes.

All complex orders consisting of more than one leg can increase transaction costs and slippage. As a Short Put Ladder has three legs, this can wrack up transaction costs, especially on illiquid underlyings. Focus on underlyings that have good liquidity in their options chains for lower transaction costs overall.

- Choose Longer Dated Options.

Choosing shorter-dated weekly options may be better if an investor feels as though a certain event is imminent and there is a chance for market mispricing. If not, it may be better to choose longer-dated options, as this gives more time for an investor’s view to be correct and reduces the transaction costs of frequent trades.

Managing and Closing Short Put Ladders

As Short Put Ladders are risk-defined trades, managing them is relatively easy. At inception, it is best to have the maximum loss as the actual maximum loss you would like to have on the trade. Although you are unlikely to experience a full loss if you close the position early, being prepared is essential.

This allows for a lot less additional trading and transaction costs as we can let our position move. This contrasts with many short options strategies which may need to be delta hedged frequently. Despite this, as the position evolves changes may need to be made.

For example, if the underlying moves up or down considerably while nearing expiry, our original trade becomes almost a delta bet with the continued movement of the stock.

If we do not want this altered exposure, often the best thing to do is take profits and either roll the position or look for a new position in another security. Choosing not to do so and holding is akin to simply hoping while negating the value you place on your view in the first place.

Concluding Remarks

Short Put Ladders allow investors to express a unique view. Investors can bet on a large move in an underlying security while still having a risk-defined structure.

Taking advantage of low implied volatility, low put skew, and large downside risk can help optimize Short Put Ladders as a strategy in the long run. Despite this, the most optimal trades will likely not be systematic but instead take advantage of unique events and views that an investor has.