Shorting Secured Out-Of-The-Money Amazon Puts Works Here

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

by bluestork via Shutterstock

Last month, I recommended shorting the Amazon, Inc. (AMZN) $235.00 strike price put option expiring today for a 1.36% yield over the month. It makes sense now to roll this put AMZN option over to the next month, as it might expire in the money.

AMZN is trading at $232.03 in late trading today, as the market closes early. This is up from a recent low of $217.14 on Nov. 20.

(Click on image to enlarge)

I had discussed shorting the $235.00 put option expiring today in the Oct. 31 Barchart article, “Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued.”

At the time, AMZN stock was at $245.90, and the put had a midpoint premium of $3.20. So, that provided an immediate yield to the short-seller of 1.36% (i.e., $3.20/$235.00).

The $235.00 strike price put option will be exercised if AMZN stays at this level. However, it still trades for 4 cents, and the short-put investor can repurchase it.

So, now it makes sense to roll this over to the next month.

Rolling the Put Option Over

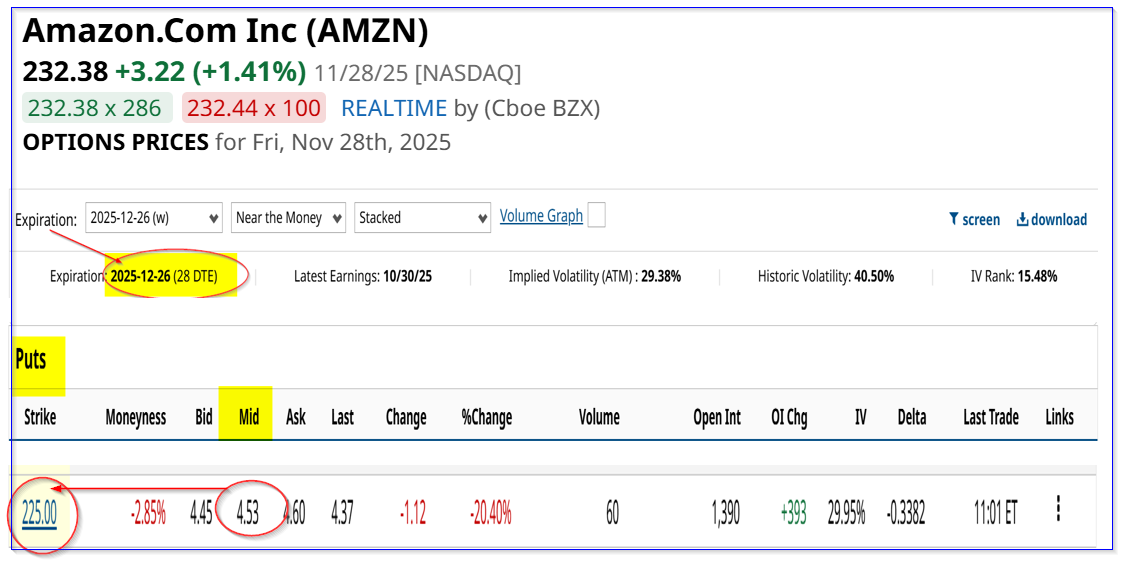

For example, the Dec. 26, 2025, put option period shows that the $225.00 strike price put option has a midpoint premium of $4.53. That provides an immediate cash-secured put option yield of 2.0% (i.e., $4.53/225.00).

(Click on image to enlarge)

AMZN puts expiring 12/26/25 - Barchart - As of Nov. 28, 2025

That is a great way to play AMZN as it sets a new, potentially lower buy-in point. For example, the breakeven point, should AMZN fall to $225.00 on or before Dec. 26, is:

$225.00 - $4.53 = $220.47

That is over 5.1% lower than today's price.

So, the investor makes 2.0% plus gets to potentially buy in at a lower point.

I set the price target in my last article at $311.50 per share, so that provides a good upside:

$311.50/$220.47 = +41.2% upside.

The bottom line is that AMZN stock looks cheap here. One way to play it relatively safely is to short out-of-the-money (OTM) put options in one-month out expiry periods.

More By This Author:

SenesTech's 43% Revenue Surge That Nobody's Talking About

Unusual Activity In Oracle Corp Put Options Highlights ORCL Stock's Value

Occidental Petroleum Could Hike Its Dividend - Price Target Is At Least 21% Higher

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more