Occidental Petroleum Could Hike Its Dividend - Price Target Is At Least 21% Higher

by Poetra_ RH via Shutterstock

Occidental Petroleum (OXY) is likely to raise its dividend next quarter. That could push it to at least $1.00 per share, giving OXY a prospective yield of 2.42%. Its 5-year average is lower, and at 2.0%, OXY would be worth $50 per share, or 21% higher.

OXY is trading at $41.34 per share, well off its recent high of $48.10 on Sept. 29. Given the strong likelihood of an upcoming dividend per share (DPS) hike, this seems like a low point.

(Click on image to enlarge)

OXY stock - last 3 months - Barchart - As of Nov. 25, 2025

Here is how the math works. Right now, the DPS is 24 cents per quarter or 96 cents annually. So, at today's price, the annual yield is 2.32%:

$0.96/$41.34 = 0.0232 = 2.32%

But, Occidental Petroleum has been raising its DPS every year after four quarterly payments. It has already paid out four payments at 24 cents per share. So, next quarter, likely in late January or early February, Occidental could announce a dividend hike.

That means that, if Occidental raises the annual DPS to at least $1.00 per share, or 4.2% higher, the prospective yield is now 2.42%:

$1.00 / $41.34 = 0.02418 = 2.42%

But, is this where OXY will stay? Not likely, given its historical average dividend yield.

Valuing OXY Stock

It turns out that over the last 5 years, OXY stock has had an average yield of 1.29%, according to Yahoo! Finance. That implies OXY stock could be worth +87.5% more:

$1.00 / 0.0129 = $77.52 price target

$71.52 / $41.34 -1 = 1.875 -1 = +87.5%

Just to be conservative, let's look at the last two years' dividend yield. Morningstar reports that in 2024, the average yield was 1.78% and so far this year it's averaged 2.27%:

(1.78% + 2.27%)/2 = 2.025% average last 2 years

In other words, we can assume, very conservatively, that there is a good chance that OXY stock will rise to the point where it could have a 2.0% yield:

$1.00 / 0.02 = $50.00 price target

That is 20.95% over today's price. In other words, we can project a 21% upside if the company raises its dividend by 4.2% the stock could rise 21%.

Analysts Agree OXY Stock is Undervalued

Yahoo! Finance reports that the average price target for 25 analysts is $50.42 per share. That is very close to my price target. Similarly, Barchart's mean price target is $49.64 per share.

Moreover, AnaChart, which covers recent analyst write-ups, reports that 19 analysts have an average price target of $51.72 per share. That implies upside of +25% from today.

The bottom line is that OXY stock looks deeply undervalued here.

One way to play this, not the only way, is to sell short out-of-the-money (OTM) puts. That way, an investor can set a potentially lower buy-in point. In addition, they get paid while waiting.

Shorting OTM OXY Put Options

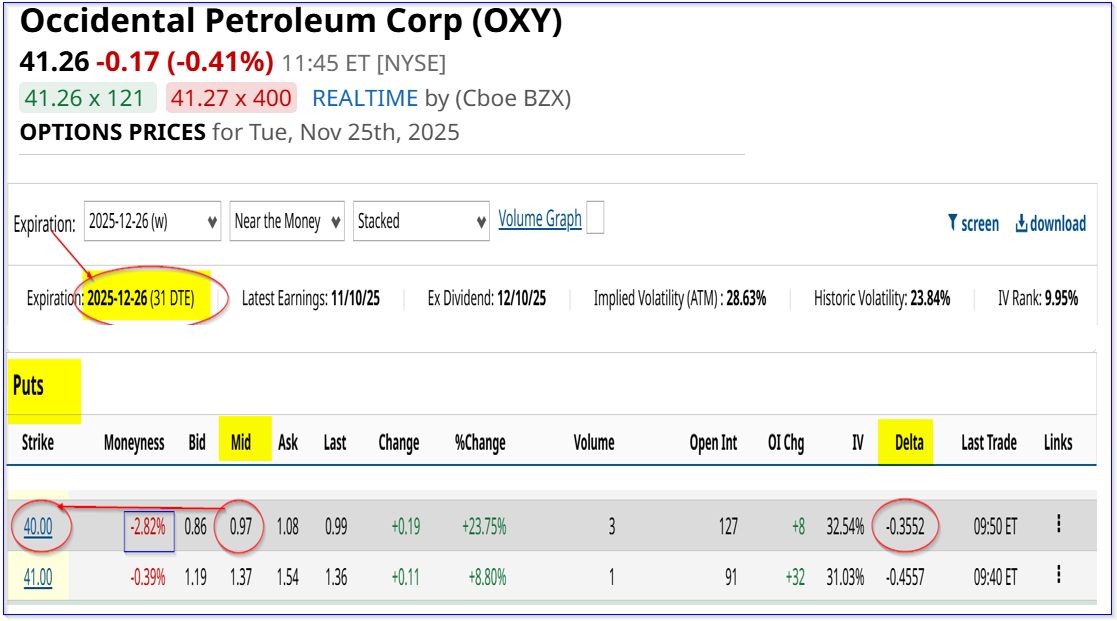

For example, the $40.00 put option strike price for options expiring Dec. 26, 2025, has a midpoint premium of 97 cents.

That means an investor who enters an order to “Sell to Open” this put will make 2.425% (i.e., $0.97/$40.00) over the next month. That is as much as a one-year dividend yield!

(Click on image to enlarge)

The breakeven point is even lower at $39.03 (i.e., $40.00 - 0.97). That is 5.4% lower than today's price. So, there is good downside protection.

Moreover, at that price, even if the stock falls to $40.00, the annual yield is 2.56%:

$1.00 prospective DPS / $39.03 = 0.0256 = 2.56% annual yield.

More risk-averse investors could short the $38.00 put option for a 44-cent premium. That yields 1.158% (i.e., $0.44/$38.00) over 1 month.

The bottom line is that OXY stock looks cheap here. One way to play it is to sell short out-of-the-money (OTM) put options in one-month away periods.

More By This Author:

Palo Alto Networks' Stock Has Tanked But Its FCF Is Strong - Price Target Is 15% HigherChevron's Latest 5-Yr Plan Implies A Major Dividend Hike - CVX Stock Looks Cheap

ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could Be 24% Undervalued

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more