Options Hedging Example

With stocks near all-time highs and an explosion present in call option buying, it is easy to forget that options were primarily developed as hedging products. This article will break down an options hedging example and take a look at the benefits and costs involved.

Buying a put option is best visualized as buying insurance. In today’s society, we can buy insurance on almost anything. From our microwave, car, house, to even our life itself. In the stock market, it is the same. We have a plethora of put options to choose from.

Deciding what option to choose can be daunting. Yet once you understand the products available and how they work, any investor can construct a prudent portfolio; one that can generate long-term returns but also allow you to sleep easy at night.

Options Hedging Example: Using Put Options To Protect A Stock Position

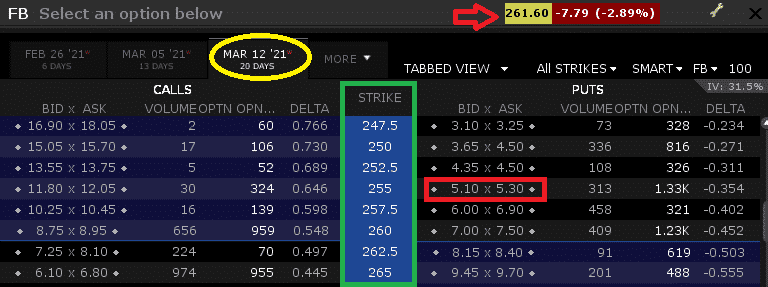

Buying a put option gives an investor the right to sell an asset at or below a certain price. This price is determined from the strike price (shown in green). When we buy a put option, we buy this right for a certain amount of time. This is known as the days to expiry or DTE (shown in yellow)

The last component is the premium. This is the price paid for the put contract. In this arbitrary example, we will consider the 255 Strike (shown in red).

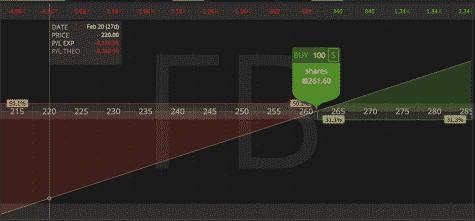

If we buy this put option, we have the right to sell Facebook (FB) stock if it falls below $255 over the next 20 days. This put option costs approximately $5.30. Below we have the payoff visualized. Remember that being long shares has unlimited downside risk until the stock reaches $0.

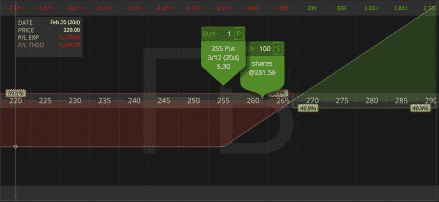

Using the put option, our loss is capped at the distance between the current price and our strike price, plus the premium paid. A price of $0 for the next 20 days is unrealistic for Facebook. So here is the risk profile visualized for a correction down to $220.

Long 100 shares:

- $261.60 – $220 X 100 shares = Loss $4,160.

Long 100 shares, long a 255 Put:

- $261.60 – $255 + $5.30 = $11.80 x 100 shares = Max loss $1,190

Notice that the put option caps our loss at $1,190.

What’s The Catch In Using Put Options To Hedge?

Capped downside risk and unlimited upside potential, sign me up! But before you go out and buy puts on every stock you have, here is the catch: for every put buyer there has to be a seller.

The seller in the insurance example would be the insurance provider. Their goal is to make money. They receive a premium, but in return, are on the hook for serious, sometimes unlimited losses.

Receiving a few hundred dollars a month to insure people against a hurricane sounds appealing until the hurricane appears. To provide an incentive to sell insurance (or in this case, sell the put), an additional premium needs to be paid. It is embedded in the options price. In options, this is known as the variance risk premia.

Variance Risk Premia

The variance risk premia is a phenomenon where put options tend to be overpriced relative to their theoretical values over time. In the same way, insurance is generally overpriced relative to its value. It does not mean that it is always overpriced. After all, buying insurance right before a hurricane pays off.

There is more good news for put buyers. Unlike home insurers, there are very little regulations required to sell puts. A few thousand dollars and some disclosures, and you can sell puts in your account. This competition for the insurance you are buying drives down the premium to appealing levels.

How To Hedge A Portfolio With Options?

Deciding if and when to buy a put can be a complex decision. I like Aaron Brown, a chief risk manager at AQR, and his take on it:

“Take on the risks we want to have, hedge away the risks we don’t.”

To see what risks we have, we need to stress our positions for when things go wrong. If we cannot emotionally or financially handle the worst-case scenario, we need to explore ways to reduce that risk or hedge it away.

Most people would say not buying home insurance is foolish. The reason for this is not that home insurance has a positive expected value. It is that, in a worst-case scenario, seeing your home collapsed in front of you without any insurance is not something we want to experience.

Conversely, buying insurance on your microwave probably doesn’t make sense. If your microwave breaks, you can simply buy a new one. This is a risk that we can reasonably take.

Now in the case of insurance, we often have more information and context than the insurer. If I have kids who like to stick anything they can get their hands on in the microwave, perhaps buying the insurance has a positive expected value. Yet, all this is for another article.

Going back to our portfolio, we probably don’t have any secret, material information about the companies in our holdings. Hence our goal is reducing the risks we don’t want to have.

Choosing Our Strike Price

The first thing a new options investor will notice is the multitude of different options strikes and expirations. Choosing what strike to buy is reasonably simple, as it is all based on your risk tolerance.

Ask yourself the question, what is the maximum amount of loss I can take on this position? Start there. As options are usually overpriced, we generally want to look for cheaper tail risk insurance, even if this insurance is more expensive in terms of volatility.

Choosing Days to Expiry

To choose our days to expiry, we want to consider our investment timeline. Are we planning on holding this investment for a month or a year? If it is a longer-term investment, buying puts every week doesn’t make much sense. The simple reason for this is increased costs in commissions and slippage.

Conversely, if we are worried about a specific event, then buying insurance for the whole year is not in our best interest, either. For the average investor with a longer-term portfolio, my advice would be to look at longer-dated options (three to six months out).

This leaves you enough time to not be hyper-managing your position, but to also be able to quarterly readjust as things change. Choose a put strike that is far out-of-the-money and see if it makes sense for you to buy that protection.

How Do You Hedge With Options?

Often the best insurance is simple. I find it ironic how many retail investors I know have a long stock portfolio and decide to hedge it with VIX/VXX calls. If you are looking to buy a single put option for a long stock portfolio, you would be better off buying a put on the S&P 500.

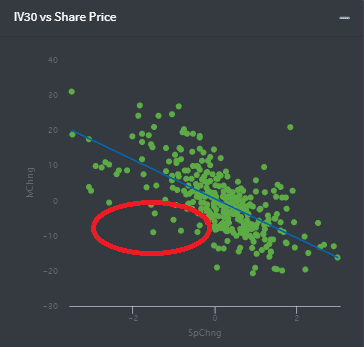

VIX calls hedge volatility risk, not price risk. Simply because volatility and index price are heavily correlated does not mean they will always move together. Below I have the S&P returns plotted against the VIX.

If the stock market goes down 1% tomorrow, I cannot promise you volatility will go up, it is only probable. This is shown by the few outlier dots circled in the graph above.

Likewise, if you buy insurance on your neighbor’s house, you may be protected from most natural disasters in your region. Yet you are not protected from a tree falling on your own house. Unless there is some fundamental reason you think your neighbor’s insurance is mis-priced, I recommend you buy puts for the hedge you actually need.

Using a Stop-Loss Instead

We know that premia put options are overpriced due to variance risk, so why not set a stop-loss instead? This is a fair question; we get to keep our premium and still have a form of risk management in place. All of this at no cost. Yet we are missing two things:

- A stop-loss doesn’t prevent us from price jumps. Let’s imagine I enter a stop-loss order on Facebook for $255 (per the original example). Overnight we have news on a new congressional investigation to break up big tech. Facebook opens the next day at $230 and we are filled at that price, not $255.

- In an event of a flash crash, your stop-loss will be executed. Odds are you have no intention of selling your Facebook shares at a 10% discount if nothing has changed. If the market rebounds 10 minutes later, it is irrelevant, you are out of the position. Conversely, with the put option, we still hold the option and shares. If we had a full rebound, we wouldn’t suffer any losses and probably gain some money on our vega exposure.

This is not to say that using stop-losses is a bad idea. If we are comfortable with these risks and consider the put options too expensive, it is a reasonable alternative.

Concluding Remarks

Today, we took a detailed look as using puts as an options hedging example. Put options offer protection for the risks that we are unable to otherwise reduce. We can hedge our portfolio to the exact level we want without the risks of stop-losses and other conditional orders.

So, ask yourself, do you have risks that you are not willing to take? If so, it is worth considering put options to hedge away that risk.

For those of you buying VXX calls against an equity portfolio, research how the VIX curve rolls down in ...

more