More Bad News For Boeing

Grounded Air China 737 Maxes (photo credit: Bloomberg reporter Gao Yuan)

More Bad News For Boeing

As Bloomberg reported early Friday, Indonesia's National Transportation Safety Committee's final report finds fault with Boeing's (BA) design of the 737 Max, as well as the Lion Air pilots involved in last year's crash, and U.S. regulators:

Indonesian investigators found scores of problems and missteps in connection with last year’s fatal Lion Air crash, ranging from design flaws in Boeing Co.’s 737 Max airplane to certification failures by U.S. regulators and pilot error.

Eighty-nine significant findings are listed in connection with the disaster, according to an extract from the final crash report distributed to stakeholders and seen by Bloomberg News. One major point of focus is a flight-control feature called the Maneuvering Characteristics Augmentation System, which has also been implicated in an Ethiopian Airlines crash in March.

Bloomberg notes that the full report isn't scheduled to be released until later Friday, but the issue with U.S. regulators likely refers to the regulatory capture that monopoly scholar Matt Stoller wrote about last month, in his Guardian piece highlighting Boeing's long term problems:

The executive team at Boeing is quite skilled – just at generating cash, rather than as engineers. Boeing’s competitive advantage centered on politics, not planes. The corporation is now a political machine with a side business making aerospace and defense products. Boeing’s general counsel, former judge Michael Luttig, is the former boss of the FBI director, Christopher Wray, whose agents are investigating potential criminal activity at the company. Luttig is so well connected in high-level legal circles he served as a groomsman for the supreme court chief justice, John Roberts.

If Stoller's analysis is correct, the Indonesian aviation regulator's report may not be the last shoe to drop when it comes to bad news for Boeing. In the event it isn't, we'll look at two ways cautious Boeing bulls can stay long while strictly limiting their downside risk.

Adding Crash Protection To Your Boeing Shares

For these two examples, I am assuming you own 200 shares of Boeing and can tolerate a 20% drawdown over the time frame of the hedge, but not one larger than that.

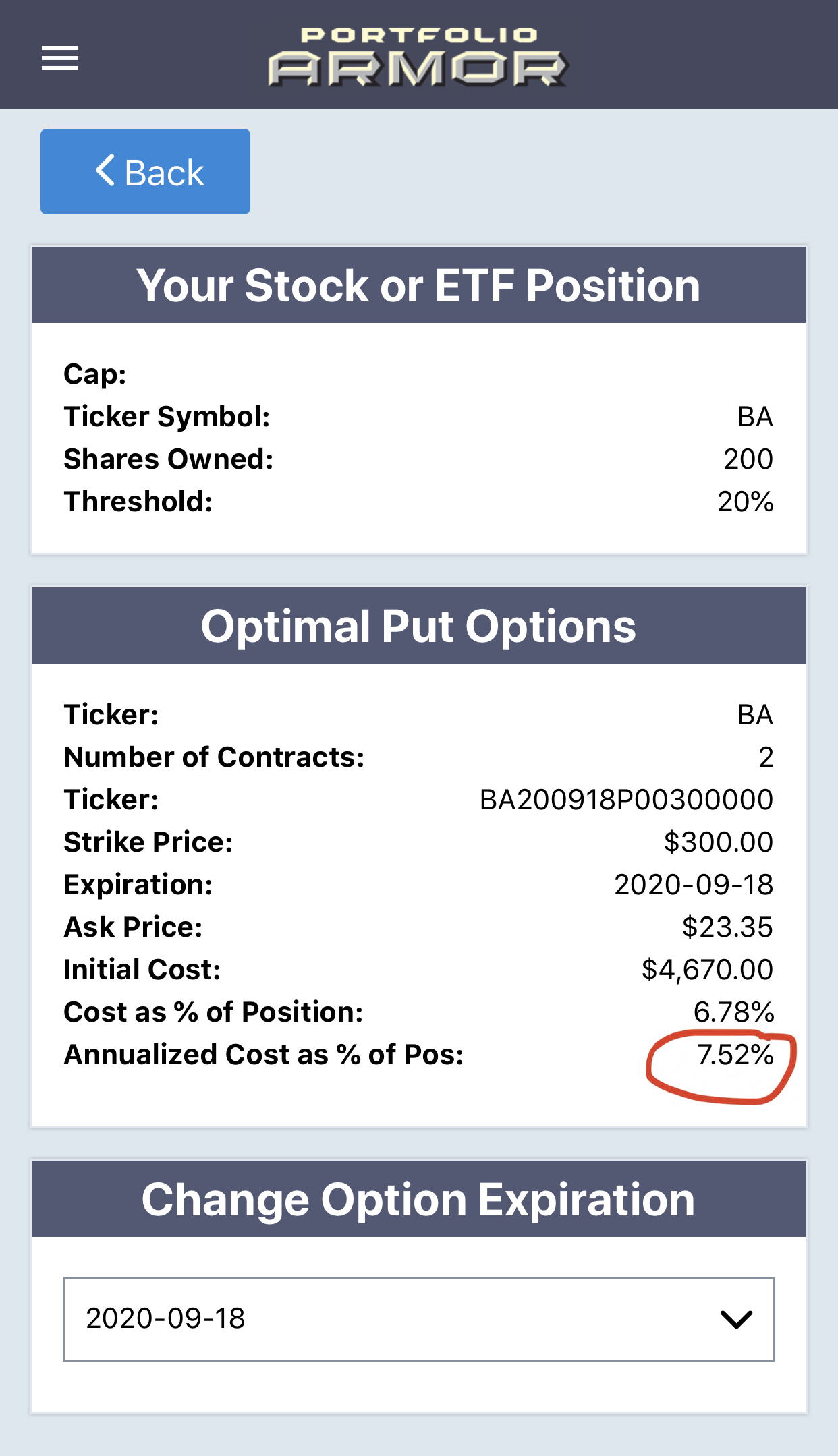

Uncapped Upside, Positive Cost

As of Thursday's close, these were the optimal, or least expensive, put options to hedge 200 shares against a >20% decline by next September.

The cost of this protection was $4,670, or 6.78% of position value (calculated conservatively, using the ask price of the puts. That worked out to an annualized cost of 7.52%.

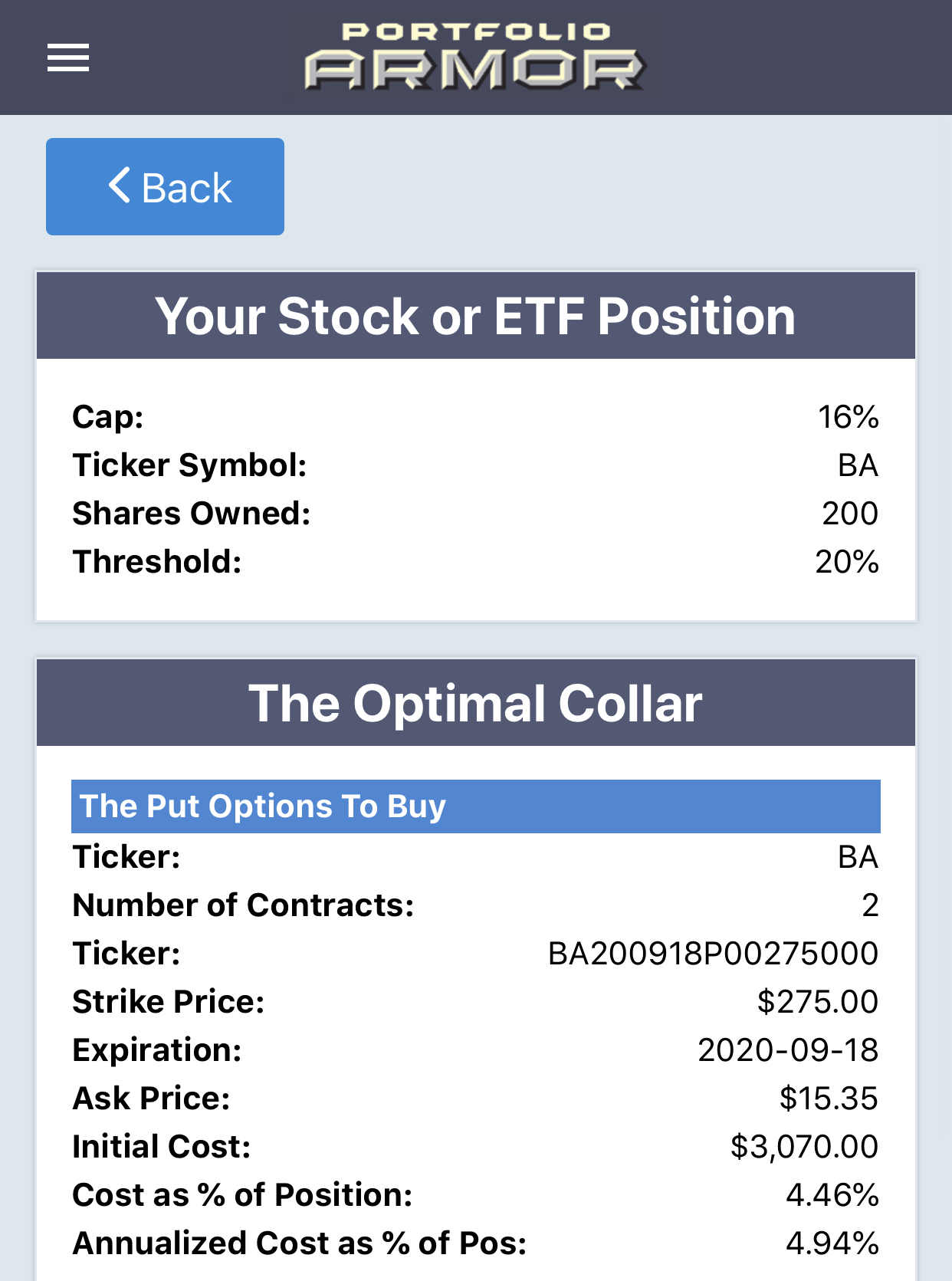

Capped Upside, Negative Cost

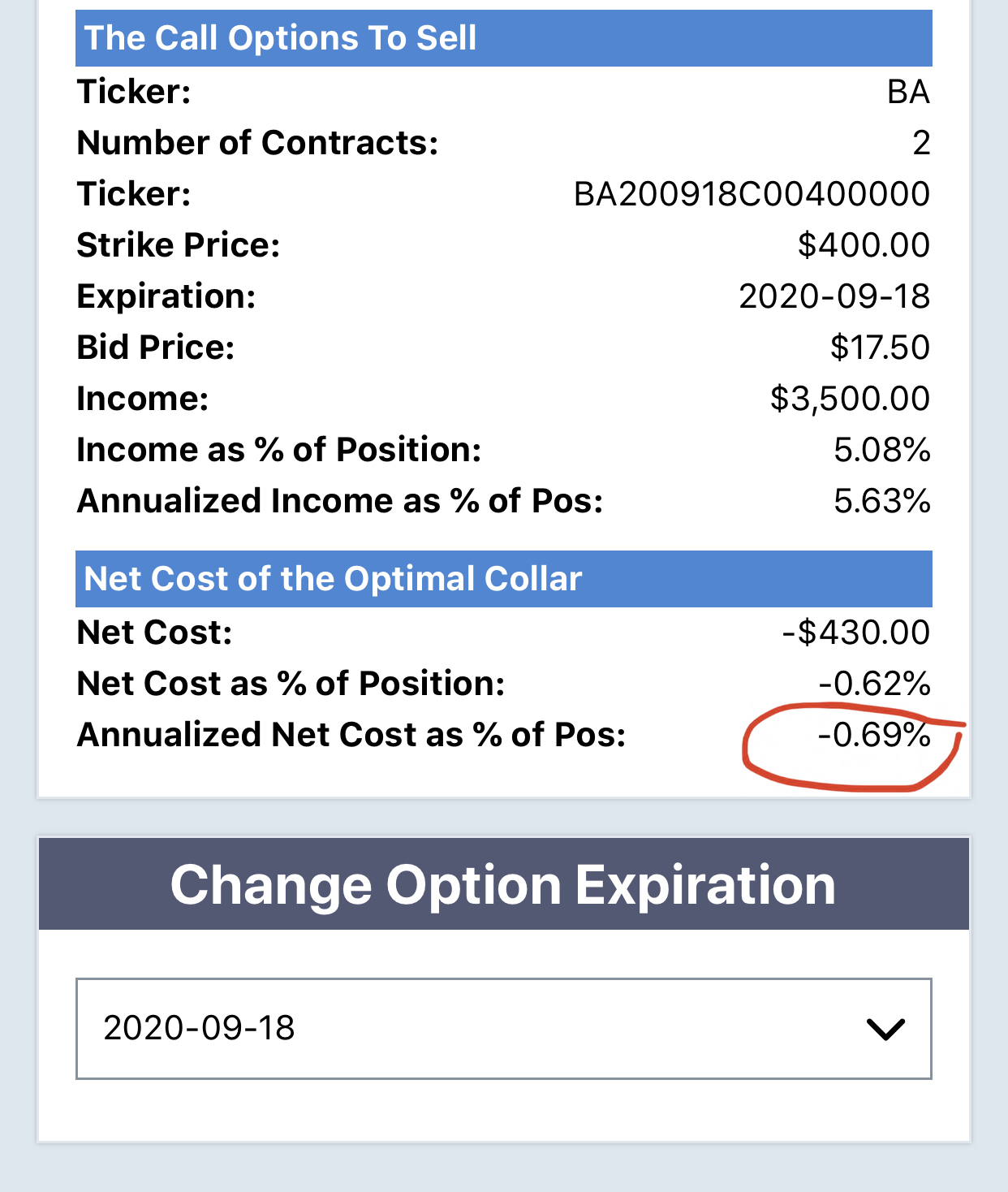

If you were willing to cap your possible upside at 16% between now and next September, this was the optimal collar to protect against a >20% drawdown over the same time frame.

Here, the cost was negative, meaning you would have collected a net credit of $430, or 0.62% of position value, when opening this hedge, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Wrapping Up: Different Parameters

I realize that some Boeing longs may prefer hedges expiring earlier or later and may have a higher or lower risk tolerance than the hedges above use.

Disclosure: None.

The news for #Boeing just gets worse and worse! $BA

The writing has been on the wall for #Boeing for a long time now. Anyone who hasn't dumped $BA by now is foolish. It will be at least a year or more before the company can start to recover.