McDonald's Stock Looks Cheap - Analysts Are Lovin' MCD And Raising Their PTs

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)

by onyBaggett via iStock

Analysts have been raising their price targets (PTs) for McDonald's stock (MCD) over the last month. Meanwhile, my price target 4 remains 19% higher at $371 per share. Shorting out-of-the-money puts and calls works here.

MCD closed at $311.23, up from its recent low of $300.72 on Dec. 2, as well as $296.37 on Nov. 3. This article explains why McDonald's stock could be worth almost 20% more and several ways to play it, including shorting out-of-the-money (OTM) puts and buying in-the-money (ITM) calls.

(Click on image to enlarge)

MCD stock - last 3 months - Barchart - Dec. 5, 2025

MCD Price Target (PT)

I previously wrote about how cheap McDonald's stock was in a Nov. 7 Barchart article, “Is McDonald's a Buy? Its Strong FCF Margins Imply MCD Could be 23% Undervalued.”

The article showed how McDonald's free cash flow (FCF) could rise to $9 billion next year based on a projected 40% operating cash flow margin.

This is 22% higher than its trailing 12-month (TTM) FCF of $7.392 billion, according to Stock Analysis.com.

Using a 29.4x multiple, the same as a 3.4% FCF yield metric, McDonald's could have a market cap of $265 billion over the next 12 months (NTM). That is the implied metric from its TTM FCF yield.

That is 19.3% higher than its present market cap of $222 billion, according to Yahoo! Finance, setting a 19.3% higher price target (PT) for MCD stock:

$265b NTM mkt cap / $222b mkt cap today = 1.193

1.193 x $311.23 price = $371.30 price target (PT)

Analysts Are Lovin' It - Raising Their MCD PTs

Stock analysts have been raising their PTs over the last month. For example, Yahoo! Finance reports that the average PT of 37 analysts is $331.20, up from $330.10 as seen in my Nov. 7 Barchart article.

Similarly, Barchart's mean survey PT is now $337.53, up from $336.43 a month ago.

Moreover, AnaChart, which tracks recent analyst write-ups, says 22 analysts have an average PT of $352.03. That is over 4% higher than the $338.35 PT from a month ago.

The bottom line here is that MCD stock remains very cheap and could have significant upside over the next year.

One way to play this, as I wrote last month, is to set a lower buy-in point by shorting out-of-the-money (OTM) puts for extra income.

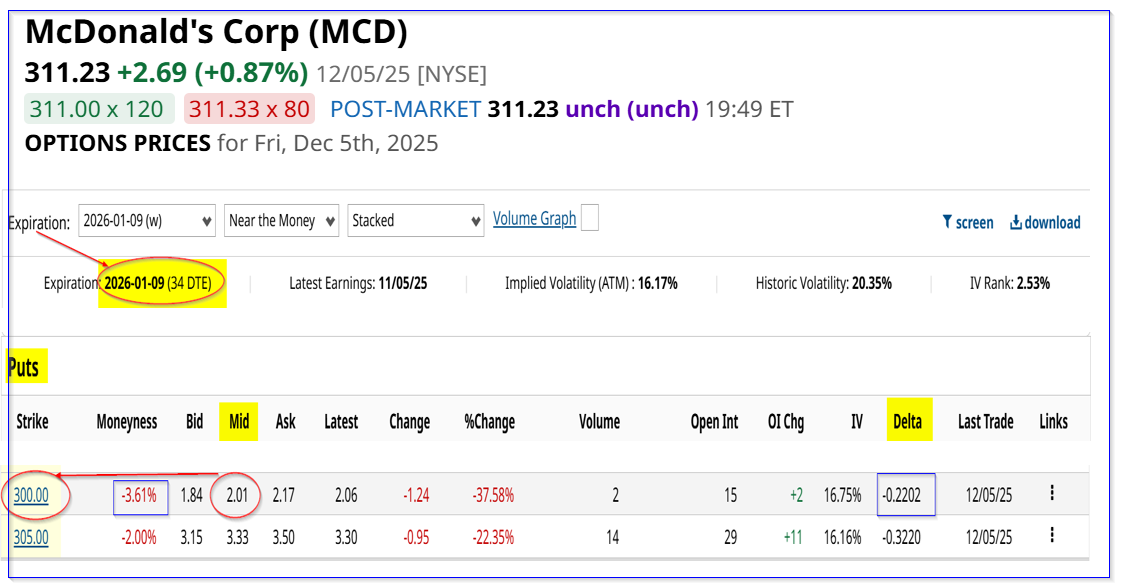

Shorting OTM MCD Puts

I suggested selling short the $290.00 strike price put option expiring Dec. 12, 2025. At the time, MCD was at $301.47, so the $290 strike price was $11.47 lower, or -3.8% out-of-the-money (OTM).

The midpoint premium available for a short seller was $3.34 per put contract. That works out to an immediate yield of 1.15% (i.e., $3.34/$290.00).

Cut to today - a month later - the 12/12/25 expiry $290.00 put option price is down to just 10 cents. In other words, this has been a successful trade (i.e., $3.34-$0.10 = $3.24). Most of the money has been made, so it makes sense to roll this trade over.

For example, the Jan. 9, 2026, expiry period shows that the $300.00 strike price put has a midpoint premium of $2.01. That provides an immediate yield of 0.67% (i.e., $2.01/$300 = 0.0067).

(Click on image to enlarge)

MCD puts expiring Jan. 9, 2026 - Barchart - As of Dec, 5, 2025

That strike price is a similar distance OTM - i.e., -3.61% as in the prior short-put play last month.

This provides an investor with a potentially lower buy-in point, if MCD falls to $300 ($300-$2.01 = $297.99). That breakeven point is -4.25% lower than today's price.

However, this yield is lower than last month's short put play. So, it also might make sense to buy in-the-money (ITM) calls in further out periods.

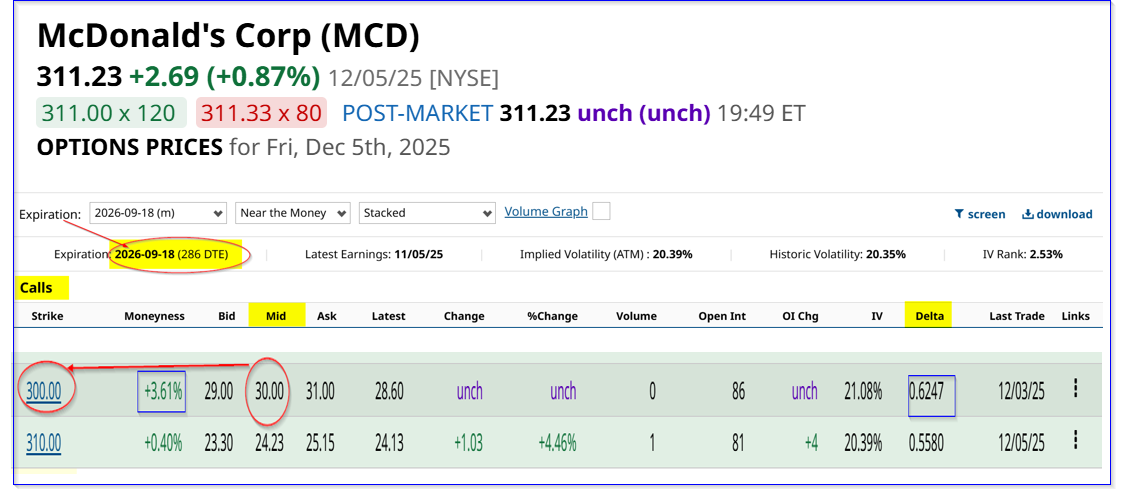

Buying ITM Calls in MCD Stock

For example, the Sept. 19, 2026, expiry period shows the $300.00 call option has a midpoint premium of $30.00 per call option. That price could be partially financed by shorting puts.

(Click on image to enlarge)

MCD calls expiring Sept. 18, 2026 - Barchart - As of Dec. 5, 2025

Here is how that works. Over 60% of the premium could potentially be paid for if an investor sells short $300.00 puts every month for 9 months:

$30- ($2.01 x 9) = $30 - $18.09 = $11.91 potential net cost

$11.91 / $30.00 = 39.7%

This could provide good upside if MCD rises to $371.00 on or before Sept. 18, 2026:

$371-$300.00 strike = $71.00 intrinsic value

$71 - $30 premium cost = $41, or

$41/30 = 1.36667 -1= +36.7% ROI, and

$41/$11.91 potential net cost after shorting puts = 3.442 -1 = +244.2% ROI potential

The investor could make a potential 36.7% buying ITM calls, vs. holding MCD shares and making just 19.3% (as shown above). Moreover, if the investor can sell OTM puts and reduce the cost to $11.91, the potential upside is +244%.

That is why it makes sense to both short OTM puts and buy ITM calls for stocks like this with good potential upside.

More By This Author:

Salesforce Generates Strong Free Cash Flow - CRM Could Be 23% Too Cheap

Heavy Volume In Home Depot Call Options - Investors Are Bullish On HD Stock

Tesla Stock Has Been Flat - Good For Shorting Puts To Make A One-Month 2.5% Yield

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more