Heavy Volume In Home Depot Call Options - Investors Are Bullish On HD Stock

/Home%20Depot%2C%20Inc_%20location%20by-%20Sundry%20Photography%20via%20Shutterstock.jpg)

by- Sundry Photography via Shutterstock

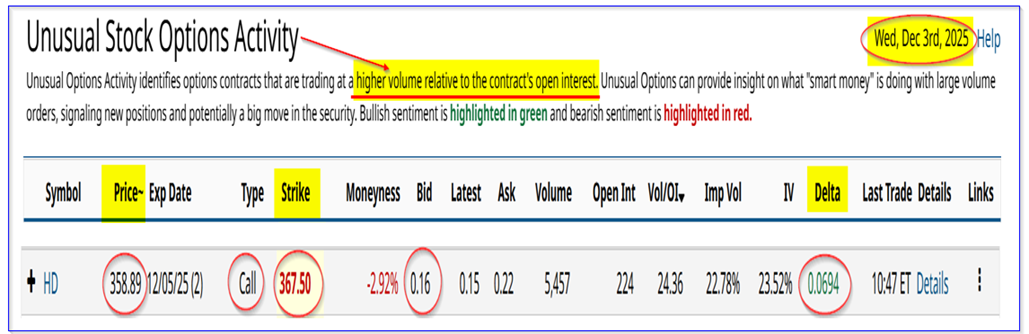

The Home Depot, Inc. (HD) stock has had a large volume of short-dated out-of-the-money (OTM) calls today. This can be seen in Barchart's Unusual Stock Options Activity Report. It could signal that investors are bullish on HD stock.

HD is at $359.64 in midday trading today. The stock peaked on Sept. 11 at $423.22, but it's up from a recent low of $332.38 on Nov. 21. That could provide a good opportunity for covered call plays in the next two days.

(Click on image to enlarge)

HD stock - last 3 months - Barchart - Dec. 3, 2025

That could be why over 5,400 call option contracts have traded today at the $367.50 strike price for expiry on Friday, Dec. 5, 2025. This is seen in today's Barchart Unusual Stock Options Activity Report, as shown below.

(Click on image to enlarge)

HD calls expiring 12/5/25 - Barchart Unusual Stock Options Activity Report - Dec. 3, 2025

Investors are Bullish on HD Stock

It shows that the bid side price of these calls is 16 cents. It means that any investor who sells covered calls (i.e., they own 100 shares of HD for every call option shorted) receives $16 per contract.

So, at today's price, for 100 shares, the investment income yield is:

$16/$35,964 = 0.000444 = 0.0444%

In other words, for two days, the investor's income is 4.44 basis points. If this could be repeated every week for a month, the investment yield is just .1776%.

That is not really a great yield.

More likely, there are also a good number of investors who feel strongly that HD stock could rise to $367.50 in the next two days. So they are buying calls.

Either way, investors have a bullish outlook on the stock. The short sellers are happy to own the shares and potentially sell them at a 2.6% higher price.

And buyers of the calls believe the stock is undervalued. Let's look at why

Positive FCF Albeit Lower Than Last Year

On Nov. 18, 2025, The Home Depot reported a 2.8% gain in sales for its fiscal Q3 ended Nov. 2, 2025. And for the nine months, its sales grew 5.6%.

However, comparable sales were up just 0.2% for the quarter. However, the company pointed out in the conference call that its online comp sales grew 11%. It expects that to continue.

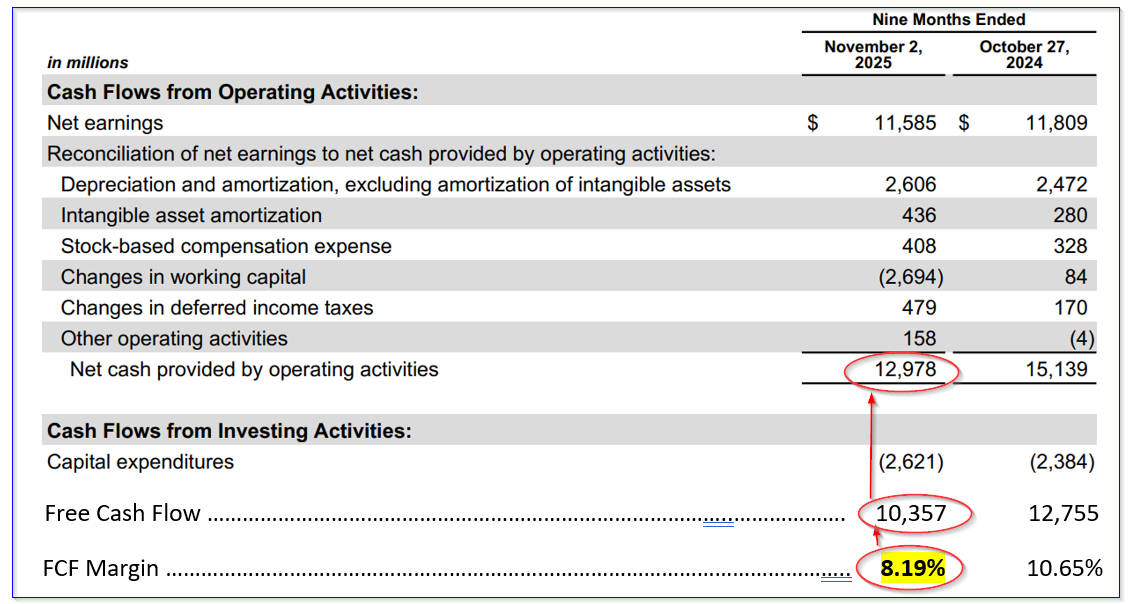

More importantly, though, Home Depot is generating strong free cash flow (FCF). For example, for the nine months, its operating cash flow (OCF) was $12.978 billion, representing 10.26% of the nine-month sales of $126.489 billion.

And after $2.621 billion in capex spending (up +9.9% Y/Y), it has generated over $10.3 billion in free cash flow (FCF). That represents 8.2% of its 9-month sales.

(Click on image to enlarge)

Home Depot 9-month free cash flow and FCF margin

However, note that this FCF margin is lower than last year's 10.65% FCF margin. That is partly due to higher capex spending and partly to lower OCF margins.

This could be due to higher tariff expenses as well. However, Stock Analysis shows that the company's trailing 12-month (TTM) FCF margin is slightly higher at 8.38% (i.e., $13.927 billion TTM FCF on $166.189 billion in TTM sales).

That implies that FCF could stay strong over the next year.

Higher Price Targets for HD Stock

For example, analysts now project sales for the next year will be over +4.5% higher at $171.85 billion for the 2026 fiscal year (ending Jan. 31, 2027).

So applying an 8.38% FCF margin (assuming its TTM margin holds), FCF could rise to $14.4 billion from $13.9 billion over the last 12 months:

$171.85b x 0.0838 = $14.4 billion FCF 2026

This could lead to a higher price. For example, right now the market assumes that Home Depot is on a run rate to generate $13.8 billion in FCF.

$10.357b / 0.75 = $13.809 b run rate FCF

And, given its market cap today of $358.464 billion, according to Yahoo! Finance, its FCF yield is:

$ 13.8b FCF / $358.464b mkt cap = 0.0385 = 3.85% FCF yield

So, applying this to our 2026 forecast:

$14.4b FCF / 0.0385 = $374.03 billion mkt cap forecast

That is +4.34% higher than today's price. This implies that HD stock could rise to $375.25 per share.

However, assuming that the market gives the stock a higher valuation as its FCF grows, it's possible that the FCF margin could improve to 3.50%:

$14.4b / 0.035 = $411.42 billion

That is +14.8% higher than today's market value. This implies a price target of

$359.64 x 1.148 = $412.87 price target

Moreover, analysts have similar price targets. For example, Yahoo! Finance reports that 37 analysts have an average price target of $402.26.

Similarly, Barchart's mean survey is at $406.08 per share. Similarly, AnaChart's survey of 22 analysts is $397.32. So, the average of these surveys is $401.89 per share, or +11.7% higher.

The bottom line is that HD stock is seen as undervalued here.

So, no wonder that investors are buying calls in HD stock (or possibly shorting covered calls). They are bullish on their investment in The Home Depot, given its current undervaluation.

More By This Author:

Tesla Stock Has Been Flat - Good For Shorting Puts To Make A One-Month 2.5% YieldApple Stock Looks Cheap Here Based On Strong FCF - Shorting OTM Put Options Has Worked

Netflix Is Still Cheap Here - Shorting Out-Of-The-Money Puts Works Well

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more