Macro Thoughts, Options, And Stocks

Image source: Pixabay

Here are some things I think I am thinking about this weekend.

1) Lots of Macro Thoughts.

I did an interview with the guys over at Excess Returns this week. We covered a ton of ground including the broader macro outlook, the impact of tariffs, the national debt, AI, etc. I think you’ll like this one so go watch it on their YouTube channel if you have some time this weekend.

2) Are Options a Good Form of Insurance?

Here’s a wonderful blog post by Cliff Asness and Dan Villalon about the surging popularity of options-overlay strategies. These things have amassed billions in assets in recent years with all the inflation uncertainty and we’re seeing news ones just about every day now. I spent an entire chapter in my forthcoming book about income style strategies and I went into some depth about options specifically.

Options are portfolio insurance. They’re a lot like a term insurance policy in the sense that you’re buying something with a specific time horizon which operates like insurance over a core position. Options were invented with this specific purpose, typically to help a corporation or individual insure and hedge some underlying position. So, let’s say you are Mark Cuban circa 1999 and your firm gets bought for an insane amount of cash and stock, but you can’t sell the stock immediately. To insure that position against a catastrophic collapse you might purchase options to protect its downside risk. This is a great (but unique) use case. More recently, these strategies are used to buffer the uncertain returns of the stock market by creating sophisticated (and usually expensive) overlays that will give you some level of upside in the stock market without all the potential downside. It kinda sounds like a…variable annuity, huh? That’s because it essentially is except it doesn’t usually come with all the insane fees.

Anyhow, I am not against insurance, especially for the right kind of investor. But there are lots of ways to insure a stock market portfolio from catastrophic loss and we don’t typically need to do that with expensive options-based strategies. For the average investor who just wants to take some level of stock market risk without all the downside I personally think they just need to construct a more traditional stock/bond/cash portfolio that’s properly bucketed out over specific time horizons according to their financial plan. I believe this is especially true when cash is yielding a real return like it is today. In fact, I’ve argued that cash is one of the ultimate forms of insurance when real yields are positive. A well constructed bucketing strategy should give you similar temporal certainty, but without the certainty of higher fees.

Then again, I am generalizing. As a behavioralist and planning based advisor I also know that sleeping well is priceless. So it all depends, but as a general rule I always think you should be skeptical when someone sells a product as giving you all (or most of) the upside with fully protected downside. There are no free lunches in this business, except diversification and many options-overlay strategies tend to be forms of diworsification. But hey, sometimes diworsification can mean sleeping better at night and in those cases these things aren’t all bad. Just be sure to check and double check those fees.

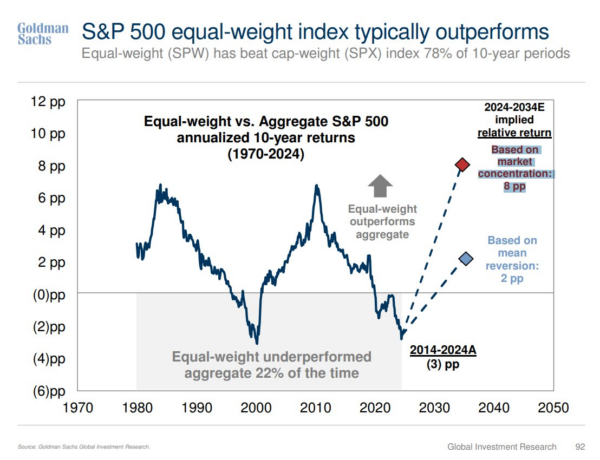

3) Equal Weight vs Cap Weight

I wanted to share this chart from Goldman Sachs because I found it so surprising. It shows the rolling 10 year relative performance of the S&P 500 equal weight vs the S&P 500 market cap weight. Equal weight outperforms 78% of the time and market cap outperformance tends to coincide with higher risk environments.

Now, I shouldn’t find this too surprising because equal weight is essentially just a smaller cap tilt. And smaller firms typically outperform larger firms over the long-term. By rebalancing back to equal weight you’re reducing the market cap’s tendency to let larger firms become a larger part of the index and exacerbate single entity risk.

What’s especially eye opening in this environment is the degree to which the large cap growth has resulted in concentrated risk. That’s been great in recent years. But so far in 2025 it’s turned out to be not so great. I have no idea where this trend is headed, but to me the whole point of indexing is to reduce concentration risk so when you end up with these extremely unusual periods where concentration leads to huge outperformance then it makes sense to diversify that risk to some degree. And that means owning international as well as watering down your exposure to large caps.

Well, that’s enough from me for now. It’s officially Spring time and that means I am headed to the garden store all weekend so we can get that spring garden all finished. I hope you have a great weekend and as always, stay disciplined.

More By This Author:

Avoiding Mistakes

Moar Tariffs

The Importance Of Temporal Diversification

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more