Avoiding Mistakes

Image Source: Pexels

Here are some things I think I am thinking about this week:

1) How NOT To Invest.

Barry Ritholtz is out with a new book called “How Not to Invest”. I loved this one.

We spend a lot of time in the investment world talking about all the optimal ways to invest. But investing is what we all call a loser’s game. That is, you don’t need to win by having the optimal winning strategy. For most of us, we just need an appropriate strategy and then ensure that we avoid catastrophic losses. For example, most of us just need to buy big broad index funds and then avoid making colossal mistakes like moving 100% out of the market when things get a little scary. You win a loser’s game by avoiding the huge loss inducing mistakes, not necessarily by optimizing performance to beat the market and things like that.

Barry’s new book (which you can buy here) is a masterclass in how to optimize your approach to avoid scammers, bad products and the wrong types of media. I highly recommend it.

2) The Big Risks Ahead.

Speaking of how not to invest – one reason I often communicate the big risks in the market is because we want to constantly be thinking about potential risks so we can prepare ourselves emotionally for them. I do a lot of debunking around here because the financial media space is filled with scary click-inducing narratives. The more we can talk about and understand these things the better prepared we can be to handle them if they materialize.

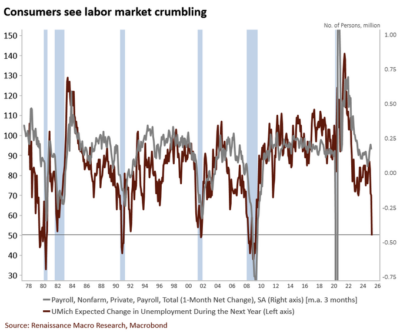

And speaking of risks – I think we all need to prepare for upside risk in the unemployment rate here. I’ve already mentioned that we’re losing the government tailwind in the labor market going forward. We have yet to see if we’re just losing that tailwind or if it’s about to become a real headwind. But as consumption slows we should also expect to see hiring slow. That’s going to be compounded by business uncertainty around tariffs and the inability to plan out 6-12 months ahead.

This was best visualized by a chart from RenMac Research showing the correlation between actual payrolls (the gray line) and the University of Michigan’s expected change in unemployment in the next 12 months. It’s a dual axis chart, which I don’t love, but this one looks like a tight enough correlation that you can’t simply dismiss it.

Now, don’t go jumping out of windows just yet. We’re just communicating that there’s downside risk to growth and employment here. Which isn’t exactly a new narrative from me in recent times, but it’s becoming a bit more exaggerated given the newfound uncertainty.

3) Earnings Mistakes.

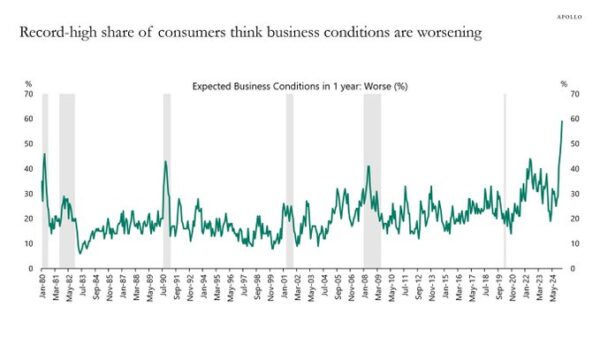

One of the messages from the stock market in recent weeks is that corporations aren’t going to be able to pass on all these tariffs. As I’ve explained in the past, tariffs are corporate taxes that induce immediate producer price inflation. But that doesn’t mean it will automatically spillover into consumer price inflation because that would mean that corporations will be able to pass on all the costs. But in recent weeks we’ve seen declining estimates of consumption which means that someone else is going to eat some of that cost and lower share prices are one way that’s likely to unfold.

As another earnings season gets into full swing I suspect this is going to be front and center in most earnings reports. We’re about to get an onslaught of guidance revisions and/or guidance that is so wide that it’s virtually useless. I am expecting a lot of earnings beats from last quarter that go along with guidance narratives along the lines of “we’re pulling our 2025 guidance” or “we’re revising our guidance from $10-10.50 to $8-$10.50”. In other words, you’re going to get a ton of revisions that price in lower potential earnings, but so wide that there’s enormous room for error.

This environment is summarized nicely by this chart from Apollo showing expected business conditions. In short, buckle up for lower earnings expectations.

How will the market respond to that? Well, it’s impossible to know how much of that is already priced in with the recent decline, but what we’re not going to see is a lot of upside surprises on guidance so expectations are adjusting to this new normal in a big way.

More By This Author:

Moar TariffsThe Importance Of Temporal Diversification

Three Bad Ideas: Strategic Currency Reserve, Tariffs And Debt Crisis

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more