Everything You Need To Know About Option Skew

What is Skew?

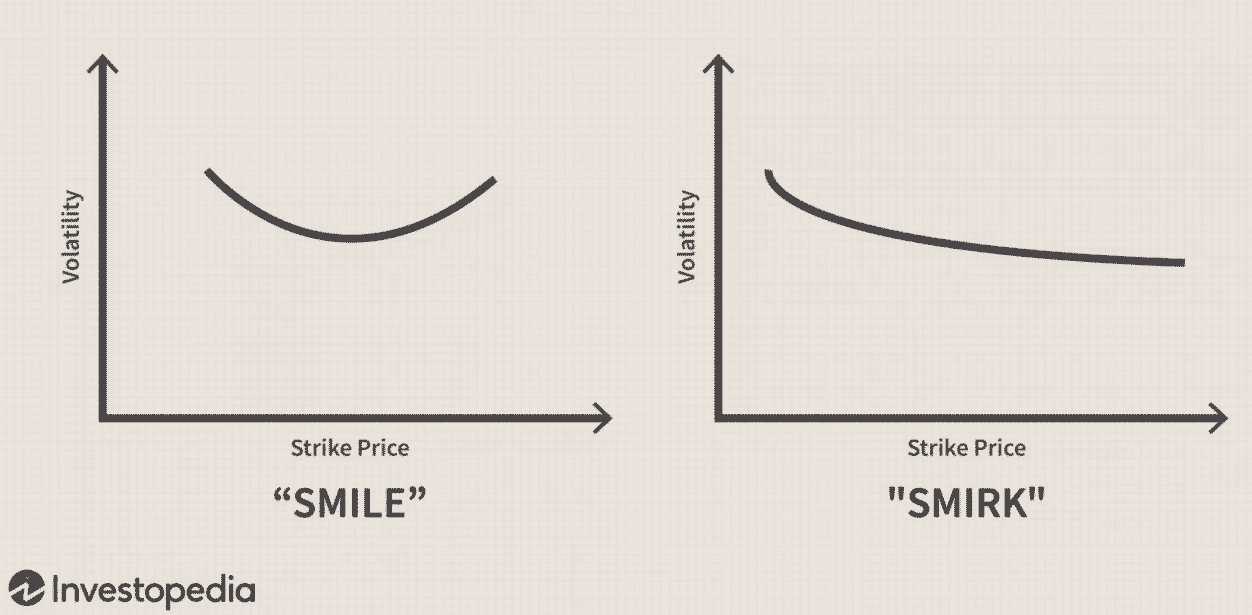

Option skew or volatility Skew stems from the observation that an underlying asset can have different implied volatility depending on what specific contract you’re looking at.

The formal definition of volatility skew from Investopedia is, “the difference in implied volatility (IV) between out-of-the-money options, at-the-money options, and in-the-money options.

The volatility skew, which is affected by sentiment and the supply and demand relationship of particular options in the market, provides information on whether fund managers prefer to write calls or puts.”

Expanding on this definition, there are two specific types of volatility skew–horizontal and vertical.

Horizontal skew refers to volatility skew across expirations at the same strike price.

Vertical skew refers to volatility skew across strike prices at the same expiration.

You can easily remember the difference by thinking of an option chain where the strike prices run vertically or by thinking of a weekly calendar where the dates run left to right.

Since a higher implied volatility results in higher prices, traders can look at volatility skew and make a determination about which options are pricy or cheap and therefore find a clue about what side of a position they should be on.

Tastytrade have specific strategies that they use to take advantage of skew.

Their Jade Lizard strategy seeks to sell naked puts that are overpriced.

When conditions change they have a strategy called twister sister that works in the other direction.

The underlying idea and observation of volatility skew can be summed up by the phrase, “Escalator up, elevator down.”

In option pricing, there is typically bias toward downside protection rather than speculation to the upside.

When the price of a stock is increasing, it is generally going to do so in an orderly fashion–marching steadily higher with low volatility.

This is, of course, speaking generally.

Certainly, in 2020, we have seen some very violent swings to the upside.

When the price of a stock is decreasing, it is more likely to be less orderly and more volatile.

It’s less likely that a stock will have a slow, steady, and orderly decline.

This is what creates option skew.

Implied volatility drives up the price of an option and the price of the underlying entity is more likely to be volatile to the downside than the upside.

Horizontal Skew

Let’s take a better look at horizontal volatility skew.

As noted before, this term refers to the idea that there are differences in implied volatility between option expirations and therefore likely inefficient pricing.

This presents an opportunity for a profitable trade.

If you’re able to identify a stock that has horizontal skew in its option pricing, you might consider using calendar spreads to take advantage of this.

For example, if the front month has higher than expected implied volatility, this option will be relatively more expensive.

This is also known as “positive” horizontal skew.

“Negative” horizontal skew is when the back month IV is higher than the front month.

These concepts are related to contango and backwardation in futures trading.

If that’s the case, you’ll want to buy the front month and sell the back month.

This is known as a “reverse calendar spread” and is most profitable when the underlying asset price makes a strong move before the expiration of the back month contract.

As a specific example, let’s say you identify positive horizontal skew in the calls of a particular stock.

This means that the market is pricing in the idea that it’s more likely for a large upside move to come in the long term than the short term.

If you believe that that’s not true for one reason or another, you can use a reverse calendar call spread to profit.

If the share price falls sharply, both contracts will be nearly worthless and you can buy back the spread for less than you sold it for which will result in a profit.

The trade will also be profitable if implied volatility decreases.

Since you sold the front month at a point where there was relatively high implied vol, you will be able to buy back the spread profitably if implied volatility falls.

The problem with this type of spread is that the margin requirements are steep because the short call that you sold is considered naked.

Until the back month-long call expires, the front-month short call is in fact hedged–but this likely won’t change the fact that your broker will expect you to have a substantial backstop.

Horizontal skew is often driven by outside factors like earnings announcements, product announcements, macro events, etc.

If there’s an earnings call in the front month you’re looking at, for example, you might see normal positive horizontal skew flatten out because investors are uncertain about what they’ll hear and therefore drive implied volatility higher.

Vertical Skew

Vertical skew is commonly interchangeable with “option skew” and “volatility skew” and refers to differences in IV between different strike prices at the same expiration.

Trading vertical skew is a bit less complicated than trading horizontal skew and definitely requires less margin so it’s likely a more favorable strategy for individual investors.

Vertical skew will help us identify opportunities to trade credit spreads or debit spreads..

Ideally, you’ll already have a thesis about the underlying asset or some type of assumption that you’re working with.

If that’s the case, then you can use a vertical skew to simply help you identify specific strike prices that are best suited for your trade.

This is in contrast to beginning your search for trade with volatility skew and then developing an opinion about the direction of the underlying after you’ve already picked out the spread you want to buy or sell–what out for confirmation bias!

For example, let’s say that you believe that the price of $ABC is going to increase before option expiration 10 days from now.

If that’s the case, you’ll want to look at strategies such as a bull put spread.

Once you’ve decided on that, it can be difficult to identify what specific strikes to buy and sell.

This is where vertical skew can help.

By looking at the skew between a variety of different strikes that you’re interested in you’ll be able to identify exactly which ones are cheap or expensive.

By doing this, along with considering your risk/reward constraints and parameters, you’ll be able to maximize the credit you receive on the put spread.

By trading this way you’ll not only maximize the credit you receive but as the skew unwinds from the levels that you traded at you’ll reach your profit target quicker which will allow you to safely exit the trade with profit and begin looking for new opportunities.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more