Chevron's Latest 5-Yr Plan Implies A Major Dividend Hike - CVX Stock Looks Cheap

by MattGush via iStock

Chevron Corp. (CVX) outlined a sustainable cash flow plan during its November 12 Investor Day that implies a potentially sizable dividend hike. It has averaged 7% over the 25 years, outperforming rivals. Even with a 5% hike in January, CVX stock looks undervalued.

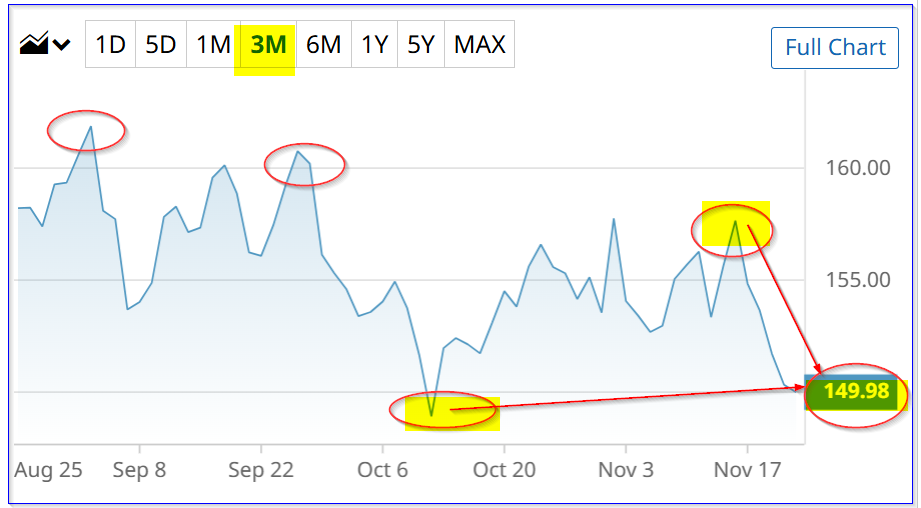

CVX closed at $149.98 on Friday, Nov. 21, 2025, near a recent low of $148.90 on Oct. 10. Moreover, it's well off recent peaks of $160.72 on Sept. 25 and $161.83 on Sept. 2.

(Click on image to enlarge)

CVX stock - last 3 months - Barchart - As of Nov. 21, 2025

At today's price, given Chevron's $6.84 annual dividend per share (DPS), CVX stock has a dividend yield of 4.56% ($6.84/$149.98).

However, Chevron has already paid out four quarterly DPS payments. Chevron has a 38-year history of raising its DPS. Its next dividend in January will likely be at least 5% higher.

Future Dividend Hikes

I discussed this in a recent Barchart article: (Chevron's Free Cash Flow Rises - An Expected Dividend Hike Could Push CVX 14% Higher."). I projected that Chevron might raise the DPS by 5% to $7.18.

That implies that the future yield is now almost 4.8%:

$7.18 / $149.98 = 0.04787 = 4.787%

However, in its latest Investor Day discussion, the company seemed to imply that it might raise its DPS by 7%:

Moreover, the company stressed that it expects to buy back a lot of shares:

The CFO stressed its “superior” shareholder returns, and the company said it

All of this suggests that there is no doubt that Chevron will certainly raise its dividend.

So, how will that affect CVX stock?

Average Yield and Price Target

Morningstar reports that the market has given CVX stock an average dividend yield of 4.08% over the past 5 years. Seeking Alpha reports that it has been 4.40% over the last four years.

Similarly, Yahoo! Finance has a 4.21% average 5-year yield statistic.

So, let's assume that over time, CVX stock will revert to an average yield of 4.21%. Here is how that works out. We can divide the 5% higher DPS by 4.21%:

$7.18 DPS / 0.0421 = $170.55 per share

That target price is $20.57 higher than today's price, and implies upside of almost 14%:

$170.55 / $149.98 -1 = 1.1372 -1 = +13.72%

In other words, over the next 12 months, we have good reason to expect to make 14% in price appreciation, as well as make a 4.8% dividend yield.

So, the total expected return (ER) is almost 18.5%:

13.72% capital gain + 4.72% dividend yield = +18.44% total ER

Given that CVX stock looks cheap here, what is the best way to play it? Just buy and hold?

Alternatively, you can enhance this return by shorting out-of-the-money (OTM) puts and buying long-dated in-the-money (ITM) calls. Let's look at this.

Shorting OTM Puts and Buying ITM Calls

The trick is to repeatedly make monthly income shorting OTM puts and using that income to help pay for a long-dated in-the-money (ITM) call option.

For example, the Dec. 26, 2025, options expiry period shows that $140.00 put option strike price has a midpoint premium of 98 cents. That gives the short-seller of this put contract, 6.65% below Friday's close, an immediate yield of 0.70% (i.e., $0.98/$140.00).

(Click on image to enlarge)

CVX puts expiring Dec. 26, 2025 - Barchart - As of Nov. 21, 2025

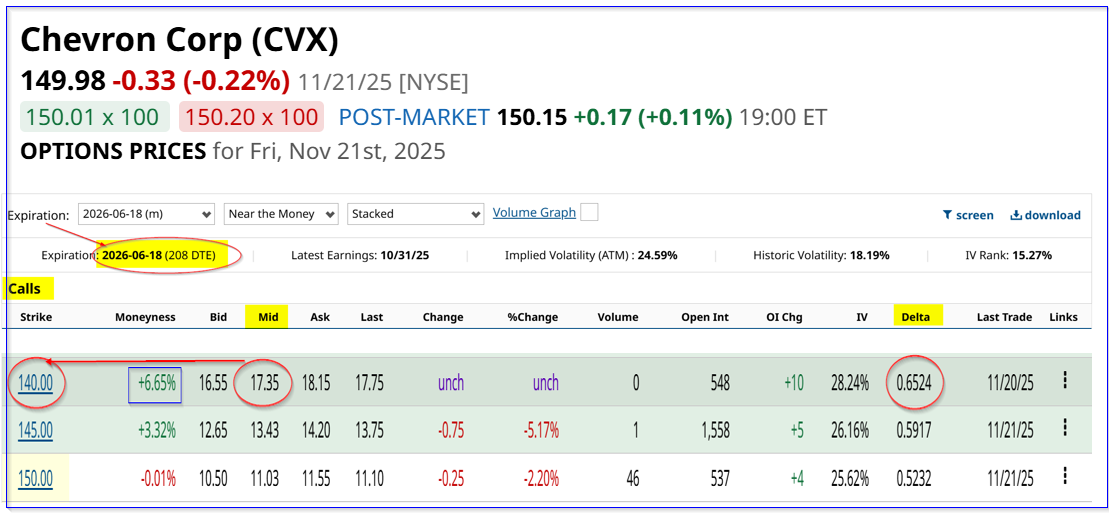

If repeated each month, this could help pay for a $140.00 call option (i.e., $10 in-the-money or ITM) that expires on June 18. That premium is now $17.35 for $140.00, giving the investor an all-in cost of $157.35 (i.e., $140.00 + $17.35).

(Click on image to enlarge)

CVX calls expiring 6/18/26 - Barchart - As of 11/21/25

This is just $7.37 over today's price (i.e., $157.35-$149.98). However, the investor could also short a call for July right before the close of the June 18 call period.

So, if an investor can short puts for seven months and makes $0.98 each month, the total accumulated income potential is $6.86. As a result, the net cost is just (assuming the investor exercises the call option):

$157.35 - $6.86 = $150.49

That is just 51 cents higher than owning 100 shares. The investor's cost is only $51 more with this play.

For example, the put and call play costs $14,000 in cash collateral to sell short a monthly OTM $140.00put, plus an outlay of $1,735 to buy one $140.00 call, or $15,735. But, after accumulating $98 each month (potentially) for seven months, or $686, the cost is reduced to $15,049.

But owning 100 shares of CVX outright would cost $14,998, or just $51 less.

However, the short-put and call investor has significant leverage. For example, if CVX rises to $170.55, the price target, the call option would have significant intrinsic value:

$170.55 - $140.00 = $30.55 intrinsic value

That would give the investor who spent $17.35 for those calls a significant return:

$30.55/ ($17.35 - $6.86 income) = $30.55 / $10.49 = 2.91x

This would give the investor a 191% return, vs. the total return of 18.44% from owning shares. This assumes the investor sells the calls at intrinsic value in six months. That is why shorting one-month OTM puts and buying six-month ITM calls works out quite well.

More By This Author:

ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could Be 24% Undervalued

Large, Unusual Call Options Trading In GOOGL Stock Highlights Its Value

Domino's Pizza Stock Is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more