Large, Unusual Call Options Trading In GOOGL Stock Highlights Its Value

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

by Piotr Swat via Shutterstock

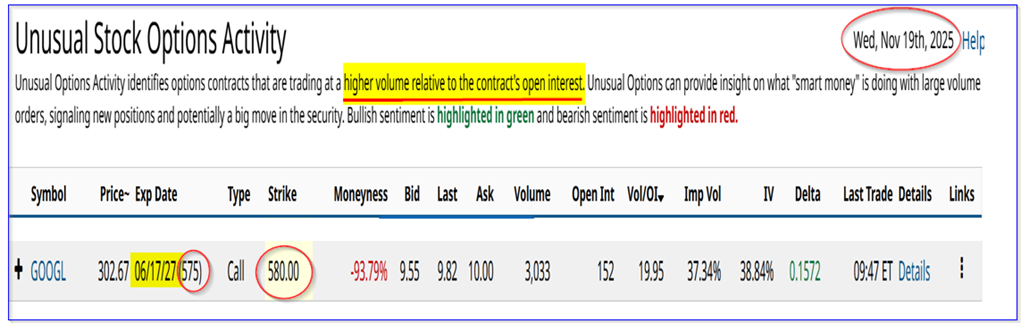

A large tranche of deep out-of-the-money Alphabet, Inc. (GOOGL) call options that expire in over a year and a half highlights the underlying value of Alphabet stock. This is seen in today's Barchart Unusual Stock Options Activity Report.

GOOGL stock is up over 5% today at $300.94 per share. This occurred several days after it was revealed that Berkshire Hathaway (BRK-A) had purchased a substantial amount of Alphabet shares.

(Click on image to enlarge)

GOOGL stock - last 3 months - Barchart - Nov. 19, 2025

Since Friday, Nov. 14, after it was revealed that Berkshire had bought $4.3 billion worth of Alphabet stock as of Sept. 30, GOOGL stock has risen almost 10% from $274.91.

I had discussed how valuable GOOGL stock was last week in my Nov. 11 Barchart article, “Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued.”

I discussed in the article how the stock could be worth $408.27 per share. This is based on its very strong free cash flow (FCF) and FCF margins.

That price target is still worth +16% more than today's price. And if Alphabet can continue showing high FCF margins, the price target could likely rise.

This could be one reason why some institutional investors are taking a long view and buying long-dated out-of-the-money (OTM) call options.

Heavy Buying of Long-Dated Calls

This is seen in Barchart's Unusual Stock Options Activity Report today. It shows that over 3,000 call option contracts have traded at the $580.00 strike price for expiry on June 17, 2027.

That is over one and a half years from now (575 days), and the strike price is $279.06 or +92.7% higher than today's price (i.e., $580/$300.94 -1).

Moreover, the premium is $9.82, so the breakeven point is $580+$9.82 = $589.82, or $288.87 higher, i.e., +96% over today's price.

(Click on image to enlarge)

GOOGL calls expiring June 17, 2027 - Barchart Unusual Stock Options Activity Report - Nov. 19, 2025

This means that for all intents and purposes, the buyers of these calls expect that GOOGL stock will more than double in the next year and a half.

Why Buy Long-Dated GOOGL Calls?

This is also a way to buy GOOGL shares with less dollar outlay and yet obtain a leveraged upside in the stock. For example, to buy 100 shares of GOOGL stock means:

100 x $300 = $30,000

But this same $30,000 can purchase about 30 call option contracts (i.e., $30,000 / ($9.82 x $100) = 30.6). That gives the investor exposure to 3,000 GOOGL shares (i.e., 30 calls x 100 shares per call) rather than 100 shares of GOOGL stock.

So, over time, if GOOGL stock moves up by $108 to $408, it's possible that GOOGL calls expiring June 17, 2027, could rise by 15.72% (based on the delta ratio):

$108 x 0.1572 = $16.98

So, the calls would be worth $9.82 + $16.98, or $26.80. That would provide a great potential expected return (ER):

$26.80 / $9.82 = 2.73

In other words, the investment profit would be +173%, compared to a just a 16% gain to $408 per share by just holding GOOGL shares.

That means the investor's account would be worth $80,400 ($26.80 x 100 x 30), buying these long-dated calls. That compares to just $40,800 owning just 100 shares. That implies a 2x greater return with just a 16% gain in GOOGL stock.

So, this is a great way to gain exposure to a large number of GOOGL shares. Moreover, there is good downside protection here, since the call options have a long expiration period.

The bottom line is that, assuming GOOGL stock performs as expected, based on its strong free cash flow, this is a good way to make a good expected return in GOOGL stock.

More By This Author:

Domino's Pizza Stock Is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

SenesTech Generates Strong Revenue Growth - Huge Upside Possible

Nvidia's Earnings Report Will Be Out On Wednesday, Nov. 19 - How To Play NVDA Stock

Disclosure: On the date of publication, more