Boeing Slips Under The Radar

Boeing Benefits From A Busy News Week

Last week was quite a news cycle. Pundits construed the chaos in the capitol the week before as a coup, and the corporate establishment struck back. National Guardsmen were brought into Washington D.C. by the thousands. By the weekend, newly highlighted footage of the Viking helmeted Capitol intruder suggested coup claims were overwrought.

“Attempted coup” pic.twitter.com/07mvbN0bE5

— Mark Dice (@MarkDice) January 17, 2021

And Biden's transition team turned its concerns toward the National Guardsmen in the capital.

Biden’s transition team has revealed there is a very real fear that members of the national guard who support President Trump might kill Biden during the inauguration so they’ve asked commanders to confiscate all ammo and magazines from the soldiers. See photo: pic.twitter.com/WUp8FKj0DZ

— @amuse (@amuse) January 17, 2021

Given all that excitement, you might have missed the news out of Indonesia on January 9th: another Boeing (BA) airliner fell out of the sky. Or maybe you saw something and figured it was a follow-up article about the other Boeing airliner that crashed in Indonesia a couple of years ago).

Maybe It Wasn't Boeing's Fault

Unlike Lion Air crash in Indonesia in 2018, the plane that crashed earlier this month was a "classic" 737. That is, it wasn't a 737 MAX with the maneuvering software coded in part by $9 dollar per hour Indian contractors. Experts are still working on the black box from this crash. So far, this latest crash has only been fatal to everyone who was on board Sriwijaya Air flight 182, and not to Boeing's share price.

Data by YCharts

In the event revelations about the crash cause Boeing shares to crash, we've posted a couple of hedges for it below. First, a quick note on our ratings of the stock.

A Top Name In September And November

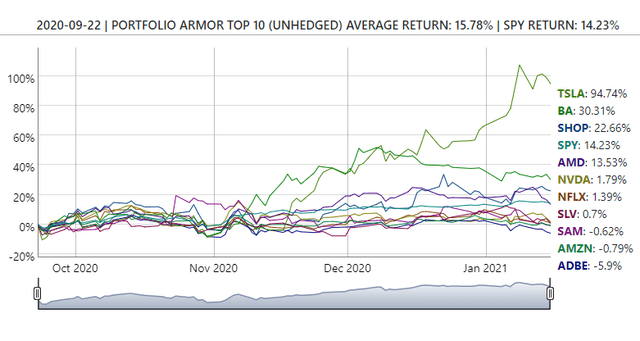

To our surprise at the time ("Betting On Clowns And Monkeys"), Boeing was one of our top ten names in September, alongside Tesla (TSLA) and Shopify (SHOP). Since then, Boeing's up 30%.

This and subsequent screen captures are via Portfolio Armor.

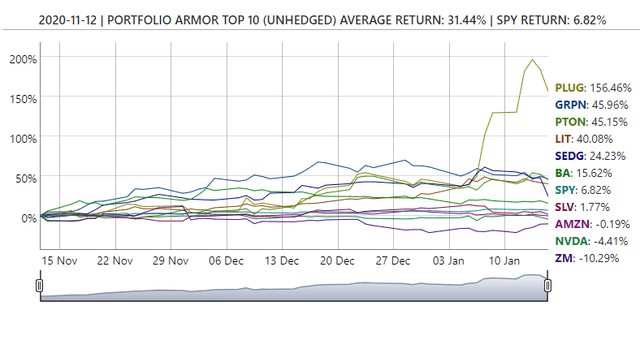

Boeing was also a top name of ours on November 12th, alongside Plug Power (PLUG). Since then, it's up a little more than 15%.

Currently, Boeing is not one of our top names.

Crash Protection For Boeing (Shares)

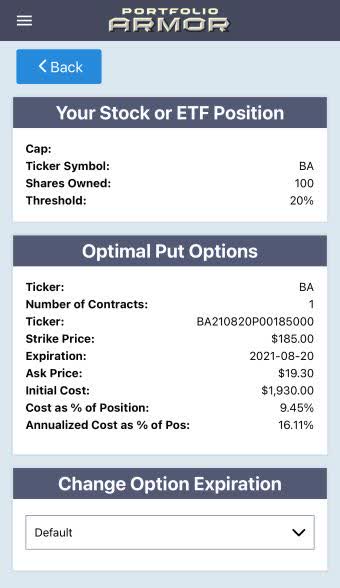

For these examples, we're assuming you have 100 shares of Boeing and can tolerate a drop of 20% over the next several months, but one larger than that.

Uncapped Upside, Positive Cost

As of Friday's close, this was the optimal, or least expensive put option to hedge 100 shares of BA against a >20% drop by late August.

Here the cost was $1,930, or 9.45% of position value, calculated conservatively, at the ask (in practice, you can often buy options at some price between the bid and ask).

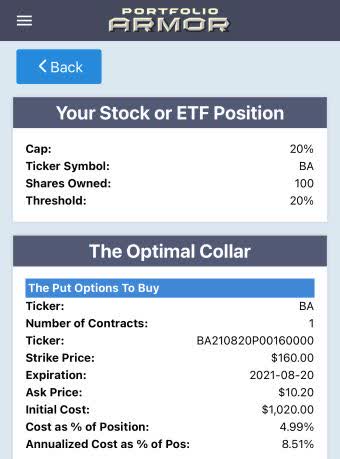

Capped Upside, Negative Cost

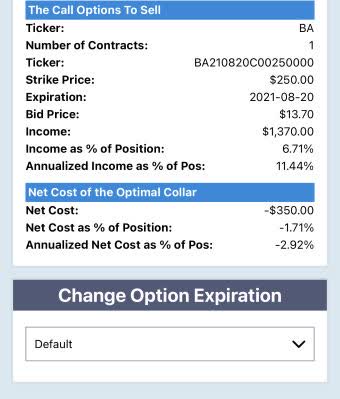

If you were willing to cap your possible upside at 20% over the same time frame, this was the optimal collar to protect against a >20% drop.

For this one, the net cost was negative, meaning you would have collected a net credit of $350, or 1.71% of position value, when opening this hedge. That's assuming (to be conservative again) that you placed both trades at the worst ends of their respective spreads.

I would have thought yet ANOTHER Boeing crash would have finished these guys. Even if the planes or situations or even causes are not the same, Boeing planes are becoming very unlucky to fly on!

The benefits of being part of a duopoly. But the Russians and Chinese may have strong competitors soon.