A Sweet Options Play On Hershey

Image Source: Pexels

Options trading can be fast, exciting, blissful, and heartbreaking — all in the same day, asserts Jim Woods, options trading expert and editor of High Velocity Options.

It’s kind of like that first love, which is exciting beyond imagination and heartbreaking beyond hurt when it’s over. First kisses also are like that, as that is often the opening salvo to it all.

Today, we are going to get into a new position that I think will deliver a blissfully profitable kiss to our High Velocity Options portfolio. That’s because today’s new position is in a company literally known for its “kisses,” and it is The Hershey Company (HSY).

Now, you likely know all about Hershey, as it is the leading confectionery manufacturer in the United States, controlling around 46% of the domestic chocolate space, with brands such as Hershey bars, Reese’s, Kit Kat and, of course, those iconic Hershey’s Kisses.

Last quarter, HSY saw strong earnings per share (EPS) growth of 32% year-over-year, and I expect the company to deliver an even sweeter result when it reports earnings again on or about July 29.

The reason is that confection sales are up of late, and I think it’s because many consumers are taking refuge in the small pleasures in life where they can, especially considering the dual pinch of rising inflation and soaring gas prices.

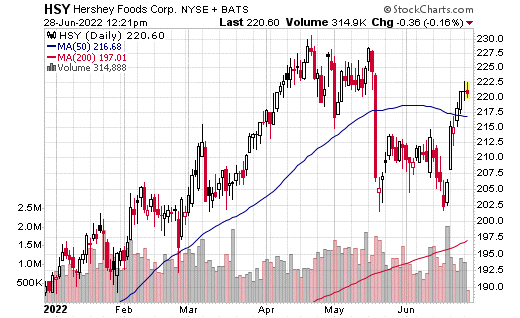

Another tasty aspect of HSY here is the stock’s technical pattern, which is showing a bullish breakout over the past few weeks that’s vaulted it back above resistance at the 50-day moving average.

So, I would say to take advantage of this trend with the following action: Buy the HSY Aug. $230.00 call options at market.

More By This Author:

Six Things That Might Go RightRetirement Bets On Cambria

5 Lessons For Long-Term Investors

Disclaimer: © 2022 MoneyShow.com, LLC. All Rights Reserved.