Not All Corporate Earnings Are Measured In The Same Way

As earnings season gets fully underway this month, investors need to understand that not all earnings measurement techniques are the same. Profits can be measured in various ways to suit management and its shareholders, independently of what the financial accounting profession calls “earnings”. This past year the divergence between non-GAAP and GAAP reporting is significantly wide as to send up a warning flag for stock investors that profits may not be what management would lead to you to believe.

GAAP guidelines are used in the national accounting for GDP and other measures of national performance. These accounting measures are the standards used to bring uniformity and credibility to measuring corporate earnings. These are the measures used by the accounting professional largely for corporate taxation filings as well as a reflection of the fundamentals of a company’s operations.

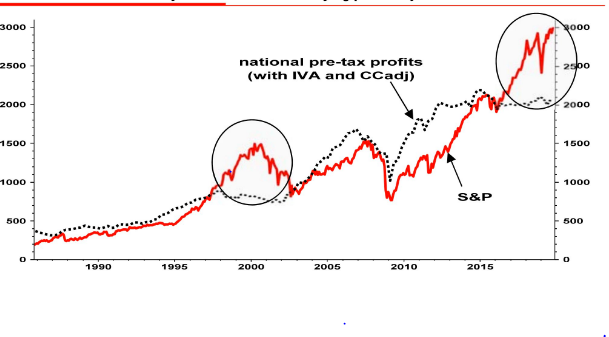

Figure 1 Difference Measurement of Profits.

Source: Société Générale

However, in reporting to Wall Street, companies have considerable leeway in portraying their operations. The use of non-GAAP accounting results in a number of adjustments, often for so-called “one-time” charges against profits. Management will maintain that these adjustments result from temporary balance sheet adjustments. These adjustments can include, acquisition costs, specific write-downs associated with discontinued corporation divisions or the treatment of compensation in the form of stock options, to cite the most common adjustments. More often than not, however, management backs out these specific types of losses to support share values and investor optimism for the coming quarters.

Historically, there have been periods when non-GAAP and GAAP reporting have largely coincided. However, when they diverge this should be at least a yellow flag for investors. The divergence today is one such time when non-GAAP earnings have far and away exceeded GAAP-measured earnings. The issue facing investors concerns which measurement is the better one to predict future earnings and hence future stock values.

From the mid-1990s to 2005, non-GAAP earnings greatly exceed GAAP earnings and ultimately non-GAAP earnings fell sharply and so did the stock market. Now, we face a similar set of conditions. Non-GAAP earnings have totally disconnected from GAAP measurements to the point that they almost represent two different universes. This makes it very trying for investors to interpret the health of corporate profits when the GAAP measure represents no growth since 2015 and the other measure claims that profits have soared. Investors are, in a sense, forced to chose sides. However, choosing non-GAAP in the past was not the right decision as the equity markets fell sharply when the two measures were so far out of sync. Is this time different?

Lying, cheating Wall Street companies. Why would anyone who needs the money risk this market? Bombshell stat, Prof.

One way to stop this lying is to tax the corporations on the inflated numbers.!