NIIP And Primary Income: Dark Matter +20 Vs. Exorbitant Privilege +40

Image source: Pixabay

Here’s a graph that I constructed, in preparing to teach the open economy component of Macro-Policy:

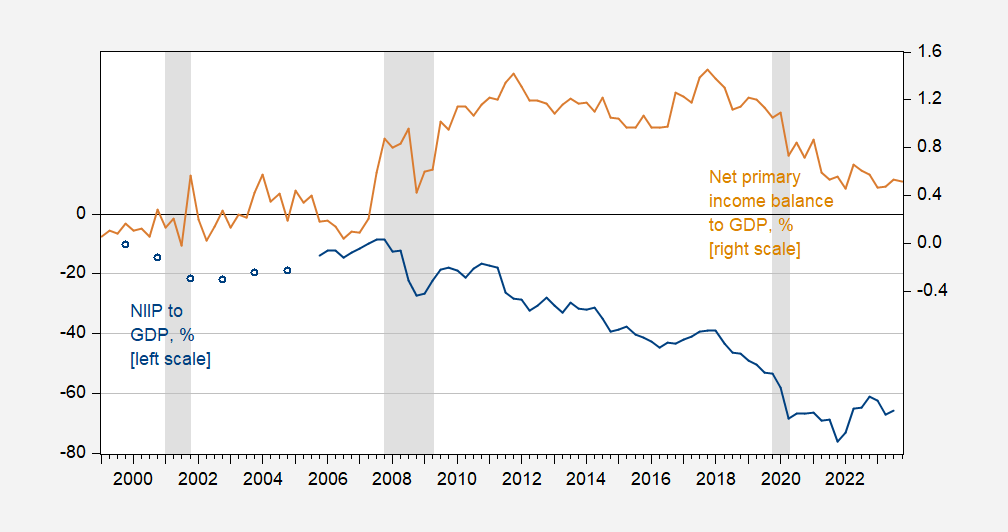

Figure 1: US Net International Investment Position as ratio to GDP (blue, left scale), Balance on Primary Income as ratio to GDP (tan, right scale), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: BEA via FRED, NBER, and author’s calculations.

For many years, the US has been a net debtor to the rest of the world (assets – liabilities < 0), and yet income from the rest of the world has exceeded payments to the rest of the world, consistently since 2007.

Either we’re mismeasuring net assets badly (Hausmann-Sturzenegger “dark matter”), or returns on our assets abroad are consistently much higher than foreign assets here (“exorbitant privilege”), or some combination of both. See a very clear and concise discussion in these slides by Schmitt-Grohe, Uribe and Woodford (slide 47 onward). Here’s a 2021 Econbrowser post.

Interestingly, the increasingly negative NIIP has seemingly finally caught up with primary income, as the latter is now coming down to zero.

More By This Author:

The IMF View On U.S. GDP GrowthGDP Forecasts Brighten Yet Further

GDP Nowcasts - Sunday, April 14