The Economic Pulse: Understanding Labor, BRICS, Retail Investment, And More

From the steady pulse of the labor market to the expansion of the BRICS coalition, the growth of retail investment in options, and the alarming rise in global fossil fuel subsidies, here’s a panoramic look at some of the defining economic developments shaping our world today.

Healthy Labor Market Trends: A Closer Look

👩🏼🏭 Initial Jobless Claims and Wage Growth:

The labor market continues to show promising signs of health. Initial jobless claims for the week ending August 19 fell unexpectedly by 10,000 to 230,000, defying a consensus forecast that called for a 1,000 increase. Meanwhile, continuing claims fell more than expected and are close to 6-month lows, indicating that newly unemployed workers are finding new jobs without significant challenges.

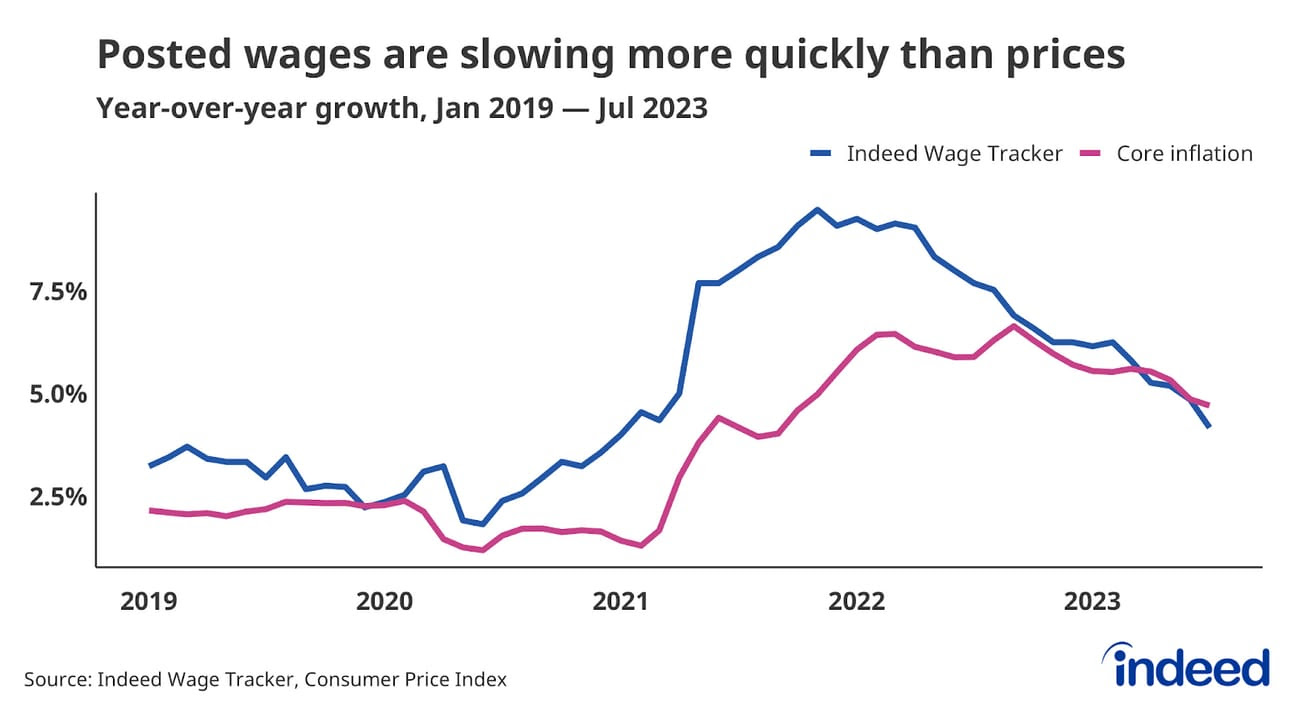

Wage Growth and Inflation Concerns:

In a concerning trend, new data from Indeed reveals that wage growth is declining faster than inflation. With the slowest gains for wages since late 2021, this phenomenon is sure to catch the attention of economic analysts and policymakers, including the Federal Reserve.

BRICS Expanding: A Global Economic Shift

🗺️ New Members Joining: The BRICS coalition is growing, as 6 new countries: Argentina, Egypt, Ethiopia, Saudi Arabia, and the United Arab Emirates have been invited to join. Effective January 1, 2024, this expansion will mean the bloc accounts for 46% and 37% of the world’s population and GDP (in terms of purchasing power), respectively.

A Catchy Name Retained: The group’s identifying acronym will remain BRICS, as eloquently stated by Brazil’s President Luiz Inácio Lula Da Silva: “The name will remain BRICS, it’s beautiful.”

A Changing Tide in Retail Investing

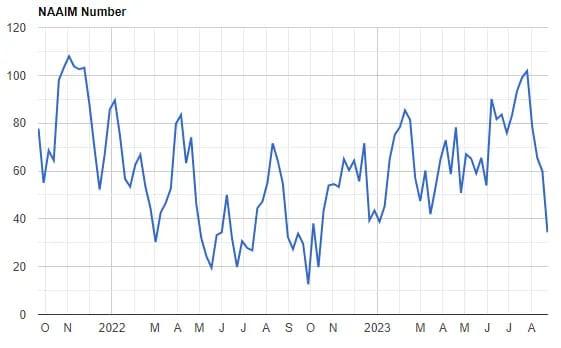

📉 Shifts in Equity Exposure

The National Association of Active Investment Managers (NAAIM) reveals that active managers have reduced exposure to equities for four consecutive weeks, with sentiment among retail investors also showing a bearish trend.

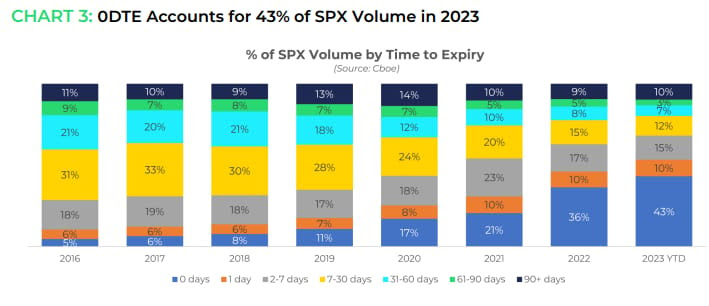

⏱️ Retail’s Love for Options

Despite the shifts in sentiment, retail investors continue to be drawn to zero-day-to-expiration (0DTE) options. With retail likely accounting for 30% to 40% of volume linked to 0DTE contracts, this trend has prompted debate among Wall Street giants on its market impact.

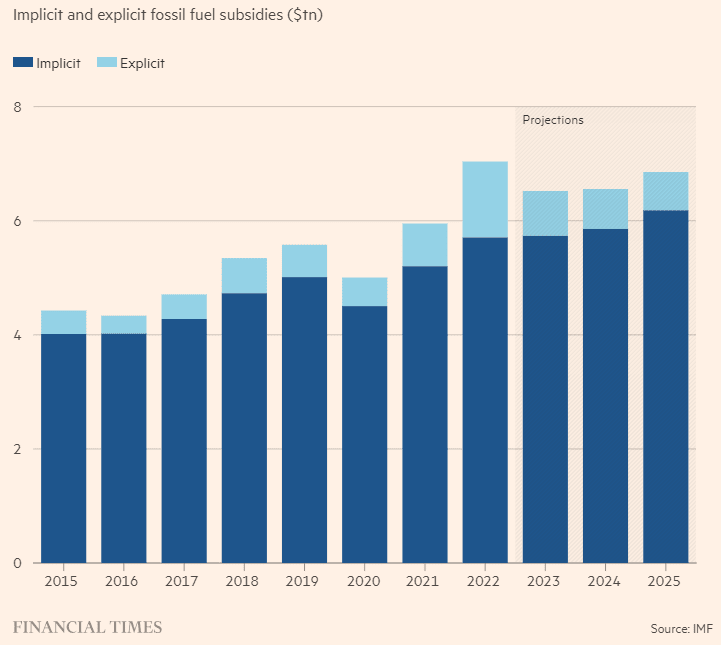

Record Global Fossil Fuel Subsidies: A Troubling Trend

📈 IMF’s Stunning Revelation The International Monetary Fund (IMF) has revealed that subsidies for global fossil fuels hit a new record in 2022, totaling $7 trillion. This figure, representing 7.1% of global GDP, highlights an urgent issue that demands global attention.

Concluding Thoughts:

These key economic insights provide a glimpse into the current state of the global economy, offering critical considerations for investors, policymakers, and citizens alike.

More By This Author:

The Market’s Tightrope: Nvidia’s Earnings, Housing Trends, Bank Ratings, and More

From China’s Debt Woes to US Housing Affordability

Navigating the Financial Currents: A Deep Dive into Today’s Market Movements

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more