From China’s Debt Woes To US Housing Affordability

In an era marked by swift economic changes and surging market intricacies, from China’s looming debt concerns to the US’s dwindling housing affordability, it’s essential for investors to stay updated on global financial shifts

China’s Overdue Debt Reckoning

Legendary investor Ray Dalio, who boasts a staggering $3B investment in Chinese businesses, recently expressed concerns about China’s mounting debt issue. Over the past half-decade, China’s debt has nearly doubled, pushing the nation’s Debt-to-GDP ratio to an alarming 281.5%.

Crisis in China’s Real Estate: The Evergrande Saga

China’s financial tremors don’t end with its national debt. The real estate sector, an integral pillar of its economy, is showing signs of deep-rooted issues. China Evergrande Group, a behemoth in Chinese real estate, has just filed for Chapter 15 bankruptcy in New York. This strategic move intends to protect the company from US creditors as they strategize a restructuring plan for their overwhelming $300 billion debt. The echoes of this financial calamity were first heard in December 2021, when Evergrande defaulted on its dollar bond. But the company isn’t the sole casualty; another major player, Country Garden, also flashed warnings as they grappled with debt restructuring.

US Housing’s Alarming Metrics

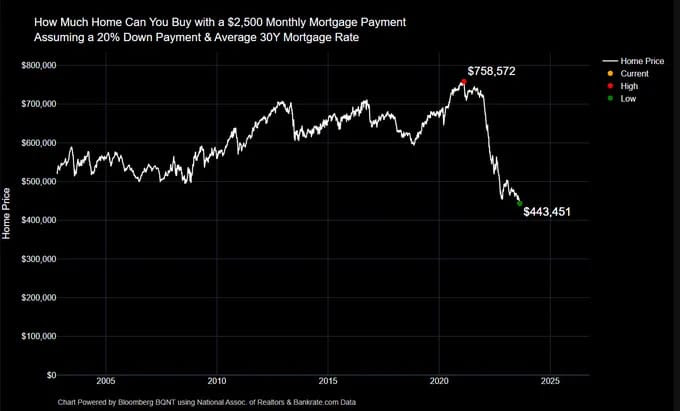

Switching continents, the US isn’t untouched by financial concerns, especially in its housing market. Presently, housing affordability in the US languishes at the lowest it’s been in four decades. A stark indicator of this downturn is the spike in the average rate on a 30-year fixed mortgage, which stands at 7.09% – the loftiest in over 21 years. To put things in perspective: three years ago, a $2,500 monthly mortgage backed by a 20% down payment could secure a house worth $758k. Today, that same amount barely fetches a $443k residence.

Rising Global Bond Yields: What It Signifies

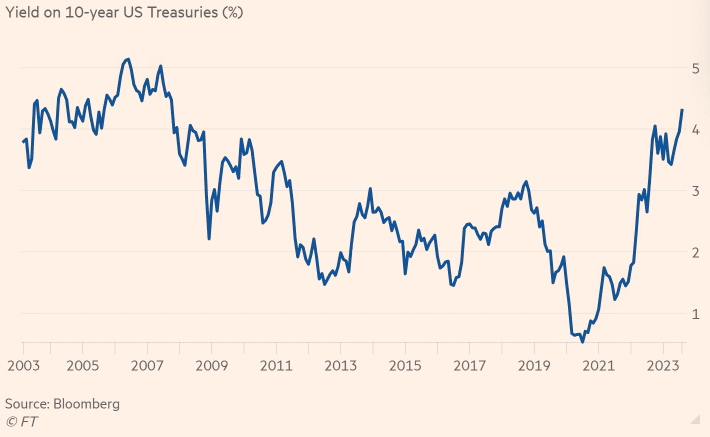

The global scene is abuzz with rising government bond yields. Most notably, the yield on the US 30-year Treasury surged to its highest since 2011. This trend isn’t confined to the US – German and UK bond yields are at their peak in 8 and 11 years, respectively. The consistent message? Central banks globally are poised to maintain higher rates to combat the ghost of inflation.

A Dip in Investor Sentiment

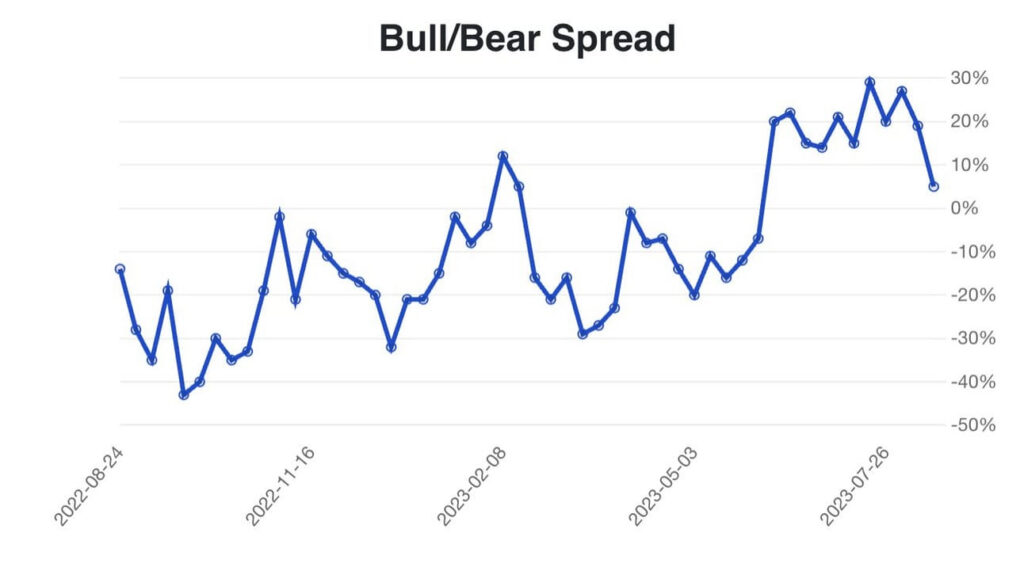

As global financial landscapes oscillate, investor sentiment hasn’t been immune to the fluctuations. Recent data from the AAII Sentiment Survey highlights a sharp decline in bullish outlooks among both retail and institutional investors. Concurrently, the NAAIM Exposure Index, a measure of active managers’ average exposure to US equities, also recorded a dip.

China’s Energy Sector Propaganda

In a candid revelation, the director of China’s National Energy Administration called for an “increase in propaganda” centered on China’s energy sector. This comes in light of China’s bid to safeguard its national interests in pivotal sectors from external adversities.

More By This Author:

Navigating the Financial Currents: A Deep Dive into Today’s Market MovementsShelter Inflation, Stock Picking, And The Surge In Gasoline: A Financial Overview

The Economic Scene: Housing Woes, BofA’s Predictions, And OPEC’s Movements

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more