Special Fed Day Update – Rate Cut & Dow 50K Coming

Image Source: Unsplash

Today is FOMC statement day. Spoiler alert. Jay Powell & Company will be cutting interest rates by 1/4%. There shouldn’t even be a debate from all of the pundits who think the odds have swung so wildly over the past month. They haven’t, and only people not paying attention think the Fed doesn’t cut or that inflation is a problem. It’s not.

The stock market model for the day is stronger than usual, calling for plus or minus 0.50% until 2 pm and then a rally. There is added strength that money should be committed early in the day, and more so than normal, because of the lack of upside enthusiasm into today.

As has been my thesis all year, the jobs market is weaker but not weak. And I do expect a strengthening over the coming few months. The economy continues to surprise to the upside, but it is not yet firing on all cylinders. That opportunity is coming in early 2026. I am old enough to remember 8 months ago, during the tariff tantrum, when some of the high-profile Wall Street types that the media loves to parade out as experts fell flat on their faces with cries about tariffs leading to spiking or soaring inflation. And then there were those who laughingly called for a repeat of 2008 or worse. Not only did our non-emotional models not call for more inflation and economic Armageddon, but I was pounding the table that the stock market, down almost 20% at the time, was easily going to all-time highs, albeit longer than two months.

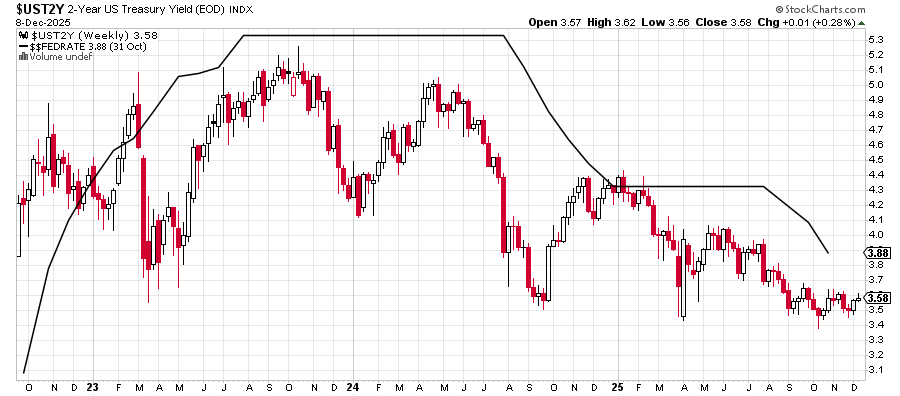

Below is my favorite and usually the most important chart when it comes to reading the Fed. The Fed Funds Rate follows the 2-Year Treasury. The 2-Year has been below the Fed Funds for almost all time since early 2023, which says the Fed is and has been overly restrictive. The market wants 1-2 more cuts sooner than later. My friend, Jim Paulsen, wrote a piece discussing how the bull market in stocks has been accompanied by the least accommodative policy in history, which is an excellent observation. It also says just how strong the bull has been without the Fed’s tailwind.

Finally, and quickly on the markets, as I have a busy day in NYC with media, our Dow 50,000 minimum upside target from 2022 should be achieved in Q1 2026. While that is only 5% away, it was modeled when the Dow was below 30,000. In the shorter term, any and all weakness remains a buying opportunity as I have offered since April. The masses continue to play performance chase into year-end, and an awful lot of folks are at risk of losing their jobs, having panic sold emotionally in April and clinging to a narrative instead of data ever since.

I will be releasing drips and drabs of my 2026 Fearless Forecast shortly. The overall theme will be that 2026 for stocks should see the worst year since 2022, which doesn’t necessarily mean a bad year, just not as strong as the last three enjoyable years.

On Monday, we bought SSO and more TQQQ. We sold SDS, SQQQ, OSIS, GWRE, and EMB. On Tuesday, we bought PFF, IWN, and more MTUM. We sold IJT and PCY.

More By This Author:

New Highs Up Next With Higher Risk Leading Into Fed MeetingIndices Poised For New Highs But They Better Not Fail First

Bulls Turn Tide – All-Time Highs – Bitcoin

Disclosure: Please see HC's full disclosure here.