New Jobless Claims End 2022 On A Positive Note; Preview Of Tomorrow’s Jobs Report

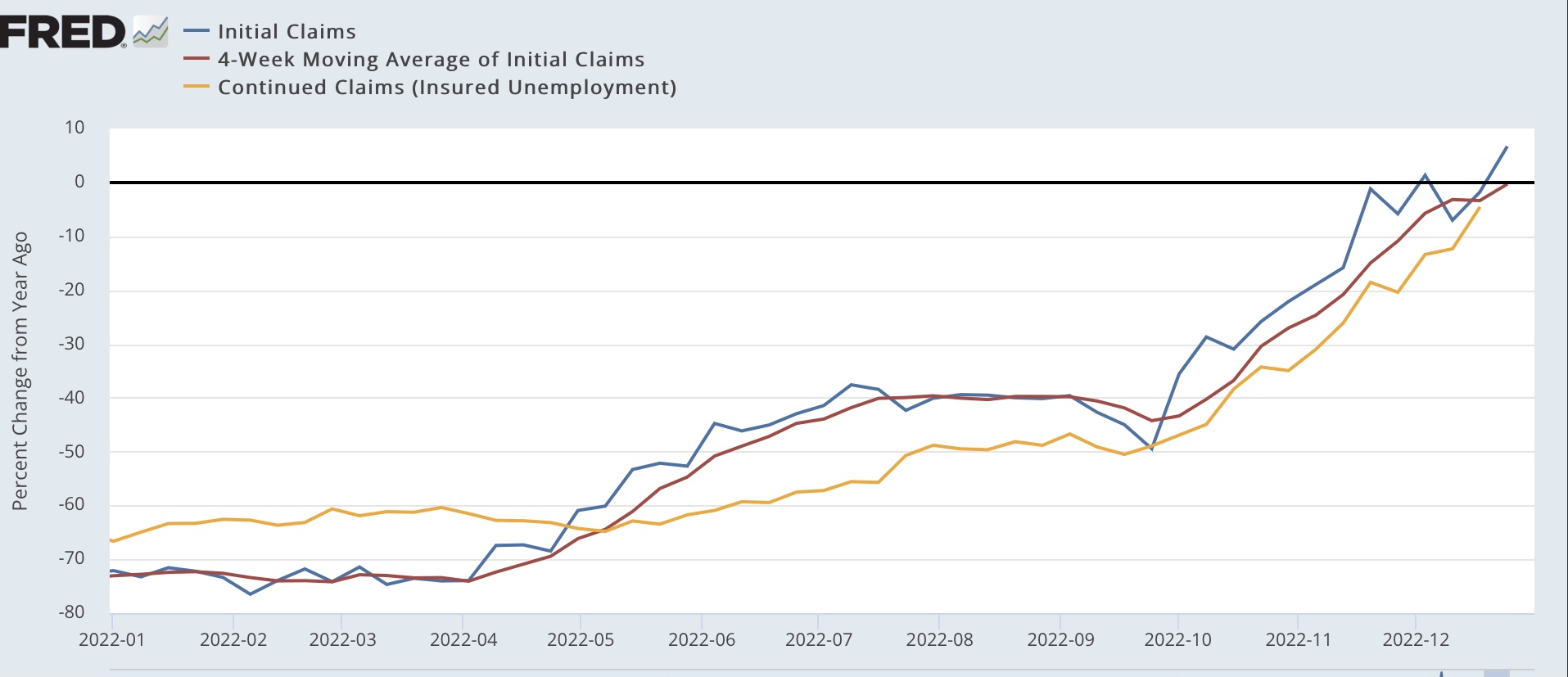

Initial claims started off the year - or ended last year if you are technical about it - on a positive note, declining 19,000 to a 3-month low of 204,000. The more important 4-week moving average declined from 6,750 to 213,750, a two-month low. Continuing claims for the prior week also declined by 24,000 to 1,694,000 (due to either a software or human entry glitch, FRED recorded the entries as December 31, 2023! Which leaves a one-year gap, so I have omitted this week’s data on the graph below):

(Click on image to enlarge)

All three numbers also remained lower YoY. The most important leading indicator, the YoY% change in the 4-week moving average of new claims, is 3.2% lower than its level one year ago (due to the same glitch, this week’s data is omitted on the below graph):

(Click on image to enlarge)

Although seasonal distortions can be at their maximum right now, this is a very good weekly report.

Tomorrow we get the much more important monthly jobs report. Because initial claims lead the unemployment rate and have remained low, I expect the unemployment rate to remain unchanged at +/-0.1%. As to payrolls themselves, I expect the three-month average of 272,000 to continue to slowly decline, which suggests a monthly number below 250,000. Because tax withholding came in negative YoY for the second month in a row in December, I will be on particular alert for a downside outlier compared with recent reports.

Additionally, I will be looking to see if there is a deterioration in some leading employment metrics that haven’t rolled over yet; specifically construction and manufacturing employment. Since the weekly Staffing Index has also weakened in the past month, I will also be looking to see if temporary employment continues to decline.

More By This Author:

December Manufacturing, New Orders Both Decline Further, To Readings Even More On The Cusp Of Recession2023 Data Begins With Another Lesson: The Remedy For High Prices Is - High Prices

Initial Claims Close Out The Year Still Positive

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.