Opportunity To Outperform

It’s been a challenging year for U.S. equities as investors adjust to a new rising rate regime, with inflation concerns at the forefront, coupled with uncertainty around future economic growth. Market commentators have argued that this environment is ideal for stock pickers to shine.

This argument is correct, but with a caveat. With the S&P 500® down 13% year-to-date through May 31, we are in precisely the environment in which skillful active portfolio managers have the most potential to add value, since relative returns are easier to achieve when absolute returns are poor. Poor returns are usually accompanied by increased market volatility, and high volatility can help active managers in two distinct ways.

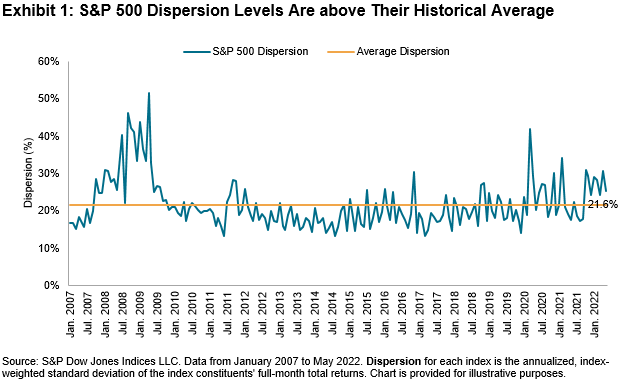

Higher volatility can manifest itself as both higher dispersion and higher correlation. Higher dispersion means a wider gap between winners and losers, while higher correlation indicates a tendency for stocks to move together. The value of stock-selection skill rises when dispersion is high: a more significant gap between winners and losers means that active managers have a better chance of displaying their stock-selection abilities. Exhibit 1 shows that dispersion levels in the S&P 500 have increased since Q3 2021 and are currently above their historical average.

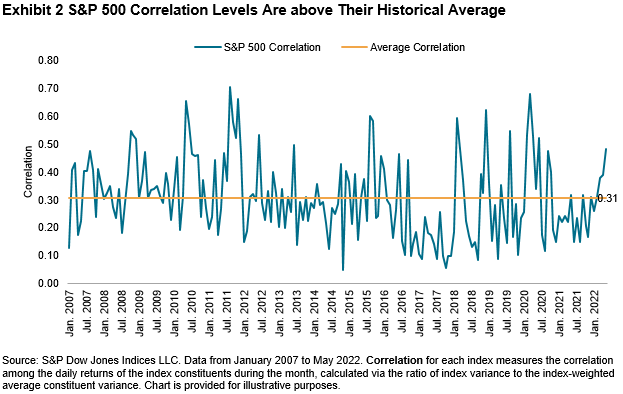

While more subtle than the obvious advantage of high dispersion, active managers should also prefer high correlations over low correlations. Because active portfolios are typically more concentrated and more volatile than their index benchmarks, active managers forgo a diversification benefit. When correlations are high, the benefit of diversification falls, as does the benefit forgone, making active management easier to justify.

Exhibit 2 shows that as macro risks have risen, so too have correlations; in fact, the reading of 0.48 as of May 2022 is the highest since September 2020.

Both high dispersion and high correlations are now working in active managers’ favor. Higher dispersion means that the value of selection skill rises, while higher correlation implies a lower volatility hurdle to overcome. However, high potential for outperformance does not automatically translate into actual outperformance. There is an equally high potential for embarrassment for stock pickers without the requisite skill. When SPIVA® results for year-end 2022 become available next year, we will learn how many active managers were able to capitalize on this opportunity.

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.