Monthly Retail Sales Sharply Higher In November, But Flagging YoY Real Sales Spell Further Trouble

Image Source: Pexels

Real retail sales, one of my favorite broad-economy indicators, was updated through November this morning, making only one month stale. This, along with real personal spending, is one of the two most important indicators which have been missing, as we know the jobs and real income have been stagnant, but in terms of important expansion vs. recession metrics, what of sales and purchases?

Let me cut to the chase: in terms of nominal spending, it confirmed the strength we have seen in the weekly Redbook and daily restaurant reservations reports beginning in November. Specifically, in nominal terms, retail sales rose 0.6% in November after -0.1% downward revision for both September and October. In real, inflation-adjusted terms, however, the story is different.

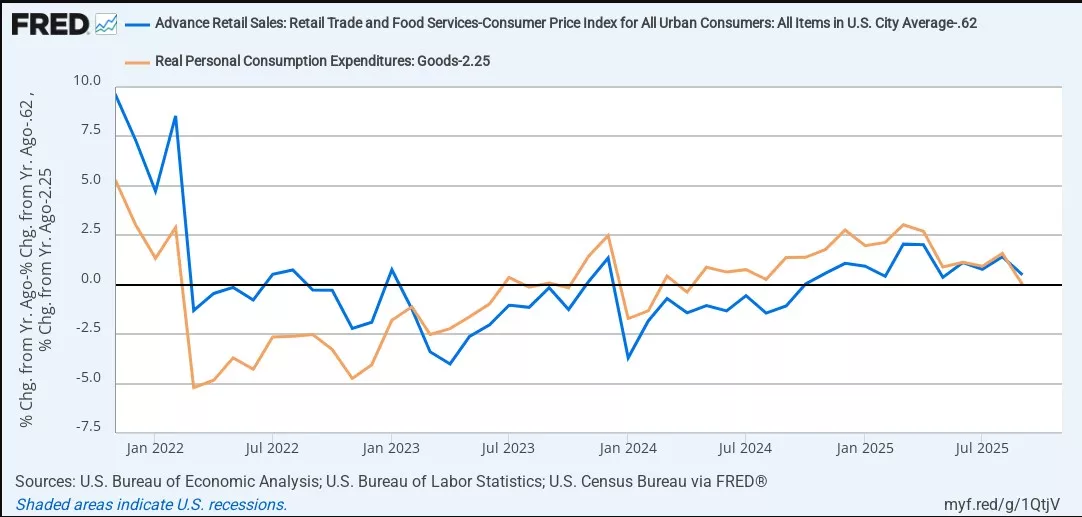

Real retail sales are more problematic, in part because there was no number for October, and November’s reading was marred by the shutdown kludge, particularly for shelter. With those important caveats noted, in November, real retail sales were higher by 0.3% compared with September, and up 0.6% YoY. The below graph, through September, shows YoY real retail sales (blue) and the similar measure of real spending on goods (gold ), with the most recent reading of each subtracted so that it =0:

If you believe, as I do, that the shutdown shelter kludge removed about 0.2% from consumer inflation, that becomes a tiny 0.4% increase YoY, the smallest such gain since October 2024. Also, recall that real personal spending has not been updated yet beyond September.

Going back 75 years, a decline in YoY real retail sales has almost always meant a recession (but both the exception in 2023!). Neither they nor real personal spending on goods are negative as of their last readings,, but real retail sales have decelerated sharply since their YoY peaks in early spring. Should the trend continue, they could be negative YoY in their December or January reports.

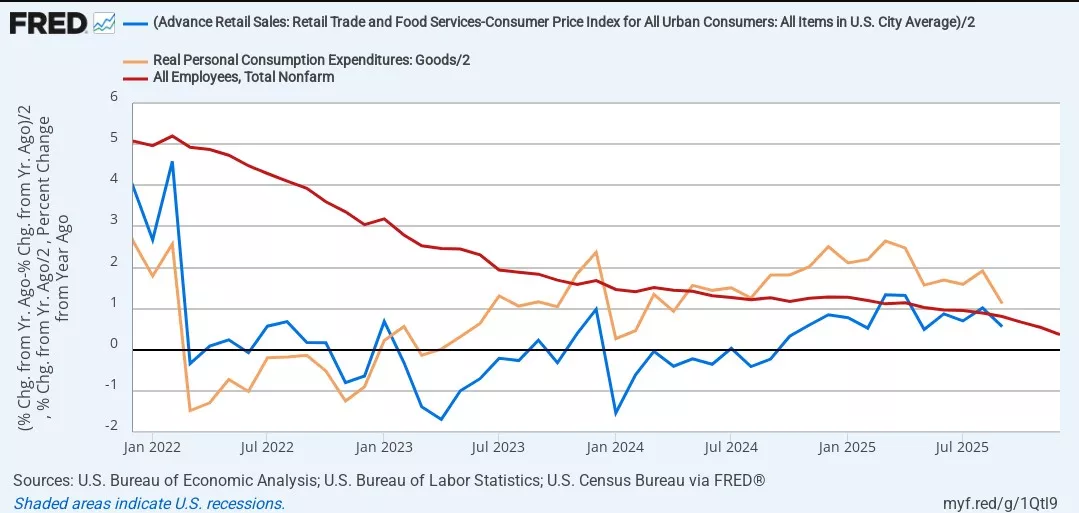

Finally, because consumption leads employment, here is the update of YoY real sales (/2 for scale) together with employment (red), updated through the December jobs report:

[Note that, since I can’t show the November real retail sales “dot,” you’ll just have keep in mind that there was further YoY deceleration] This sharp deceleration in YoY growth in consumption forecast the slide in employment, and suggests that the jobs reports in the next several months will get no better.

More By This Author:

December Jobs Report: Ringing The Alarm Bells For Imminent Recession, With CaveatsNovember JOLTS Report Consistent With A Weak, But Sideways Rather Than Negative, Trend In The Labor Market

Jobless Claims Start The Year Where They Left Off: Very Low Firing, Problematic Hiring Possibly Easing