Markets Face Crosscurrents Ahead Of PCE Data As Fed Stays Cautious

The market is entering a tricky phase, preparing for more balanced behavior amid conflicting signals. The Fed Chair recently highlighted highly valued equities against the backdrop of labor market weakness and elevated inflation risks, factors likely to keep the rate cut trajectory controlled, with only modest 25bps moves. Despite this caution, dovish conditions such as narrowing credit spreads and a steepening yield curve continue to fuel buying scenarios, keeping record highs in play.

Recent PMI and Richmond Fed data showed signs of cooling in the manufacturing sector, shifting focus toward the upcoming PCE Price Index as the next major catalyst. A hotter print would act as a pressure factor, while growth concerns could also tilt the market into a more balanced regime. If growth persists alongside elevated inflation, commodities such as gold, silver, and copper may continue to benefit. The key risk remains policy error, cutting rates into rising inflation, which could drive real yields negative, weaken the dollar, and spark capital flight into hard assets. While this risk plays out over the longer term, the short-term outlook remains tilted upward until inflation or growth concerns take hold.

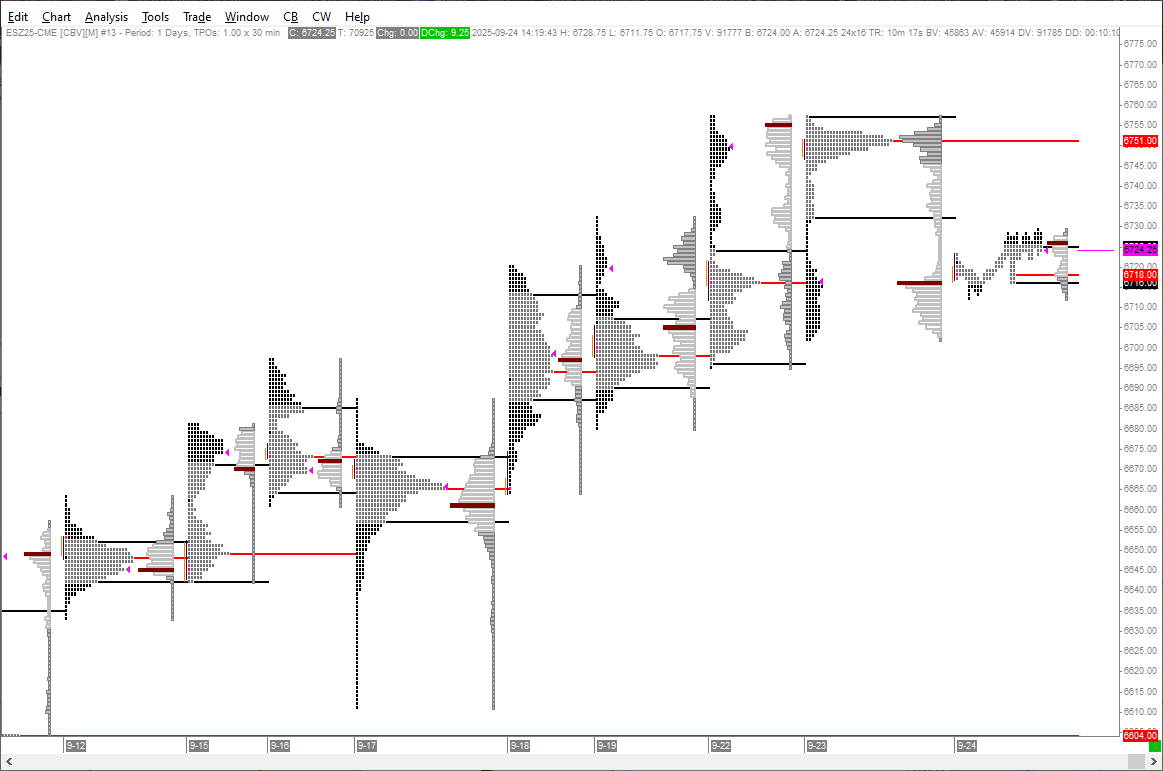

On the technical side, signs of long liquidation and profit-taking near record highs pushed the market lower in the E-mini S&P 500 Futures contract, offering participants opportunities to reload core long positions. With the POC located around 6750, the market may gravitate toward it, while the VAL at 6732 could act as a resistance or selling zone, maintaining intraday rotations. This chart perfectly illustrates the current risk outlook for the broader market:

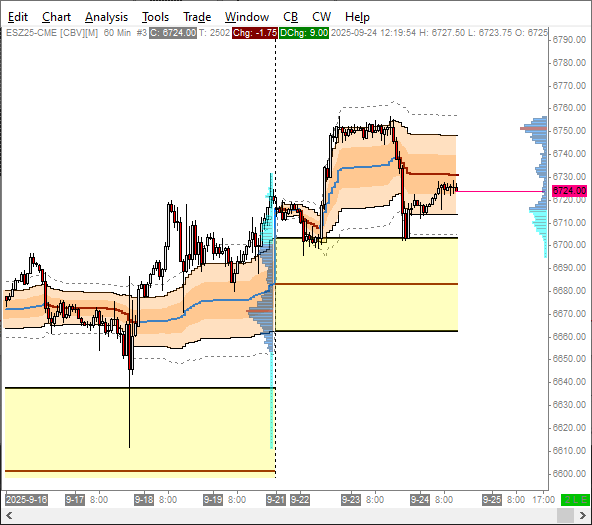

The weekly VWAP close near the previous VAH continues to offer a supportive base as traders await fresh data, with new home sales the only notable release on the horizon.

More By This Author:

Fed’s Steady Cuts Propel Markets Toward Record Highs Amid Growth Signals

Markets Eye NFP Revision As Rate Cut Bets Clash With Inflation Risks

Markets Eye Record Highs As Powell’s Dovish Tone Fuels Rate-Cut Bets

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more