Market Briefing For Wednesday, March 4

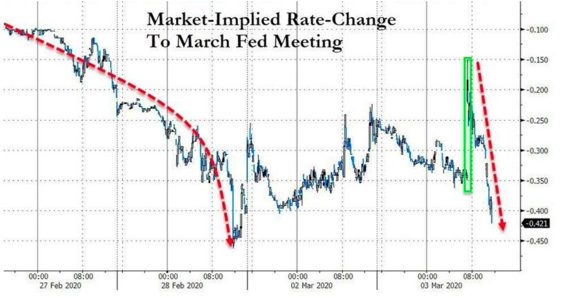

Visibility for a Fed rate cut - has been evident for about a week, aside the President's cajoling for easier monetary policy, and simply because it was set-up with the Fed Funds rate below the entire U.S. Yield Curve.

My own view was that the Fed would bend (surprised it didn't happen on the weekend or yesterday, but knew they might wait for the G-7 meeting communique), and that's what they did, with the pretext of no instant cut after the G-7 (for a couple hours) supposedly intended to be a 'surprise'.

No surprise at all. Again along with everyone else we thought they'd cut, based on the Yield Curve and of course White House sidelined pressure. At the same time 'on the surface' we believed they would, be also thought it unwarranted with regard to attracting money to the U.S., and keeping a decent advantage. The President felt it unwarranted, but presumably he is speaking from a political perspective, believing a high S&P is probable if there's no incentive at all to go into the Bond markets, hence TINA (There Is No Alternative).

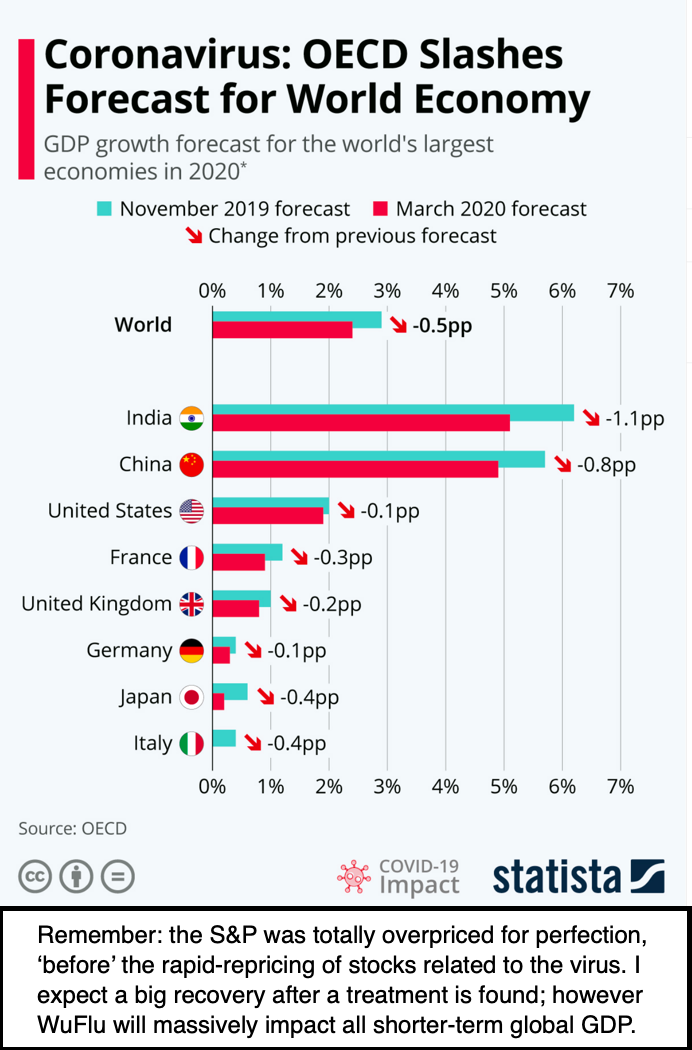

TINA is dangerous as the market showed with the 'trench warfare' today. While the actual Fed cut became a 'buy the rumor / sell the news' event, it nevertheless has nothing to do with actual economic prospects (more in a moment), any more than this rate cut makes a dent in business activity or even imports and exports (it's minimal and that's a cover story Trump promotes, while it allows him not to say he wants lower rates to push up the S&P and hence his Election prospects).

Those prospects may be solid anyway given the possible alternatives, at the same time the rate cut does little to cushion angst, build support from a financial perspective, or even increase morale among the citizenry. Just the opposite perhaps, because if things are so good in the economy then why cut rates. That's what most people not looking at the Yield Curve will ask after this, and it does not instill confidence in my opinion, for now.

The Real Deal?

I'm going on a limb a bit, but with the caveat that I don't know for sure, let me speculate 'why' the Fed cut rates 50 BP, and didn't even mix that with an explanation other than the most superficially obvious.

They cut because this Monday morning the Repo bids (that they didn't fulfill) were the highest ever, more so than a fairly recent series of liquidity injections. So, another reason the Fed might cut would be, as one or two analysts in a logical sense will recognize, 'if' a bank was in trouble. However nobody has an idea of any such problem. Perhaps I have an inkling.

Remember those 'Pandemic Bonds' that were structured by WHO and it seems the World Bank? This incidentally has nothing to do with Trump or a lot of scuttlebutt out there. And there is a reason the Fed contemplated a cut last week (hence we were all looking for one), while the WHO still it seems was 'in-denial' (and yes there are cases in the Nile too, now) about declaring a pandemic.

Well late today, after getting Dr. Fauci to do that JAMA piece about a low mortality rate (which obscured his 'pandemic-like' conclusions about how numerous the infected folks could become) the WHO is really getting you ready for their 'declaration of a pandemic'.

In a report out late today, WHO says ... "the death rate is 3.4% globally; a higher level than previously thought". Actually that's close to Zombie Apocalypse stuff; since we live in an era where the population thinks that there's a pill or shot for everything almost. Since that percentage (orders of magnitude above the lower-than-usual stories they were putting-out), it is not just disconcerting, but probably pretext to Pandemic Declaration.

A Pandemic Declaration will be the trigger to liquidate those bonds (in a way I'm not fully familiar with) to release funds to help countries that are less advanced in healthcare (given the low testing kits and such here, it might be only slightly cynical to include the United States in that area). If a bank or hedge fund or similar entity (and I have no idea who invested) is heavily leveraged and/or in those, it could cause a default or nearly so.

Again, I'm just speculating because nobody can find a specific concern in the financial sector, hence I'm contemplating whether it's .. just that. We'll likely be visiting lower levels, with persisting periods of volatility, just as it appears China is doing a better job of getting a handle on things.

Meanwhile it looks like Biden is sweeping the States reporting so far.

In-sum: aside the obvious responses to WuFlu, a global epidemic that's really a non-acknowledged pandemic, and extremely easy central banker monetary policies, you had a market ready to correct 'anyway' from very extended valuation metrics 'before' the virus gave more than an excuse, of course, to decline. WuFlu became the catalyst to retreat closer to fair values. However we're not really at fair values because the TINA picture continues to retard many investors (money managers primarily) from the sensible approach of circling the wagons beyond what they already did.

The President and the Fed have now further hurt the financial status of a slew of elderly retirees, who now have even-lower chances of surviving in a lower income environment, and even despite that it won't help the S&P and may even hurt it because it very soberly brings the risk into view by a greater number of citizens and investors.

At least the Administration is contemplating (they better like China had to after being shamed by turning away a pregnant lady from treatment who then died because she didn't have money to pay a hospital) ... paying all hospitals and providers for treating uninsured coronavirus patients.

Bottom-line: now that we've mentioned that the Fed has wasted bullets on another rate cut, you've got the Fed in-position to hurt the future with a move into negative rates, which is not out of the question.

In Europe you have intelligent leaders starting to surface (like Christine Lagarde at ECB now), but they can't do anything significant in this WuFlu 'emergency' and they're hobbled in this ridiculous 'race to the bottom'.

Conclusion: mission accomplished for the foolish crowd engaging in this 'race to the bottom' in rates. Rate cuts only encourage if you expect most things to get better, and are counterproductive when in a downward spiral of concern and economic activity, which is where we are for now.

Was Jerome Powell trying to pressure European Central Banks by announcing the rate cut after the G7 call, why a surprise rate cut on Super Tuesday, didn't the markets have enough to react to? Seems a waste of a "silver bullet" to me, what do you think?

Good question.

The rate cut was to deflect Pandemic Bond default (the WHO declaring a panic would trigger release of those funds, and possibly harm a bank or hedge fund investor. That is what I alluded to last night and discussed on our 3 intraday comments you don't see here. Please join us by subscribing to Daily Briefing ($159.) at www.ingerletter.com/subscribe and this week as the market alternates big moves, I'll upgrade you to our Premium MarketCast (normally 390) 'on the house'. I cannot just provide everything here without compensation. Thanks!

Will do Gene, thanks

thanks! when you sign-up you might also send me feedback or an email to: gene@ingerletter.com and that way I'll know it was from TalkMarkets and set it up with the upgraded service.