Market Briefing For Wednesday, Jan. 16

Stocks may be 'temporarily furloughed,' like many Federal workers, for a couple of reasons. One of course results from an extension of the Government shutdown, which as we mentioned the other day, and Jamie Dimond of JP Morgan (JPM) also noted today; at some point this does matter in fundamental terms. Delta Airlines (DAL) also emphasized this concern, related to lower 'traffic' from Government and related travelers (in this regard they've not mentioned the greater impact from lower Chinese bookings, which lots of corporate customers are deferring or minimizing, until things resolve).

Incidentally, JP Morgan had misses all-around, yet the shares stabilized (of course when dealing with banks, you can imagine there is support aimed at cushioning at a meaningful negative impact). Also the trading 'miss' shouldn't have surprised anyone; as we believe banks in-general would be negatively impacted by capital market pressures during much of 2019's first half.

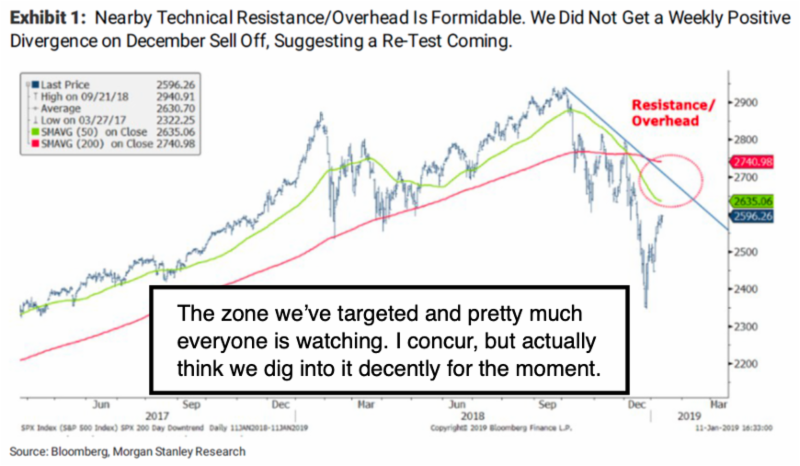

As to the technical market picture; it rebounded very nicely as expected, not just to the S&P 2600 level; but a bit into congestion above it. There are some technicians that not only agree with this idea; but are either selling now (generally premature), or suggesting it's 'all-clear' if the S&P gets over 2700 or so (too optimistic).

In-sum: generally this market is doing our preferred pattern of hanging-in; of absorbing financial aspects of the Government Shutdown (so far, but that's a temporary aspect if they don't resolve it quickly; and it's no longer quick); as well as handling the sloppy bank results from Citi (C) and JP Morgan (JPM). And late yesterday United Airlines (UAL) soared by giving better guidance than usual.

We really do need to see a Trade Deal later this month; the idea is for the market not to explode higher, but 'grind' a bit more into congestion; and then perhaps a spike higher (which could conclude the short-term) 'if' we get a Trade Deal. If we don't, well, there are definitely more bearish alternatives.

The daily action generally focuses on 'earnings season' and the market's ability (at least so far) to absorb negative surprises. To me, most surprises would be in the other direction, with more optimistic guidance versus conservative calls looking forward. One of the optimistic ones was United Airlines, while just yesterday morning, Delta Airlines contended the opposite.

The probability is that of course United is benefiting from juggling a myriad of well-known issues, while Delta is hobbled a bit by not just the Government Shutdown which resulted in a dearth of Federal employees flying; but also contractors and all the vendors and so on that would normally be flying. They didn't hone-in on Asia; but we've noted the slack bookings for March-April, especially when I'd checked seating charts to China and Japan.

It is being reported that businesses are especially hesitant to send any key executives to China at the moment. China's behavior in the legal area and IP has a lot of companies nervous. This isn't an effort to criticize; but an observation that 'even if' we get a good Trade Deal with China, there will be some reticence about restoring normal travel and ties, if we don't see improvement in other areas too. That includes respect for the rights of neighboring countries. It's also perhaps why at least some telecom companies are going with U.S. European or Israeli firms as vendors, rather than allowing Huawei or ZTE to expand their presence. I may have more on that topic in the near future; I'm looking into a few ideas.

Conclusion: the entire market was helped by Netflix's (NFLX) rally (ridiculous and I question the sustainability of their price hikes); and then by how well the market absorbed the NO vote on Brexit; although that was widely expected.

There is no general pattern change or other expectation other than churning in this 'zone' for awhile, as we've identified as likely for some time. Ideally an up-dip-up pattern would be welcomed on Wednesday, with a bit of 'chop'.

You said there are two reasons for the "stock furlough" and explained that one was the government shutdown. What's the other?