Market Briefing For Thursday, July 9

Executive Summary:

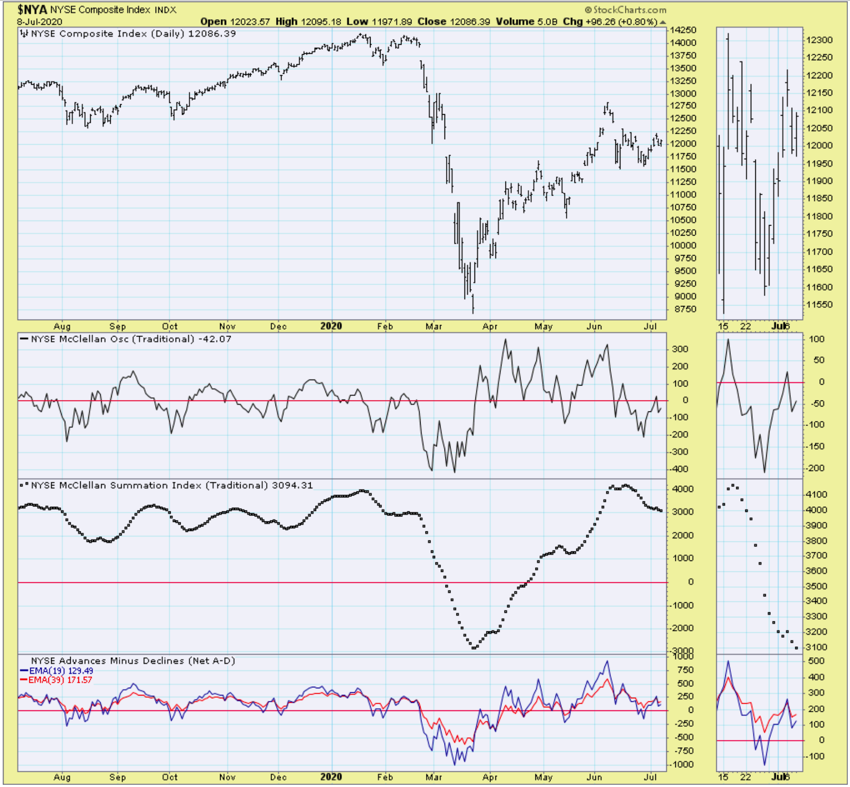

- The Bull/Bear rivalry often fails to realize this market has not and is not up on anything related to the economic conditions or immediate recovery prospects coming out of a V-bottom in the S&P, more so than in the overall economy.

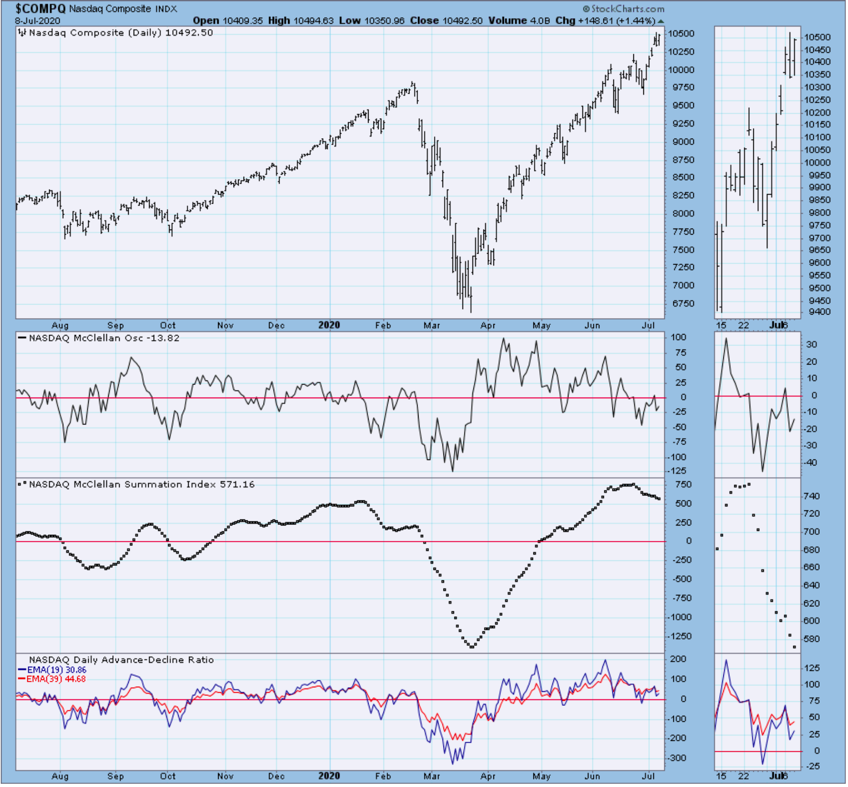

- This market is envisioning (besides the leverage liquidity employed since the beginning of the recovery in late March) a serious recovery from COVID-19, too, at the same time a primary 'reason' for advance is the ability to engineer it.

- Government 'assistance' (a gentle term) enabled this, and that liquidity has a slew of institutions, and lots of individuals too, pressing upside in 'super-cap' stocks, often irrespective of valuation associated with 'price'.

- That's even if they'll massage numbers to give some 'cover story' for what is liquidity-driven trading, and ironically without the stimulus funding 'structure' the Fed provided, there's a prospect that this action would not be feasible.

- Hence the opposite interpretation applies: the market has been interesting, because there is disconnect between stocks and economy struggles.

- Now, outside the separation from reality by S&P (after the solid advance we called-for coming off the nailed March lows), you have a concentrated focus on technology and stocks that actually do reasonably well during COVID-19.

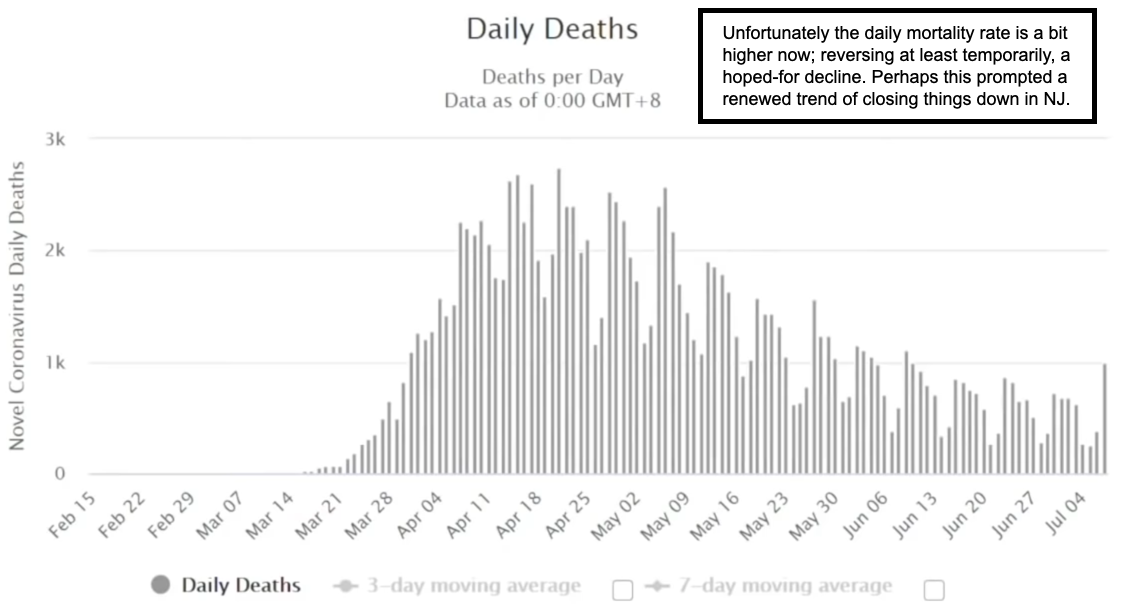

- S&P and Nasdaq remain in the higher portions of the weeks-long trading range as often discussed, and will have trouble ignoring the rising case loads resulting from COVID-19, if this week's slight rebound in mortality persists, or of course if we finally get a retreat in a couple days for technical reasons.

Daily action - Futures are down about 5 handles at press-time, and Thursday is looking to be yet-another session of (probably) a soft opening, but then further upside, even if gains are trimmed later. No change in our overall view.

The domestic situation is not improving, there are worries in California regarding receipt of unemployment benefits, the ICU-capacities are being challenged both in Arizona and Texas, with doctors here in Florida suggesting the situation again is 'worse than being reported', and somewhat masked by the state withholding a certain amount of data about hospitalizations, and issue mentioned previously as politically-influenced, and apparently has surfaced again.

I have been a bit optimistic, not that the market wouldn't encounter consolidation and even a correction as the month evolves (news dependent and no disaster in terms of the financial backdrop yet, with earnings not a general focus compared to the behavior of the super-caps, and they can be sensitized to earnings a bit), but that we might be seeing a 'flattening curve in mortality' while 'cases increase' and while it's hard to say, today's numbers were not encouraging.

I know Bank of America (BAC) today spoke of 'peak virus' being specifically today, and I have to take a bit of issue with that. As much as I respect their work, I don't think we're there as yet, but hope the increased mask-wearing and precautions gets us there quickly of course.

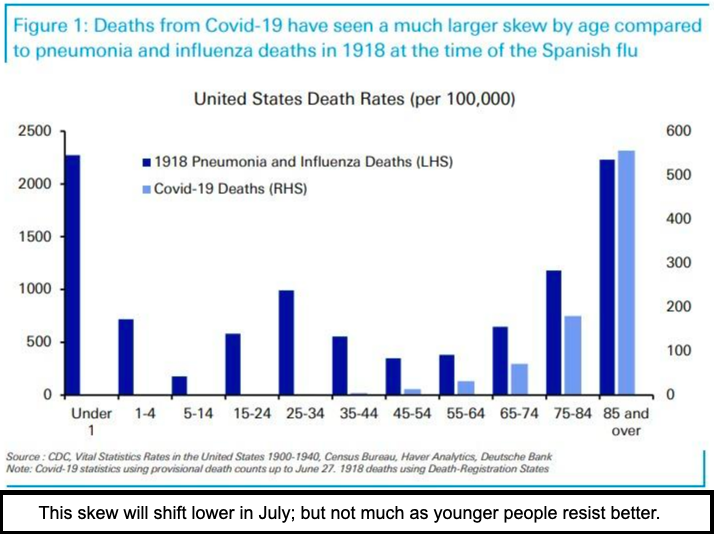

Interesting, and thanks for the comparison between the 1918 epidemic and the 2020 epidemic.