Market Briefing For Monday, Mar. 20

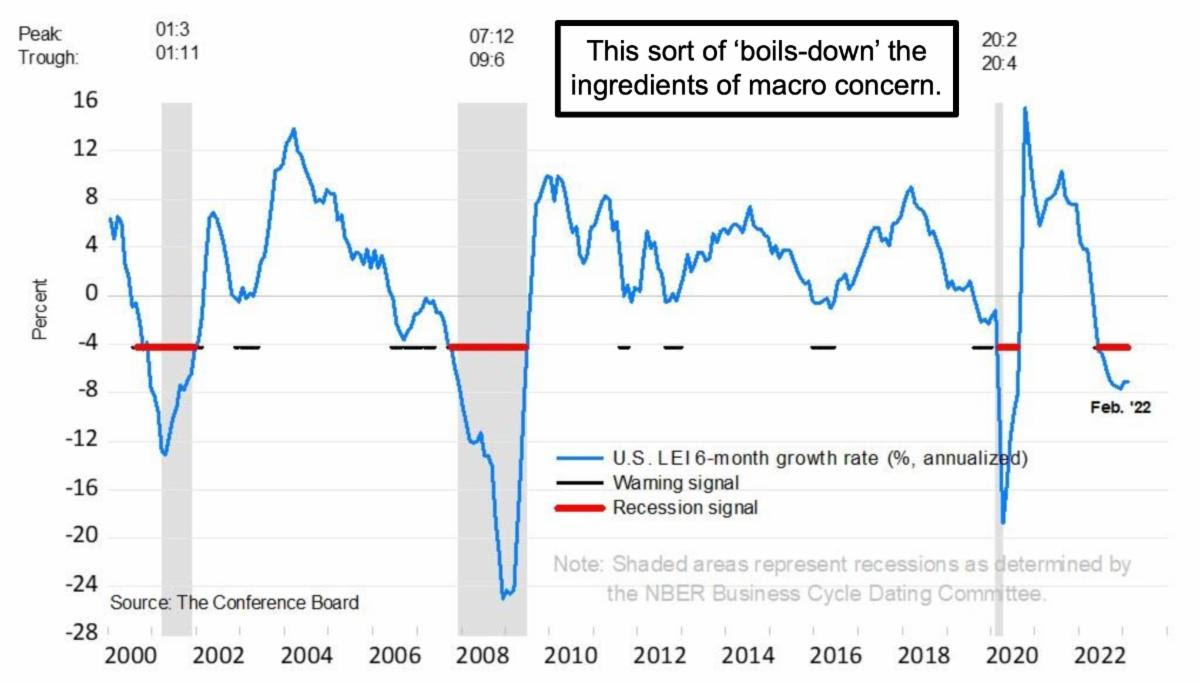

An overly-indebted system cannot easily handle fast-rising interest rates to start with; much less with a series of hikes the way our Fed engineered it. In such situations, a leveraged Fractional Reserve System has breakage risk.

That's what we meant for weeks, saying if the Fed keeps it up something will break. When counter-parties lose trust, their money flows elsewhere, or from lower-paying money market funds into short-term Treasuries, until the rollover occurred days ago. Too-big-to-fail came into the fracas as multiple 'regional' bank failures occurred, not just to be benevolent; but it's in their interest and at this point costs little, since they just moved 'reserves around'. However that didn't help; because that Bank's (FRC) shares dropped precipitously again.

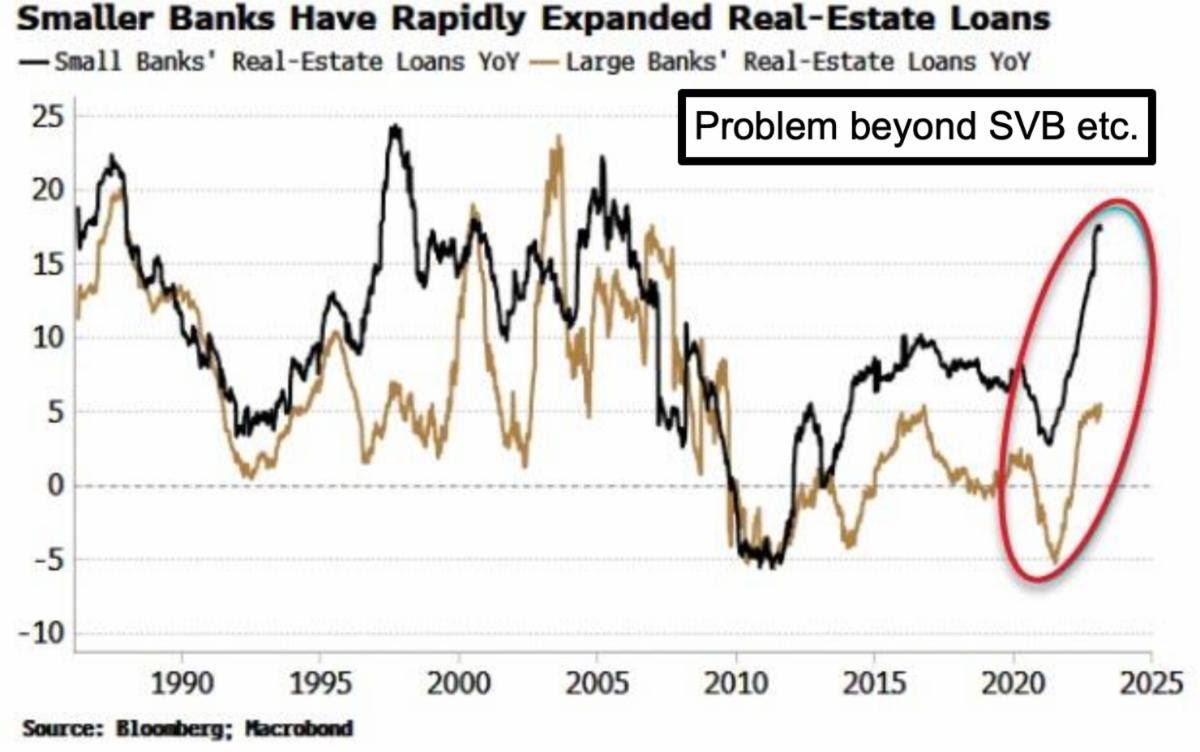

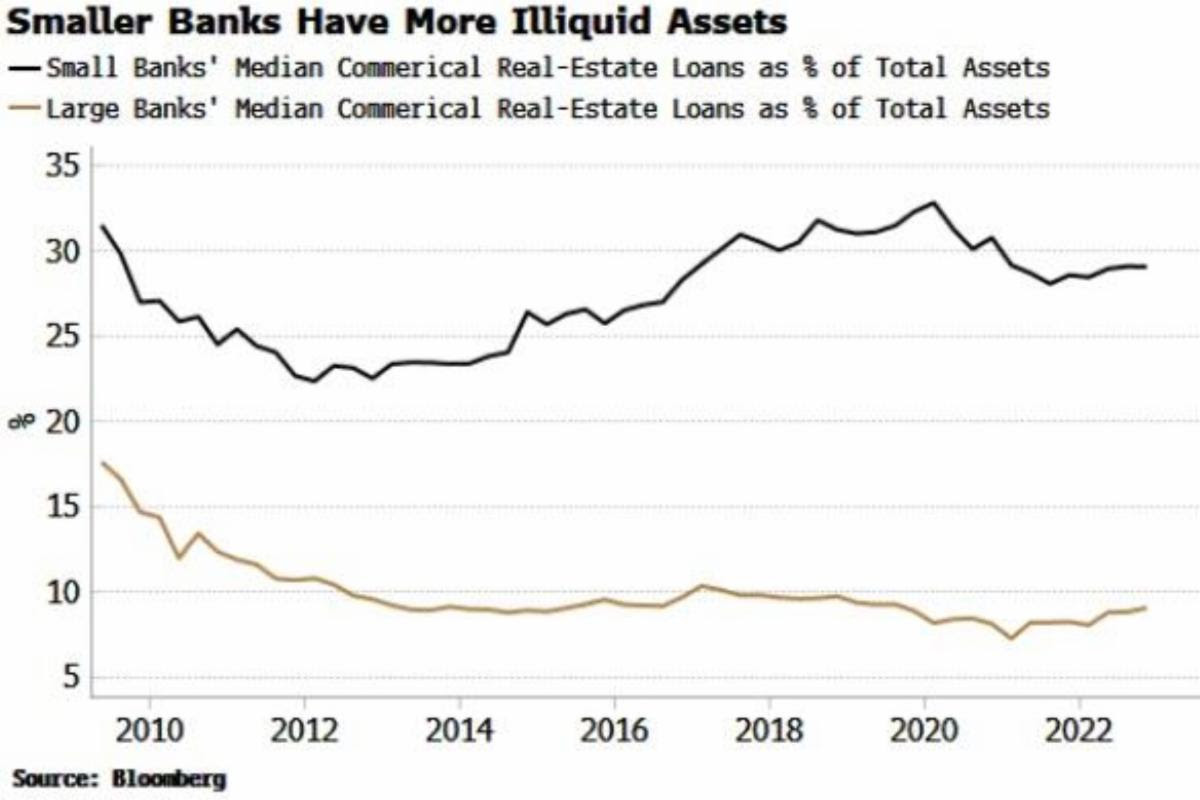

Yes, Central Banks must wake-up to the structural inabilities to merely fight a nagging inflation, by the conventional means. Well I guess they got that note, as Credit Suisse essentially failed (injection) and then the consortium of U.S. money-center banks saving First Republic via deposit transfers. Surely they know the reaper threatens them if they don't stabilize the system. And if we're to point out (as we have) where their risk lies; it's commercial real estate. Not on the scale of the 'Epic Debacle' of 2007-'08, but as I term it, 'cousin-close'.

Oil might have reflected some trading strategies gone wrong ahead of 'crude' Expiration; hard to say. But it's down to the levels where price supports more or less kick-in, by virtue of Strategic Petroleum Reserve purchases. So it's not just 'financial systems imploding', nor is about supply/demand; but a mixture of contributing factors, as well as sales of anything liquid, by those needing to.

Certainly, funds / pools and so on, invested in Commercial real-estate could be the next shoe to drop; or banks with poor capital profiles and exposure to that area. Major banks can handle the stress of this ... better. Now, recognize that that Washington has to know how poorly they responded; and of course how the 'backstop' funding didn't really have the expected response. So now you get these bad banks absorbed into the big (too-big-to-fail) banks. But for sure even those banks are not immune to impact from property loan failures.

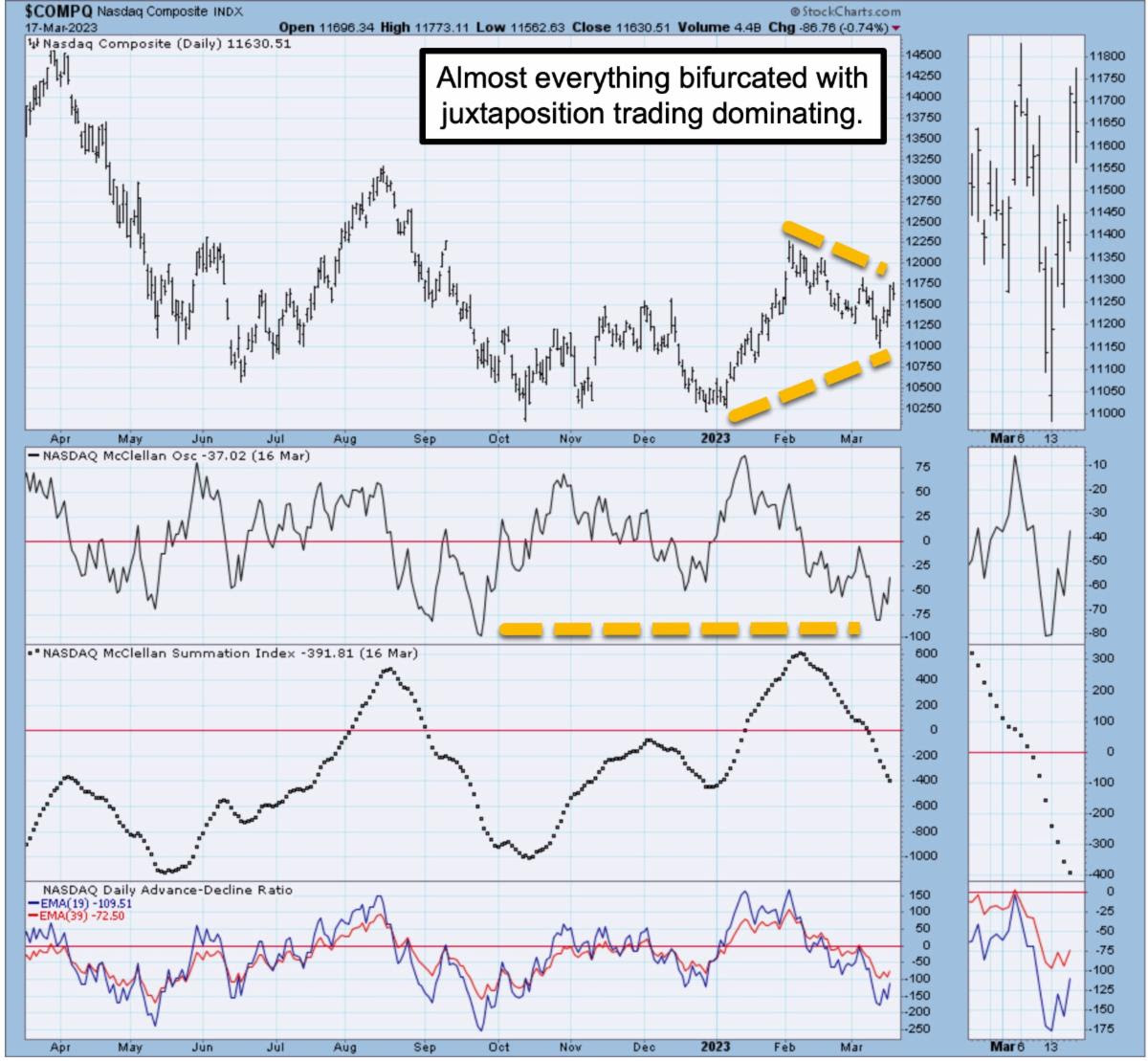

I'll qualify this week: it wasn't a robust response; but S&P was actually up for the week; and Nasdaq was pretty decent; despite banks mostly sliding yet again. Investors 'might' find some other policy change before Monday opens; but that's totally speculation. Also 'if' the backstop funding hadn't 'reassured' California depositors, even if it opened eyes elsewhere to risk, a suspicion of Fed pivot is actually a slight unwinding of the negative influences. Not exactly 'pivot' yet, but the Fed is both easing and tightening simultaneously. Go figure, but they are.

Anyway, in this scenario valuation is still too pricey; so that's what's restraining big-caps in-particular. Plus we'll have higher Capital Requirements for Banks in the wake of all this; so essentially that's making all the Banks pay for those that were absent proper risk management. Consumer Recession still lurks, at the same time parts of the economy (like Construction) are still strong (given infrastructure spending to some extent). And that seems to confuse the Fed. Plus you had Janet Yellen's candor at Congress; making it clear there's not a blanket uninsured deposit protection in place of yet-intended Nationally.

Also keep in mind that lots of smaller stocks dropping have heavy hedge fund ownership. In this macro crisis situation; almost all such stocks become just a 'source of funds' to meet obligations; especially if they are leveraged funds of banks, or hedge funds with bank funding. It's infrequent during history, but of course when that happens, managers are forced to sell basically anything or nearly so, just to reduce leverage (which is much greater than individuals get) and as we have seen in the past, you get dramatic surges (short covering) or purges (general liquidations) irrespective of company news or prospects.

So as we stay calm and 'aggressively neutral' towards the market for now, it's more essential to watch for accidents or helpful interventions than to cull-out any sort of fundamental (or technical) individual issue news. In a sense, just a stock 'not' succumbing to the broad brushstroke decline says something; and of course sets up bargain pricing (in theory) on those that emerge solvent as well as with good prospects (and that's a posture we've felt for awhile now).

In sum: the overall crisis is not over; and we are in a potentially cascading scenario that requires 'better' handling by both Treasury and the Fed. That doesn't mean run for the hills; although depositors in smaller banks already did just that (contributing to the problem; and as risk-managers were MIA).

Missing-in action 'risk management' probably applies to Quant Funds too; so I wouldn't be surprised if you get some algo-driven deb t-side fund failure; but of course we don't know. Most funds/hedgers hold details close-to-their-vests so to speak, so hard to know when the dust precisely settles; though it will. If Goldman Sachs was involved with Silicon Valley Bank 'improperly', that may matter too. Also hard to say but there is some chatter about the prospect as relates to underwriting and offerings involving tech fund raising and SVB... it's separate and apart from typical reporting requirement, if anything occurred..it might also be an effort by officials to blame Wall Street instead of Washington. While too-early-to-tell; SVA was a valuable resource for tech and start-up's; so frequently that has tie-ins to firms like GS. But an interest rate fiasco exposes more issues that 'may' lie-in-wait; unless they are 'handled' too..

So, get ready for a Fed 25 bp hike; and recognize that parts of the market are acting 'as if' positioning for Spring rally (it will likely be so); but more drama is likely between now and then, which can be frenetic and compressed in time.

P.S. late news surfaced that UBS has agreed to 'absorb' Credit Suisse Sunday (for $3.2B). It likely starts a series of banking consolidations here and there; and goes beyond just temporary deposit (loans) to shore-up a bank's condition.

Enormous financial (and political) stakes are at-play; and unrelated to stocks valuations. However, many big-cap stocks have been excessively priced for a couple years, so that makes it hard to argue an advanced S&P achievement, even in a rally, and that remains the case even should be get a Spring rally as the current crisis ebbs, presuming it ebbs of course..

This coming week has lag-effects, an FOMC Meeting; post-Expiration action; and discussions of responsible (or absent-minded) behavior by Fed officials, which find themselves in the interesting position of tightening and easing for the most part at the same time.

Draining the Balance Sheet but hiking 25 BP soon at the FOMC, are atypical of course, but basically what you're looking at 'if' the Fed follows ECB action; which often hints at what the agreed strategy is. And maybe it's o.k. as 25 BP one way or another doesn't really impact the current status.

Bottom line: market action is frustrating or even depressing at moments; but interestingly sort of seems like it 'could be worse' given the Banking Crisis as has proven to be somewhat systemic, regardless of official denials about that.

If we get a throw-out-the-baby with the bathwater scenario at some point in the big-caps, fine. We might get interested. Otherwise 'aggressive neutrality' is still prevailing with regard to S&P behavior, mostly just below the 200-DMA.

Monday should feature jitters regarding more bank consolidation (or palliative) reactions and who knows what chapter is next in this saga; then the focus will shift to the Fed's presumed 25 basis point hike (we prefer not; but realistically) and then will be interesting if S&P rallies a bit since everyone thinks decline. It is worth noting valuation for most big-caps remains 'mixed-to-high', so maybe that's why S&P today is just where it was exactly two years ago.

More By This Author:

Market Briefing For Thursday, Mar. 16

Market Briefing For Wednesday, Mar. 15

Market Briefing For Tuesday, Mar. 14