March Retail Sales Were All About Front-Running Tariffs

Image Source: Pexels

Normally, real retail sales are one of the indicators I treat as most important, because it tells us so much about consumer behavior, which is not only 70% of the economy, but also has a lengthy track record for leading both employment and the coincident indicators for recession.

Not this month. In March, real retail sales told us that consumers were front-running tariffs, Bigly.

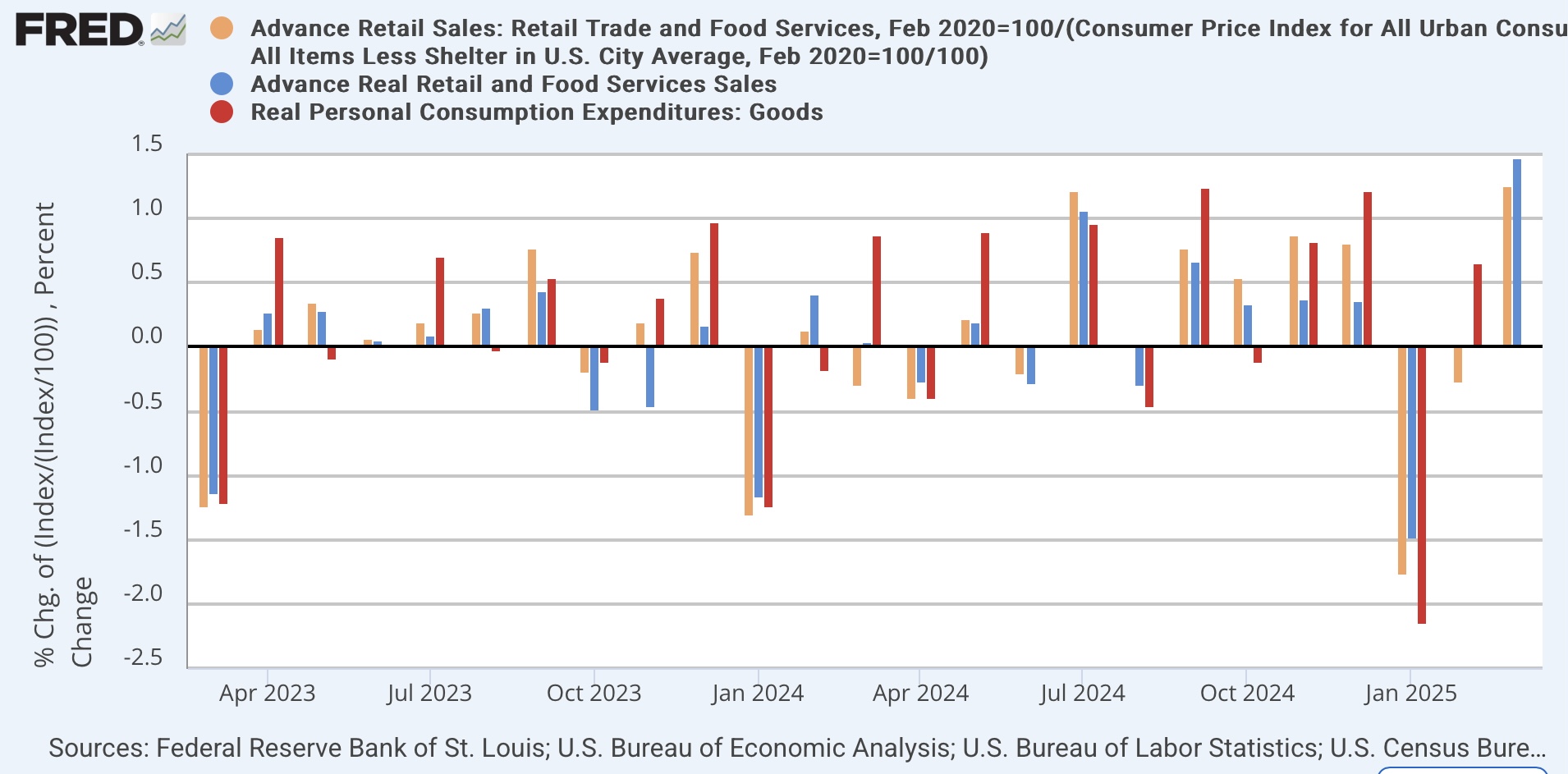

For the record, nominally, retail sales increased 1.4% in March. Since consumer prices declined -0.1%, real retail sales increased by 1.5%. Even more telling, ex-auto retail sales rose 0.5% nominally and 0.6% in real terms. This was the biggest increase in sales in 2 years (blue in the graph below). Because of shelter distortions in the CPI, recently I’ve also begun including real retail sales ex-shelter (gold), which also increased the most in two years. This also telegraphs that real consumer expenditures on goods, which won’t be reported until the end of the month, will also increase sharply (red):

In other words, there was a big rush to buy vehicles in March. Anecdotally, in my neck of the woods, a major auto dealer’s advertising was all about hurrying up to beat the tariffs.

In absolute terms, real retail sales were also at their highest in two years, with the exception of last December:

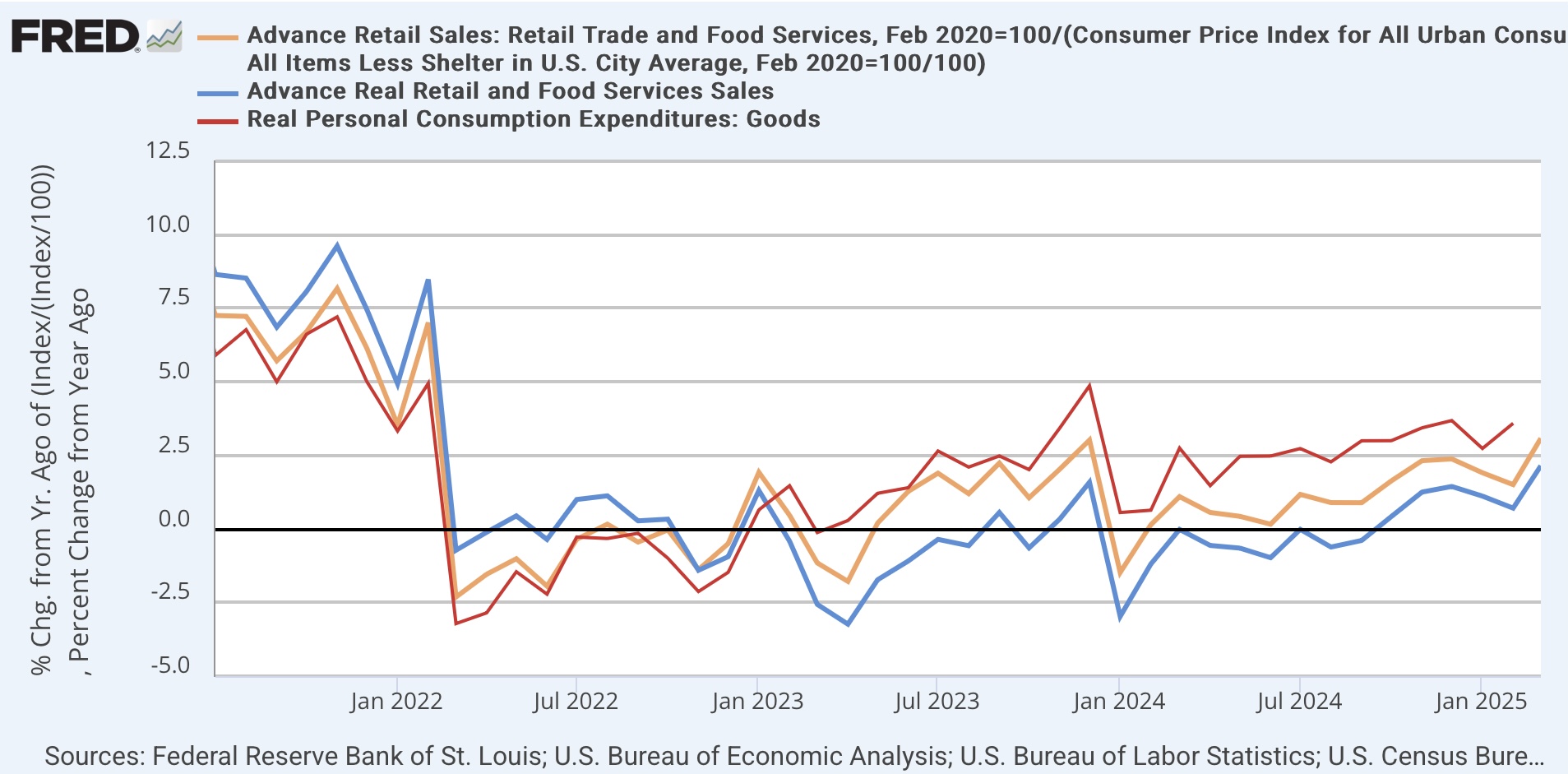

Since when real retail sales are positive YoY, historically, there is no recession on the immediate horizon, here is that measure:

Of course, this might well be another exception, since front-running in March pulled demand ahead from later this spring and summer. Sharp declines in the next several months are therefore quite possible, distorting the series to the negative.

More By This Author:

March Manufacturing Production Also Shows Evidence Of Tariff Front-RunningThe State Of The Short Leading Indicators: Why There’s No “Recession Watch” - Yet

The Bond Market Sends A Warning; Has The U.S. Crossed An Economic Rubicon?