March Payrolls Lowest In 27 Months, In Line With Expectations; Unemployment Rate, Hourly Earnings Drop

Ahead of today's jobs report, Goldman shared the following market matrix on how to interpret the data: "The best case scenario for stocks is a small headline miss...call it 175k – 200k range. Stocks don’t want a surprising print in either direction (big beat investors will stress over inflation and continued rate hikes / big miss investors will stress the hard landing)." To be sure, now that the BLS has finally stopped defending the "strong labor market" myth, the risk was to the downside, with Newedge warning that “based on a linear regression of jobless claims, ISM employment, NFIB hiring, ADP, JOLTs, conference board, and Indeed/ZipRecruiter surveys that predict a negative 49K.”

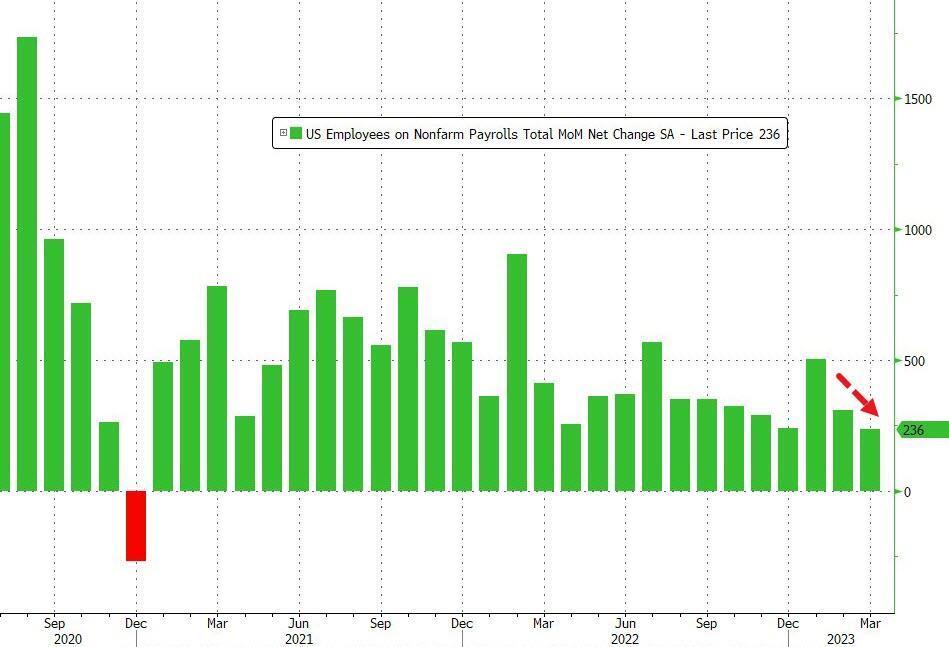

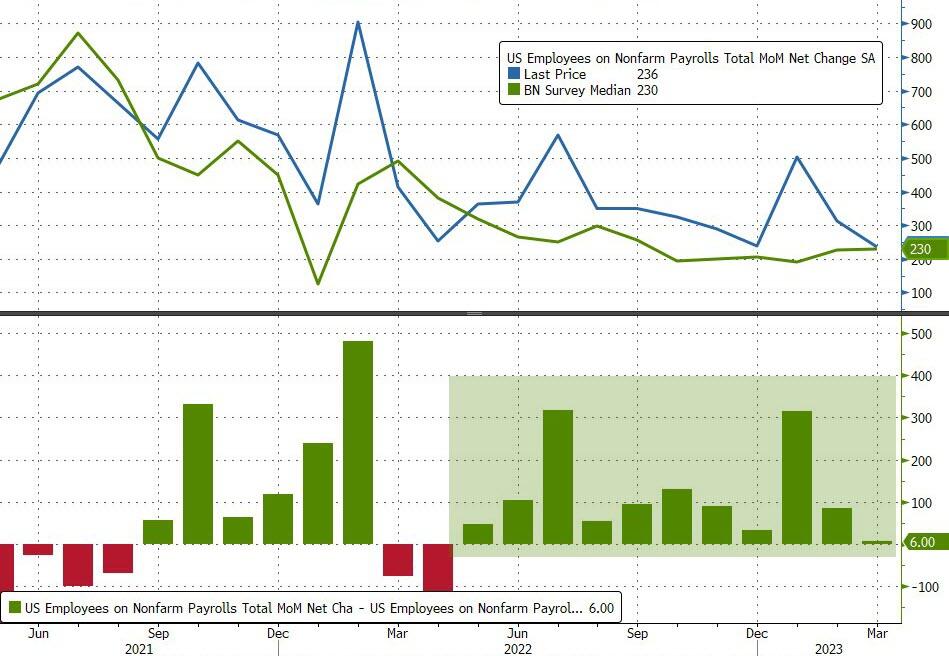

In the end, however, the BLS decided not to ruffle any feathers on a day when markets are closed and the March payrolls print came at 236K, just above the 230K expected, and below last month's upward revised 326K (up from 311K). Despite the aggressive recent revisions, this was the lowest monthly increase in 27 months: the last time we had a lower monthly print was December 2020 when they tumbled 268K.

The change in total nonfarm payroll employment for January was revised down by 32,000, from +504,000 to +472,000, and the change for February was revised up by 15,000, from +311,000 to +326,000. With these revisions, employment in January and February combined is 17,000 lower than previously reported.

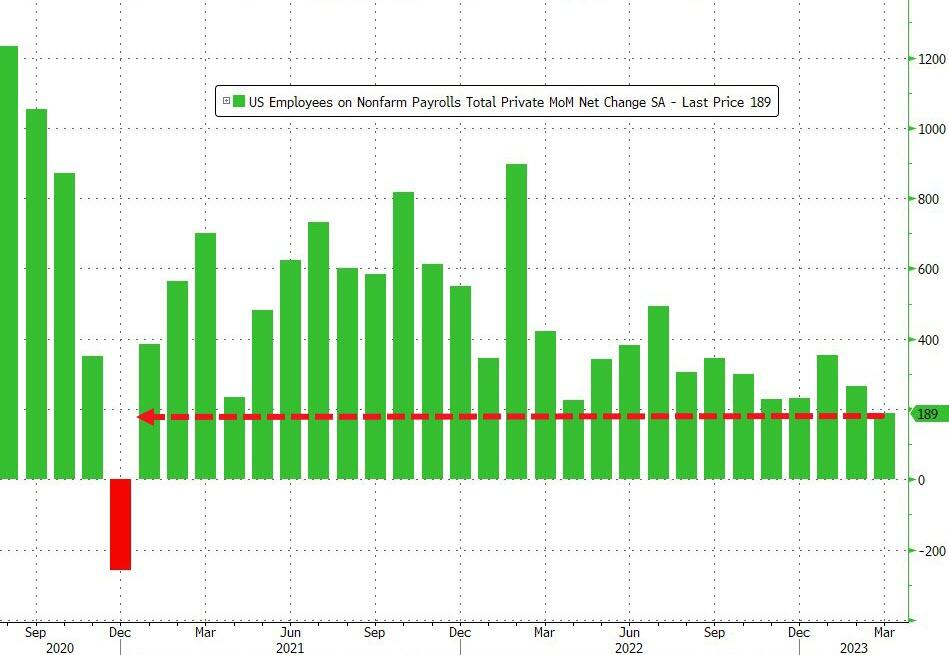

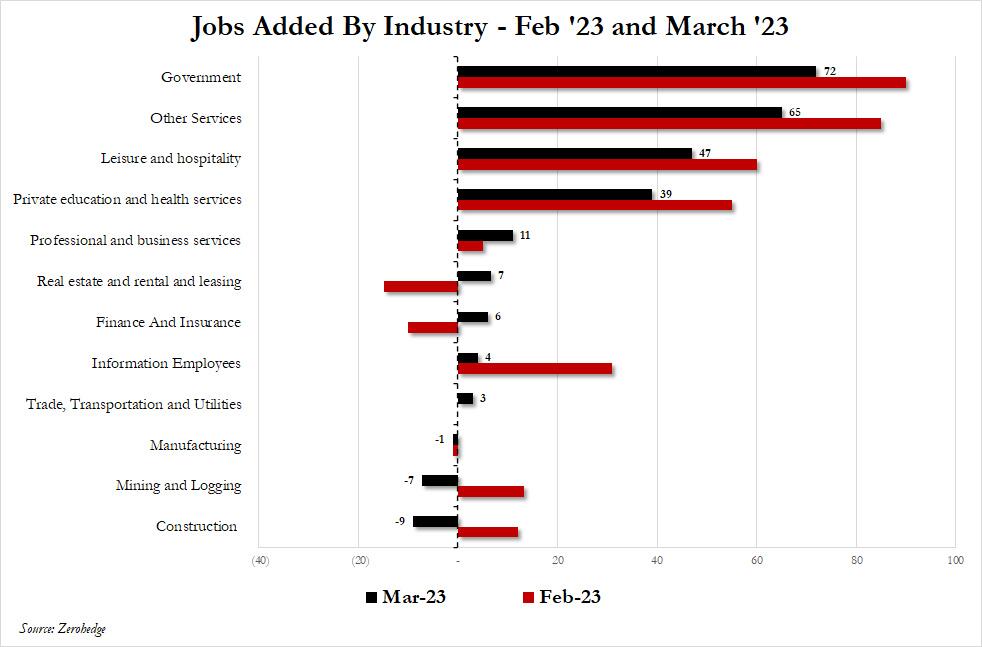

While total payrolls came in just stronger than expected, this was thanks to 47K government jobs, private payrolls were only 189K, missing the consensus print of 218K and below February's 266K.

For those expecting the long-overdue mea culpa from the BLS on its payrolls fabrication, especially after the dismal JOLTS and claims prints, well they will have to wait some more because today's jobs report was the 11th monthly beat in a row.

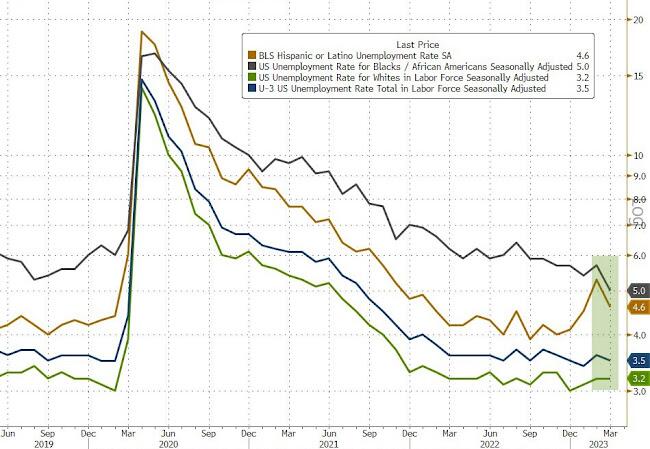

The unemployment rate unexpectedly dipped after rising last month, and dropped from 3.6% to 3.5%, below the 3.6% consensus; the number of unemployed persons, at 5.8 million, was little changed in March. Among the major worker groups, the unemployment rate for Hispanics decreased to 4.6% in March, essentially offsetting an increase in the prior month. The unemployment rates for adult men (3.4 percent), adult women (3.1 percent), teenagers (9.8 percent), Whites (3.2 percent), Blacks (5.0 percent), and Asians (2.8 percent) showed little or no change over the month. Of note, this was the lowest unemployment rate for blacks on record.

It wasn't just the unemployment rate that improved, the participation rate did as well, rising from 62.5% to 62.6%. The employment-population ratio edged up over the month to 60.4 percent. These measures remain below their pre-pandemic February 2020 levels...

... but the prime-age participation rate is now back to pre-Covid levels.

Perhaps the biggest surprise in today's report, however, was the continued drop in hourly earnings, which in April came in at 4.2% Y/Y, down from 4.6% in February and below the 4.3% expected. On a monthly basis, earnings rose 0.3%, as expected, and up modestly from 0.2% last month. That, however, may be due to another modest drop in the average hours worked, which dipped from 34.5 to 34.4, below the 35.5 expected.

Some more details:

- The number of people employed part-time for economic reasons was essentially unchanged at 4.1 million in March.

- The number of persons not in the labor force who currently want a job was little changed at 4.9 million in March and has returned to its February 2020 level. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force was little changed at 1.3 million in March. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also was little changed over the month at 351,000.

A breakdown of the various jobs shows the following:

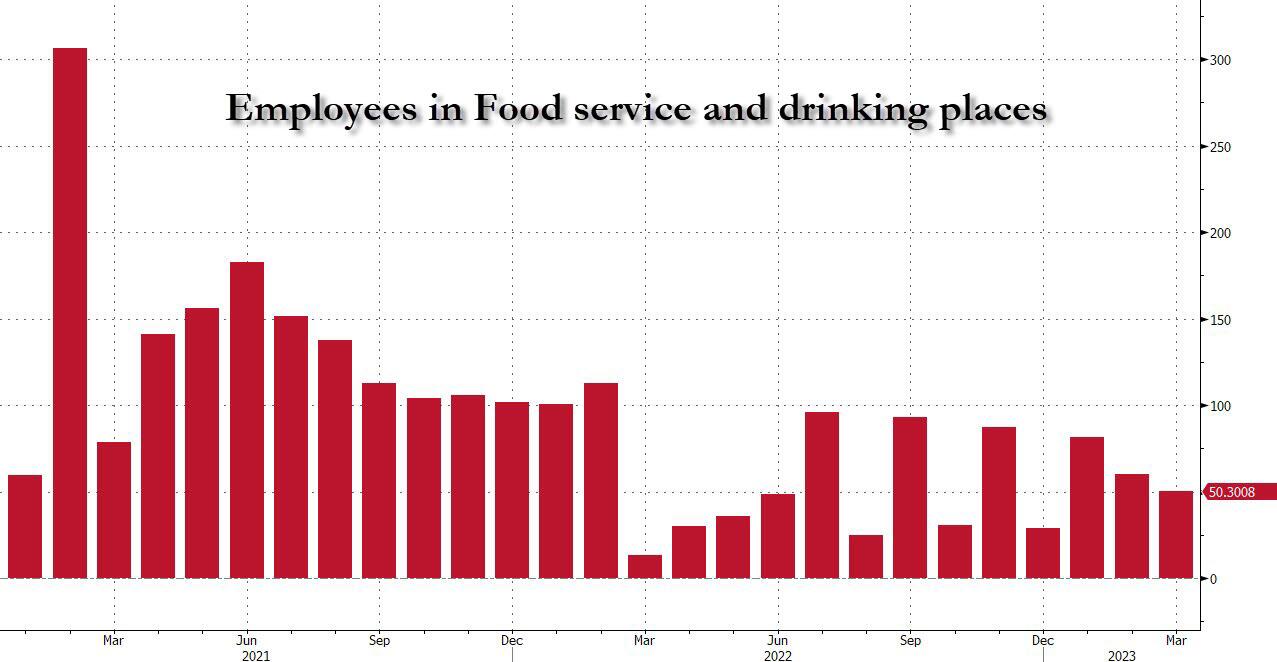

- Leisure and hospitality added 72,000 jobs in March, lower than the average monthly gain of 95,000 over the prior 6 months. Most of the job growth occurred in food services and drinking places, where employment rose by 50,000 in March. Employment in leisure and hospitality is below its pre-pandemic February 2020 level by 368,000, or 2.2 percent. Of note, the number of waiters and bartenders rose by 50.3K, this was 26% of all private payrolls.

- Government employment increased by 47,000 in March, the same as the average monthly gain over the prior 6 months.

- Employment in professional and business services continued to trend up in March (+39,000), in line with the average monthly growth over the prior 6 months (+34,000). Within the industry, employment in professional, scientific, and technical services continued its upward trend in March (+26,000).

- Over the month, healthcare added 34,000 jobs, lower than the average monthly gain of 54,000 over the prior 6 months. In March, job growth occurred in-home healthcare services (+15,000) and hospitals (+11,000). Employment continued to trend up in nursing and residential care facilities (+8,000).

- Employment in social assistance continued to trend up in March (+17,000), in line with the average monthly growth over the prior 6 months (+22,000).

- In March, employment in transportation and warehousing changed a little (+10,000). Couriers and messengers (+7,000) and air transportation (+6,000) added jobs, while warehousing and storage lost jobs (-12,000).

- Employment in retail trade changed little in March (-15,000). Job losses in building material and garden equipment and supplies dealers (-9,000) and in furniture, home furnishings, electronics, and appliance retailers (-9,000) were partially offset by a job gain in department stores (+15,000).

Hilariously, in a month when we saw the biggest banking crisis since Lehman, the BLS "calculated" that 1,000 financial activity jobs were lost.

In his kneejerk reaction to the jobs report, Academy Securities strategist Peter Tchir writes that "NFP didn’t completely confirm the weakness in ADP, nor the bump up in jobless claims" and while the headline number of 236k, with -17lk of revisions was right in line with expectations (though maybe a touch above the “whisper” number), somewhat disappointing was private payrolls were only 189k, much lower than expectations, so government hiring picked up the slack.

On the Household side, there were 577k jobs added! That is impressive and reduces the longstanding gap between the establishment and household portions of the survey. It is also why the unemployment rate inched lower to 3.5% while the participation rate actually increased (which is good in my view).

Wage growth remained steady at 0.3% on the month (up from 0.2% last month). Hours worked were a touch light.

This allows/forces the Fed to remain on the “hawkish” side of things:

- 3.5% unemployment is almost the lowest it has been since they started hiking, so the “jobs for inflation fighting” argument has not materialized.

- 0.3% wage growth is “only” 3.6% annualized (ignoring rounding), which is getting into the comfort zone, but not as good as last month’s number, and this Fed is likely to want to beat down any re-emerging pressures.

As Tchir concludes, "You could probably craft a “Goldilocks” scenario around this data for markets, but equally compelling, especially around current positioning, you could craft a scenario that isn’t great for markets."

Finally, as it pertains to stocks, Tchir writes that he expects the data, on balance, to reinforce the recession is near narrative in the coming weeks "so that is why I cannot buy into any “goldilocks” theories on today’s numbers."

More By This Author:

Fed Balance Sheet Shrank By Most In 34 Months But Bank Bailout Facility Usage RisesIMF Warns Global Growth Outlook Weakest In Over 30 Years

And Then There Were Three: India Is Latest Central Bank To Pause Rate Hikes

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more