March Monthly GDP Growth At 0.1%

That’s from Macroeconomic Advisers today. Turns out a bunch of monthly indicators have recently been released, including today’s employment report. Here are some key ones followed by NBER’s Business Cycle Dating Committee (BCDC).

(Click on image to enlarge)

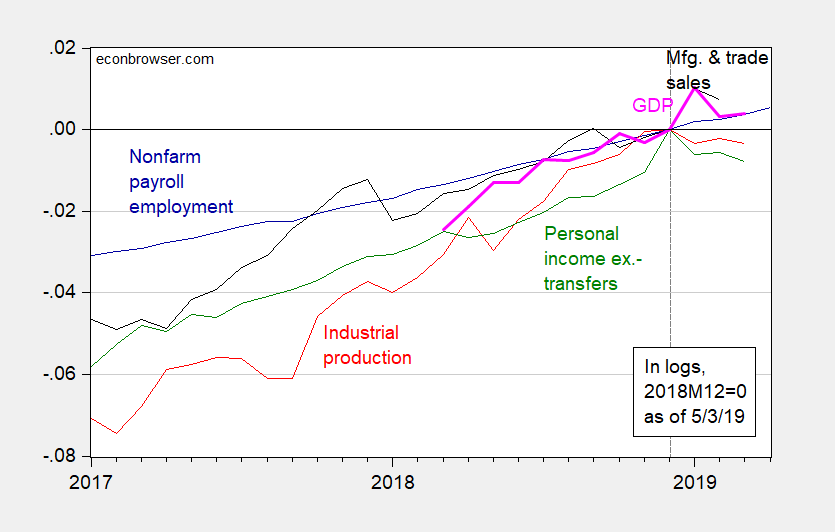

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2018M12=0.Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers, and author’s calculations.

Note that normalizing on 2019M01 would have been reasonable as well. Monthly GDP and manufacturing and trade sales peaked in January (as far as we can tell from the reported data).

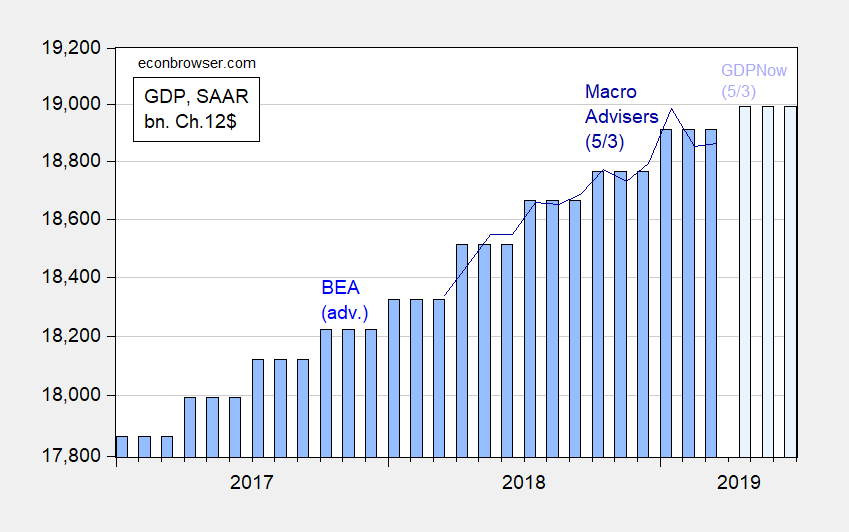

While the official advance estimate on GDP surprised on the upside, high frequency indicators (like the monthly GDP series from Macroeconomic Advisers) and nowcasts such as those from the Atlanta Fed suggest a slowdown (I know there has been some confusion as to what the word “suggest” means; here I use it synonymously with “hints at”).

(Click on image to enlarge)

Figure 2: Official quarterly GDP (blue bars), MA monthly GDP (dark blue line), and Atlanta Fed GDPNow for 2019Q2 (light blue bars), in billions Ch.2012$ SAAR, all on log scale. Source: BEA 2019Q1 advance release, Macroeconomic Advisers 5/3/2019 releases, Atlanta Fed 5/3 release.

Given continued robust growth (albeit in GDP, and not necessarily in final sales or in final sales to domestic purchases), the decision to maintain the current stance of monetary policy seems not unreasonable.

One thing to remember, however; the yield curve remains inverted between the 6th month and 10 years maturities.

Disclosure: None.

Rates should be lowered to stimulate a slowing economy. But the Fed is worried some guy might get a 5 percent raise. They are nuts!