Manufacturing Is Back & Better Than Ever?

The COVID-19 crisis has caused a K shaped recovery because some industries and people have the ability to adapt and some don’t. It was an unforeseen risk that was brutal to some and a boon to others. Specifically, software and online retail firms were helped, while bars and hotels were decimated. According to Blomberg, 65.5% of computer and mathematical employees are working from home. On the opposite side, 0.9% of farming, fishing, and forestry workers are doing work at home. Of course, the real losers weren’t in forestry because that can be done outside in a social distant manner. Only 2.6% of food prep and service workers worked from home which is unfortunate because it can’t be done in a socially distant manner.

21.8% of Americans work from home. Anyone who can work from home is doing so because of the risk. If there is little productivity loss, it makes sense to stay home because it makes the company look bad if there is an outbreak. On the other hand, most people are going to go back to work in the office when the pandemic is over because it will look bad to employers if they stay home. That’s the same reason people don’t take their vacation days. If the competition is meeting clients in person, firms can’t let them have that easy leg up especially since that’s how business operated before the pandemic just 11 months ago.

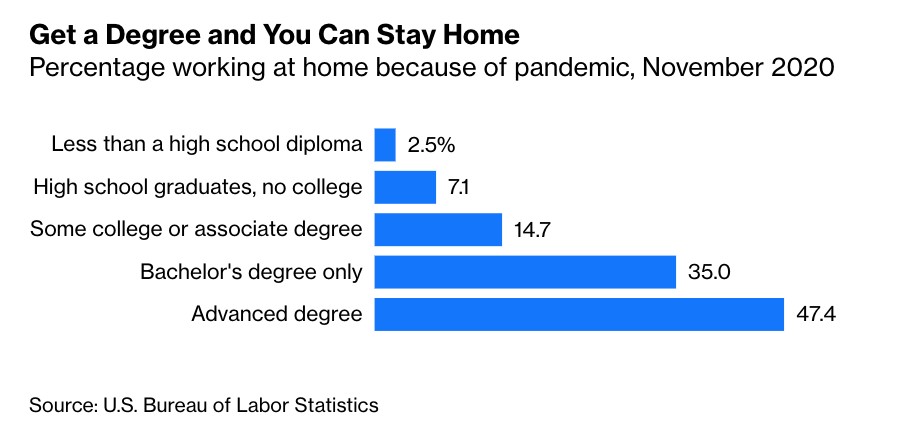

The most brutal part of the K shaped recovery is it hurt the people who could least deal with financial trouble. As you can see from the chart above, only 2.5% of people without a high school degree where working from home because of the pandemic in November. This group was doing so well before the recession as the labor market was very tight. Now these people either don’t have a job or do work that puts them at risk of getting sick. On the opposite side, 47.4% of those with an advanced degree were working from home because of the pandemic.

JOLTS Update

The JOLTS report from October was before the latest slowdown due to the 3rd wave of COVID-19 cases. That being said, this report was only okay, with industries having dramatically different experiences. The number of job openings rose from 6.494 million to 6.652 million which beat estimates for 6.4 million. Gone are the days of there being more openings than unemployed people. The ratio is now 1.5 (unemployed/openings). That’s over double where it was in October 2019. The number of hires fell from 5.886 million to 5.812 million. That’s actually about where it was before the recession.

Job openings in the manufacturing sector have surged to levels not seen in the history of the data series. Openings are usually a good sign for future jobs growth and business confidence. pic.twitter.com/UCoLrewBSz

— RenMac: Renaissance Macro Research (@RenMacLLC) December 9, 2020

As we mentioned, openings varied by industry. From February to October, openings in the financial activities industry were down 27%. They were down 17% in leisure and hospitality. On the other hand, manufacturing openings improved 24%. Manufacturing is at the start of a cyclical upturn even before the vaccines go out. The chart above shows manufacturing openings are at a record high. We are excited to see what the November industrial production report shows given the extreme optimism in the Markit survey.

Dividends Are Back

Who remembers the initial projections in the spring for it to take many years for dividend payments to come back? This wasn’t a normal recession though. It was a shutdown that should be over by the spring of 2021. In the meantime, the Fed did whatever it could to support the market.

As you can see from the chart below, in October and November combined there were 59 new dividends initiated or raised and just one cut or suspended. Once the vaccines go out, there will be a wave of dividends reinstated. Recognize that the software work from home stocks generally don’t pay a dividend because they are growth firms that sometimes don’t even make a profit. The reopening stocks pay more dividends, so there will be a bit of a bonanza next year when they get the all-clear sign.

S&P 500 dividend cuts have moderated, increases have accelerated - @SoberLook @ISABELNET_SA @GoldmanSachs pic.twitter.com/eCoaYbJ5VH

— Rob Hager (@Rob_Hager) December 9, 2020

Obviously, some firms won’t be able to pay a dividend right away because they will need to pay off the debt they incurred during the crisis. However, we aren’t wrong to say there will be a bonanza. As you can see from the chart below, firms’ ratio of cash to debt is the highest in years. With debt so cheap and visibility increasing, we could also see a boost in M&A activity. Liquidity is flowing and firms have a lot of cash. Look for more deals especially if the speculation cycle is still going.

Corporate Cash#SavingsGlut $MACRO pic.twitter.com/2z2H26t6Eh

— Callum Thomas (@Callum_Thomas) December 10, 2020

Value Stocks Are Cheap Everywhere

As an investor, you should get nervous when your businesses underperform and when their multiples expand. When your stocks go up, their expected returns usually fall unless a positive catalyst occurs. Now is no time to celebrate, but to consider removing the exuberant names from your portfolio. The best place to go is value stocks.

As you can see from the chart below, value stocks are cheap everywhere. International markets tend to be cheaper than the US because they include more value names. This chart is from September 30th which is before November which was the best month for value ever. However, this shift to value from growth won’t end in a few weeks. It’s a multiyear cycle. There are plenty of places to look for these potential winners.

From GMO, Value is cheap everywherehttps://t.co/rMJwVtt4I7 pic.twitter.com/DCsKWTpVGR

— Lawrence Hamtil (@lhamtil) December 9, 2020

Conclusion

Working from home is still the norm, but there will be a wholesale shift back to work next year as it will be a competitive advantage to meet clients in person. The JOLTS report was only okay, yet manufacturing is roaring as openings hit a record high. Dividends are coming back. They will come back even more after the vaccines are distributed because many reopening stocks are value firms that usually pay hefty dividends. The excess cash firms are carrying might create an M&A boom as well. Value stocks are cheap everywhere. It should scare growth investors how expensive their stocks have gotten.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more