Lululemon's Valuation Appears Untenable

Summary

- LULU's revenue and EBITDA is 17% and 53%, respectively. The company still outperformed many of its peers.

- EBITDA margins were the double-digit percentage range. I consider this a win.

- Its liquidity and pristine balance sheet should be a competitive advantage.

- At over 40x EBITDA, the valuation appears untenable. Sell LULU.

Source: Barron's

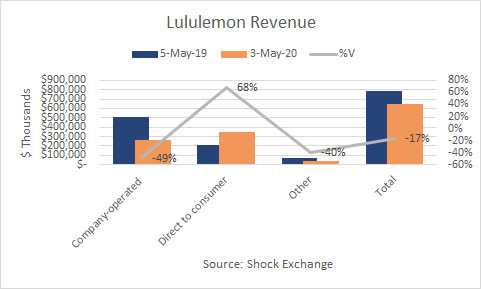

It has been a tough earnings season, particularly for retailers. Retailers with a strong digital presence have fared better than others. Lululemon (LULUl) was one of the first traditional retailers to embrace online sales. It paid off last quarter. The company reported total revenue of $651.96 million, down 17% Y/Y. The revenue decline was to be expected, given that millions of Americans have been stuck at home amid the pandemic. A higher percentage of retail sales have occurred online, testing retailers' digital prowess.

Several retailers experienced revenue declines north of 30%. Lululemon's decline of only 17% made the company an outlier of sorts. Company-operated stores experienced a 49% decline, primarily due to the impact of the coronavirus. Stores in North America, Europe and certain parts of Asia were closed temporarily.

The Direct-to-Consumer ("DTC") segment was a stalwart, growing revenue 68% Y/Y. Increased website traffic and improved conversion rates helped drive the segment. As more retail sales are derived online, DTC will become even more important. Lululemon embraced digital sales early on and now the bet is paying off. DTC is now the company's largest segment at 54% of total revenue. It also has healthy operating income margins of 45% (prior to corporate allocations).

Continue reading on Seeking Alpha.