Labor Market Indicators Amidst The Shutdown

On November 5th, we’ll get the ADP numbers for private NFP. Bloomberg consensus is for +28K, while betting on Kalshi is for +43K. We won’t have October numbers from the BLS for some time, if ever (so EJ Antoni may get his wish, although quarterly employment numbers given no data collection might not be more accurate in this case). If the ADP release hits the consensus number, here’s the picture of the labor market.

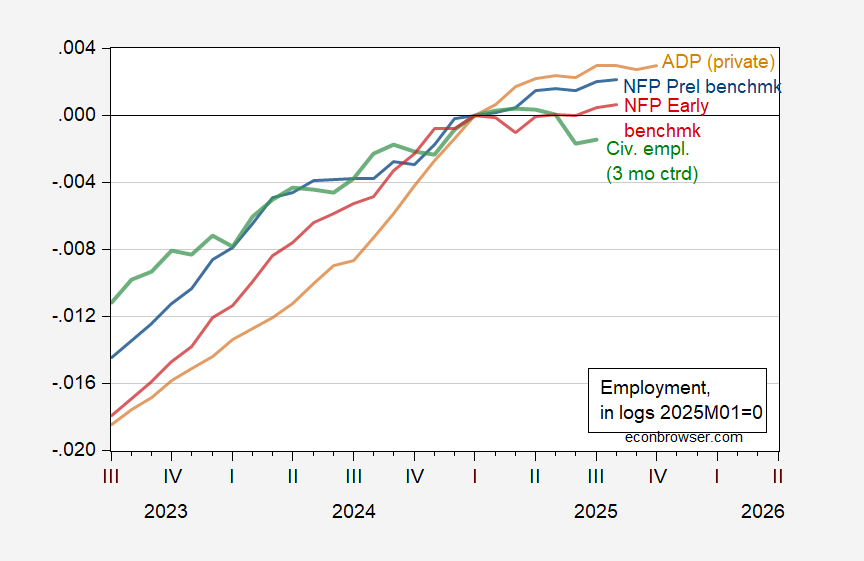

Figure 1: Implied NFP preliminary benchmark (blue), NFP early benchmark, using latest changes for extended forecast period (red), civilian employment – experimental series using smoothed population controls, 3 month centered moving average (green), and ADP private NFP (tan), all in logs, 2025M01=0. October ADP figure is Bloomberg Consensus. Source: BLS, ADP via FRED, BLS, Philadelphia Fed, and author’s calculations.

If it’s true the the civilian employment series — based on the household survey — peaks either contemporaneously of before the BLS NFP series as is sometimes asserted (see discussion here), then we should worry (note the civilian employment series is not revised month by month, so the trajectory of this series will not change over time).

Since the current betting is on about 46.5 days shutdown (taking us to mid-November), I suspect we will have to wait quite a while for the government’s latest reading on the labor market.

More By This Author:

CA, NY, And The Nation: GDP Vs. EmploymentGrowth Deceleration Relative To “Liberation Day”

Non-Federal Statistic Of The Day: Recession Predictor?