June Inflation Almost Non-Existent Except For The Fictitious Measures Of Shelter

The message of this morning’s consumer inflation report was the same for almost everything except for the fictitious measures of shelter: sharp deceleration everywhere.

Let’s take a look:

Headline CPI up 0.2% m/m and 3.1% YoY (lowest since March 2021)

Core CPI up 0.2% m/m and 4.9% YoY (lowest since October 2021):

(Click on image to enlarge)

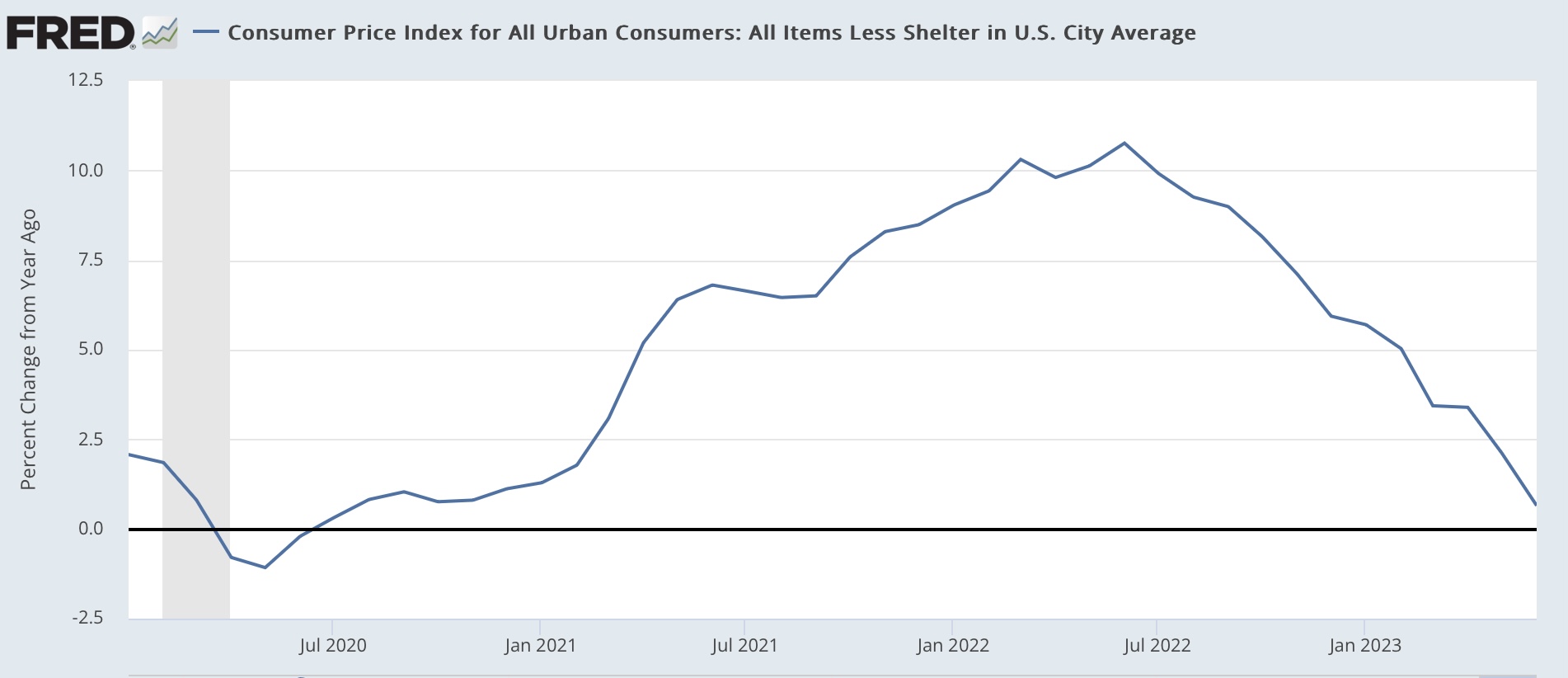

CPI less shelter up +0.2% and 0.7% YoY (lowest since February 2021):

(Click on image to enlarge)

New and Used vehicles: 0.0% and down -0.5% respectively m/m, and up +4.1% and down -5.2% YoY respectively:

(Click on image to enlarge)

Food up 0.1% m/m and 5.7% YoY:

(Click on image to enlarge)

But food is only up 0.3% in the 4 months since February:

(Click on image to enlarge)

Transportation services (replacement parts, repairs etc.) has also been a hot spot, and has also decelerated, up 0.4% m/m and up 8.2% YoY (but down from a peak of 15.2% YoY last October:

(Click on image to enlarge)

Finally, Owners Equivalent Rent up 0.4% m/m:

(Click on image to enlarge)

and 7.8% YoY (down from all time YoY high of 8.1% YoY in April):

(Click on image to enlarge)

Here’s what it looks like in comparison with house prices as measured by the Case Shiller national index YoY (/2.5 for scale):

(Click on image to enlarge)

Since the beginning of this year, monthly increases in OER have declined from 0.8% to 0.45%. YoY OER is probably going to be below 4.0% and maybe below 3.0% by the end of next winter.

To sum up: except for the fictitious measure of shelter, the only other remaining “hot spots” for inflation are new vehicles (but resolving as the supply chain issues have finally resolved) and transportation services. Food inflation has basically stopped in the past 4 months.

And if actual new rent increase and house prices were substituted for the fictitious OER measure and the 12 month average used for leases, headline inflatioin would only be up about 0.8% YoY, and core inflation up 3.0%.

But I’m sure there’s some sticky price blah blah blah somewhere that will justify the Fed’s continued hawkishness.

More By This Author:

Scenes From The June Employment Report: Consumption Leads Employment, Goods Vs. Services EditionJune Jobs Report: Deceleration Continues, With Weakest Private Jobs Sector Growth Since 2020

May JOLTS Report: Continued Decelerating Trend, But Still Extremely Positive