Jobless Claims Continue To Paint A Much More Positive Picture Than The Unemployment Rate

The return to normalcy in jobless claims after a skewed reading for Thanksgiving week due to unresolved seasonality continued. Initial claims declined -13,000 to 224,000, very close to the midpoint of its range since the beginning of July. The four week moving average, which still includes the outlier Thanksgiving week, rose 500 to 217,500. Continuing claims, which are delayed one week and thus only one week out from the Thanksgiving skew, rose 67,000 but were still below 1.9 million at 1.897 million.

On the YoY% basis which is more important for forecasting purposes, initial claims were up 0.9%; the four week average still down, by -3.5%, and continuing claims higher by 1.9%.

It will be two more weeks before the skewed week is out of the four week average, so I would discount that reading.

Still, very slight YoY increases in new and continuing jobless claims are neutral and do not portend an imminent recession.

Last week I noted that the unresolved post-pandemic seasonality that was so apparent in 2023 and 2024 has been much more muted, especially in the second half of this year. Claims did rise into June, but then sharply declined in July, and have generally remained in that range since. I further noted that in the first half of this year, jobless claims typically were in the +10,000 range YoY. That all changed since the end of June. In the 23 weeks through one week ago, jobless claims averaged just under -4,000 lower YoY.

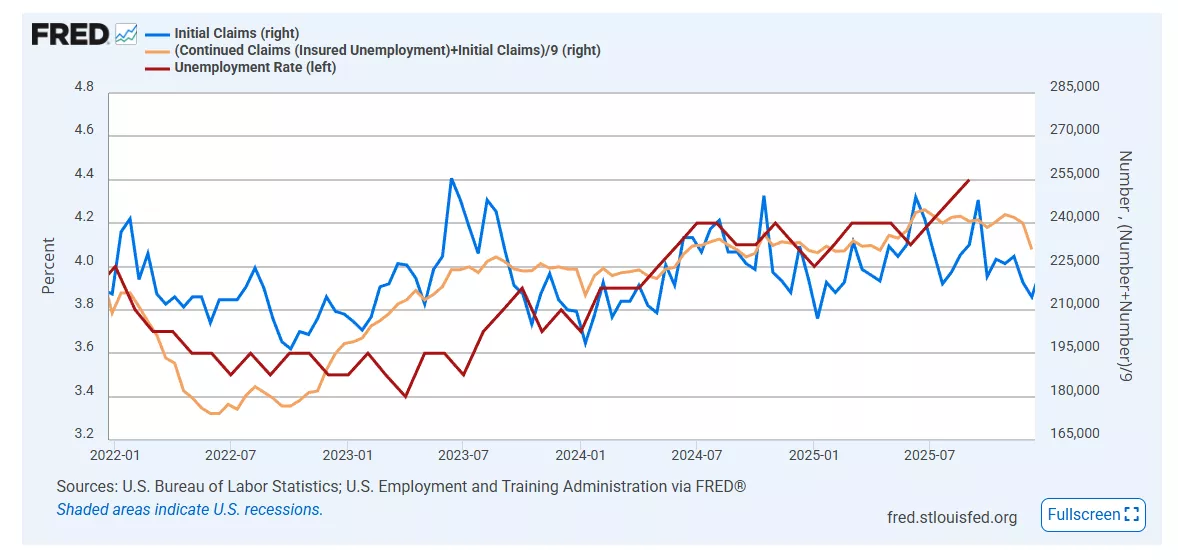

This week’s initial claims number was only 2,000 higher than last year’s for the equivalent week, which adds another week of evidence for the idea that there has been somewhat of a change in regime for jobless claims since the middle of this year. Significantly, it also suggests a serious disconnect between what has been happening with both initial and continuing claims vs. the unemployment rate, which as you recall increased to a multiyear high in the jobs report released for November the other day. Here is the update on that comparison:

An unemployment rate 0.4% higher than one year previous has in the past almost always meant that a recession has begun. The exceptions were one month in the 1950s, two months in 1963 - and five months last year. The jump in the unemployment rate is consistent with the significant increase in continuing claims that started in June.

It is also possible that this is a reaction to the anomaly last year in the unemployment rate, which was put down (rightly I think) to a miscalculation of the impact of immigration on the population numbers. But this year all the evidence is that has reversed. The answer apparently lies in the 0.6 million surge in the unemployment level as well as a 1.2 million surge in the civilian labor force calculation in the Household Survey since July, especially in comparison with very low increases calculated last November. I suspect we are going to have to wait for January for YoY comparisons to be more valid, since they will not be against the big immigration undercount of 2024. Since that undercount does not affect jobless claims numbers, at very least we have to take the alleged triggering of the “Sahm Rule” in November’s jobs report with extra grains of salt.

More By This Author:

Real Retail Sales Contract; Depending On Inflation Report May Signal Further Job LossesCombined October And November Jobs Report: A Hairs-Breadth From Recessionary, At Best

What Do Vehicle Miles Traveled And Gas Usage Tell Us About The Economy?