It's Zombie Inflation

Maybe we should call it Zombie Inflation.

Every time the mainstream declares price inflation dead and buried, new data comes out and rains on the funeral.

However, if you understand the root cause of inflation, the CPI data comes as no surprise.

And it isn’t fundamentally about tariffs.

The inflation machine has been running for more than a year, and the Federal Reserve is poised to crank it up a notch or two.

August CPI By the Numbers

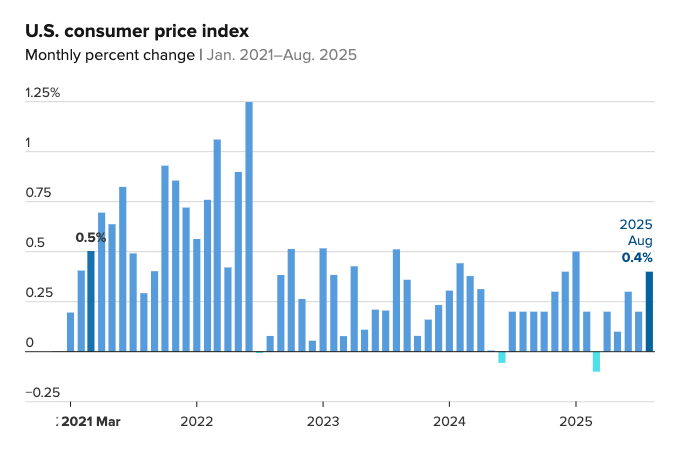

The headline annual CPI came in at 2.9 percent, according to BLS data. That was up from 2.7 percent in July and the highest print since January. The reading was in line with expectations.

On a monthly basis, prices rose by a healthy 0.4 percent. That was up from 0.2 percent in July and above the 0.3 percent projection.

If you annualize that monthly number, we’re talking about 4.8 percent CPI.

Stripping out the more volatile food and energy prices (if only we could do that in real life), core CPI rose 3.1 percent on an annual basis. Month-on-month, core CPI was up 0.3 percent, the same as July.

Over the last three months, core CPI has increased by 0.2, 0.3, and 0.3 percent, annualizing to 3.2 percent. Core CPI has been mired in this range for months.

When you look at the CPI in graphical form, it’s clear that inflation has been bouncing in the same range since around mid-2022.

Note that none of these numbers is anywhere near the Fed’s mythical 2 percent target.

As you parse the data, keep in mind that the CPI doesn’t tell the entire story of inflation.

The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS used the old formula, we’d be looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

The recent massive revisions to the BLS employment data have also cast some doubt on the veracity of government number-crunching.

However, this is the formula the government uses, and it drives decision-making.

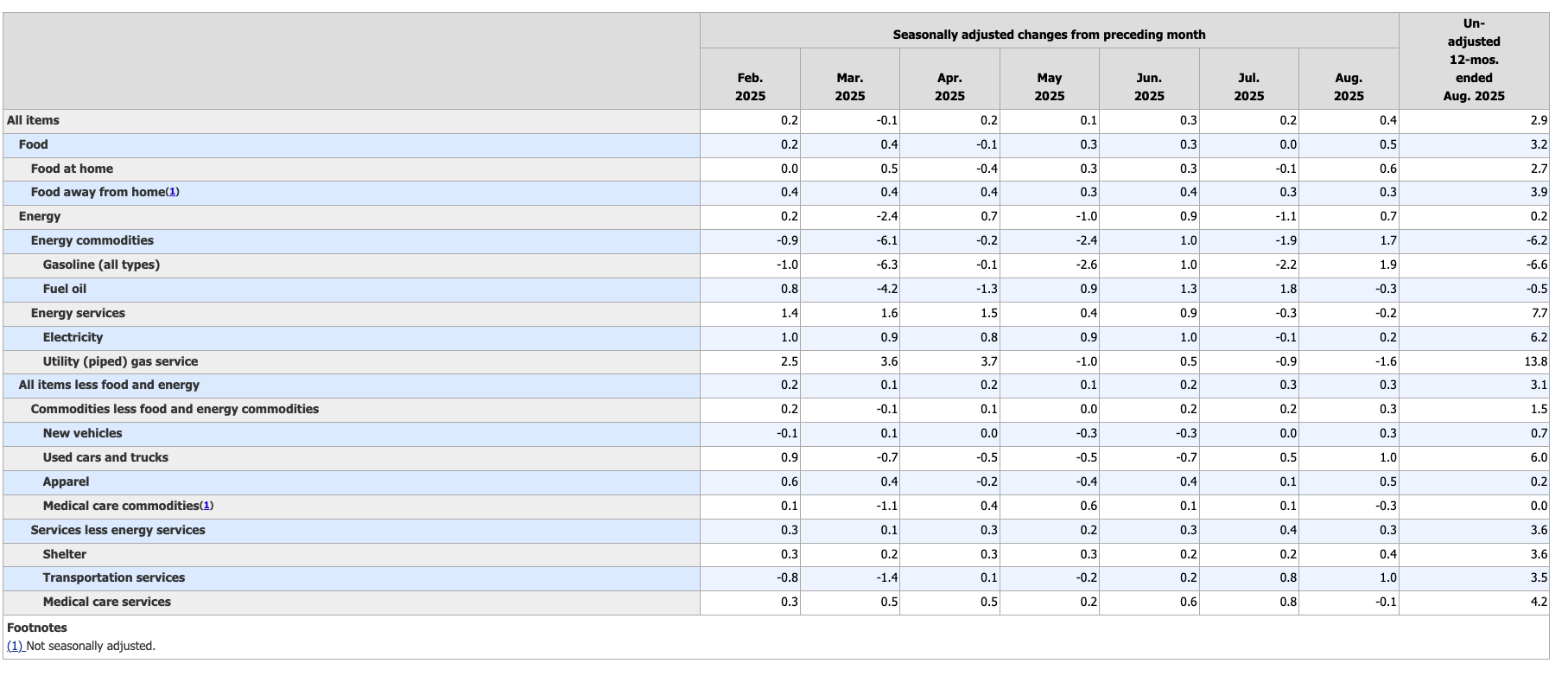

Looking more deeply at the data, we find the energy prices have started creeping up. The energy index rose 0.7 percent, driven by a 1.9 percent increase in gasoline prices.

Food prices are also creeping higher, with the index up 0.5 percent. All six major grocery store food group indexes increased in August.

Service prices were up 0.3 percent month-on-month and 3.6 percent annually. This is significant because you can’t blame tariffs for rising service prices.

The Real Inflation Story

The mainstream mantra has been that tariffs are going to boost price inflation. But the data doesn't really bear this out. There have been some price increases on tariff-sensitive goods, but the unabated increase in shelter and service costs reveals something else at play. Even CNBC suddenly affirmed that tariffs don't cause inflation.

"Historically, tariffs have been looked at as temporary boosts to the prices of goods but not a longer-term inflation driver."

The problem is that people misunderstand inflation. Rising prices aren’t “inflation” as the term is properly defined. Inflation is an increase in the supply of money and credit. Rising prices are one symptom of this monetary inflation.

The fact of the matter is that inflation has been increasing for more than a year.

And it appears the Federal Reserve is ready to crank up the inflation machine higher. According to CNBC, “market pricing indicates a 100 percent certainty that the Fed will lower its benchmark interest rate” at the September meeting.

That’s because there is significant softness in the labor market. Based on the BLS data, the economy only created 22,000 jobs in August. Meanwhile, the BLS has erased nearly 1 million jobs from the data through revisions. Initial jobless claims surged to 263,000 last week, a 4-year high.

This signals economic contraction.

And what do we call low economic growth and high price inflation?

Stagflation.

This puts the Fed between a rock and a hard place. In fact, it has faced this Catch-22 for months. It needs to cut to support the debt-riddled bubble economy. But it also needs higher rates to keep price inflation under control.

Obviously, it can’t do both.

It looks like the central bank will choose inflation.

As already mentioned, it made that choice months ago when it stopped raising rates. The fact is, the central bank never did enough to rein in inflation.

No matter how you choose to parse the CPI data, inflation is already increasing, and a rate cut will accelerate that trend.

After the last Fed meeting, Chairman Jerome Powell called the current monetary policy “modestly restrictive.”

This characterization is debatable.

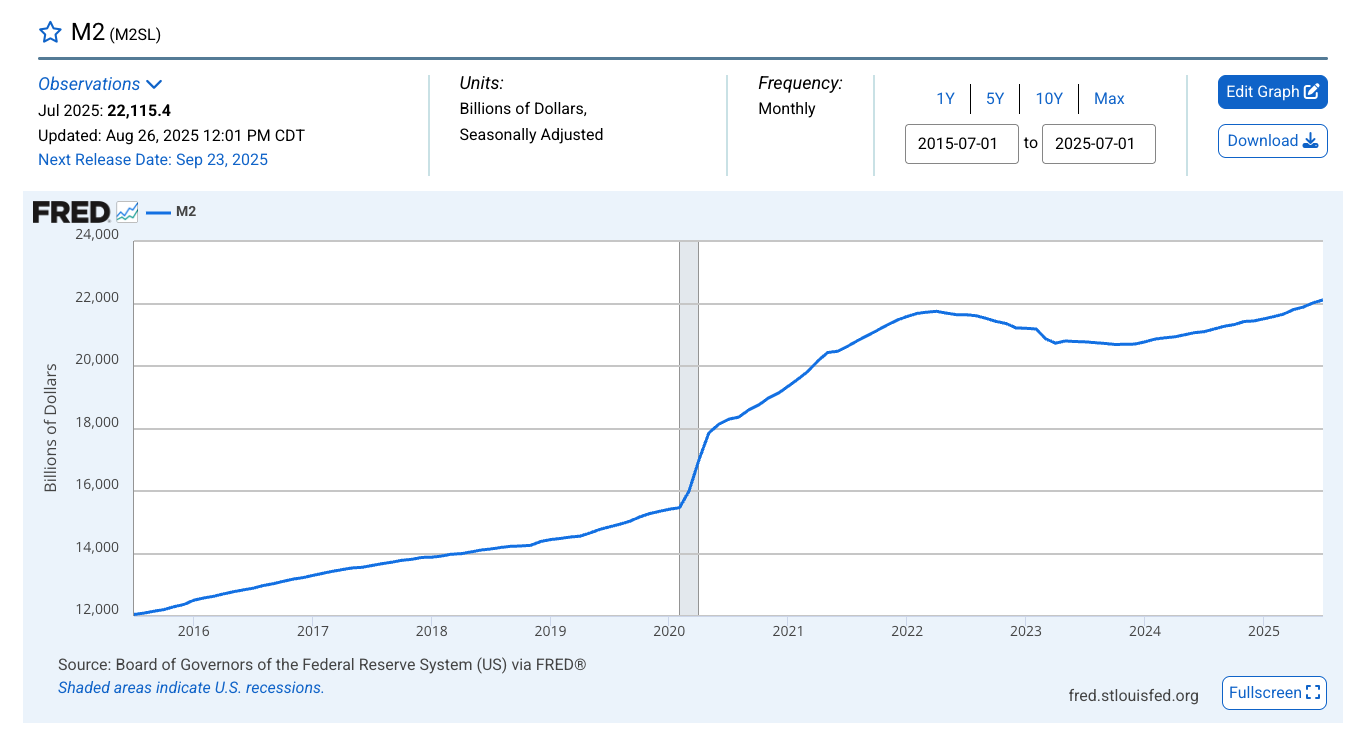

As of the end of June, the money supply had expanded by more than $600 billion since its low point in mid-2023.

As of June, the M2 money supply stood at $22.1 trillion and is above the peak reached during the pandemic.

We can’t overstate this fact: this IS inflation.

During the Fed’s inflation fight, the M2 money supply contracted. This is exactly what needs to happen to wring out inflation from the economy. The money supply bottomed a little over a year ago at $20.60 trillion.

That sounds like an impressive inflation fight, until you realize that the money supply would need to fall by at least another $3 trillion to get back to the trend of 2019. Clearly, that’s not the trajectory.

And now the Fed is going to push up the throttle on inflation.

You would be wise to prepare for more currency devaluation.

More By This Author:

Consumer Debt Unexpectedly Surged In JulyEven With The Recent Price Surge Silver Still Appears Cheap

The Gold Bugs Are Right