Is It Priced In?

What a week, eh? It feels as if my last dispatch at the beginning of the month was written a lifetime ago. The sell-off in equities was already severe by then, and I was in a buy-the-dip mood. My initial intuition proved correct; the rebound happened, as did the new low. My prediction of subsequent choppy sideways movement was brutally refuted, however, sell-off, a surge in volatility and dislocation across multiple markets to an extent not experienced the financial crisis.

There are so many things we don’t know, so let’s start with the few things we do:

Covid-19 is now morphing into a hit to the real economy not seen since the financial crisis. The virus’ foothold in Europe is strengthening, and country by country are now shutting down their economies in a desperate attempt to avoid the disastrous scenario unfolding in Italy. The U.S. and the U.K. are acting as if they’re somehow immune or different, I fear they aren’t. In any case, it is besides the point. The global economy is now in recession, and the scrambling action by fiscal and monetary policy is really just an attempt to prevent an economic shock turning in to a prolonged crunch with a wave of private sector bankruptcies and soaring joblessness.

I am sympathetic to Greg Mankiw’s attempt to do a quick run-through of the situation; a recession is inevitable, the focus should be on making sure the health system can cope, the latter which requires the adequate funding, and temporary measures to restrict movement and social interaction. This will be expensive—in terms of lost output—and governments should focus on creating a social security/support parachute for those sectors and workers, which are about to get hammered. Central banks, for their part, should step up as liquidity providers and lenders of last resorts. Market dislocations are unavoidable, but policymakers can make sure markets keep functioning, at least. Make no mistake, this has the makings of an extremely severe crisis if it is not addressed timely and with adequate care. It’s one thing helping households and firms through a rough patch, it’s entirely different mopping up after job losses and bankruptcies have swept through the real economy. In short; this doesn’t have to turn into a repeat of 2008 for markets and the economy as a whole, but it might. The jury is still out.

IS COVID-19 PRICED IN?

It seems offensive to discuss market prices in the context of a crisis, whose cost is counted in loss of lives, but that’s what we must do all the same. Last week’s price action was record-breaking in both directions leaving investors gasping for air. Thursday delivered the worst daily decline in equities since 1987, followed by the biggest rise since 2008 on Friday. Good luck trying to pick the signal from the noise in that one.

Policymakers have had mixed results with their interventions. The coordinated easing package by the government and BoE in the U.K. on Wednesday looked like a well-oiled response. By contrast, Ms. Lagarde’s press conference on Thursday was the most calamitous performance by a central bank official that I have ever seen. Nevermind the BTP gaffe. The ECB has since walked that back, and I am willing to it slide. More worryingly, though, a central bank, which repeatedly, either implicitly or explicitly calls for fiscal policy to “help” is an institution signalling that it has lost faith in its own tools and ability.

Thursday’s worst daily slide in Eurostoxx 50 on record shows what happens when you send that message to markets.

In the U.S., meanwhile, the Federales are flexing their muscles. The 50bp emergency rate cut earlier this month was an appetizer. The main course was served yesterday via a 100bp cut, taking the FF rate to zero, a €700B QE program, and the re-start of dollar swap lines with other major central banks. Cynics will note that printing money to buy financial assets won’t help cash constrained SMEs, which are about to get hammered. This is self-evident, as is the fact that fiscal policy needs to step up. That said, monetary pump-priming probably is a necessary, but not sufficient, condition to prevent a meltdown in markets and the economy alike.

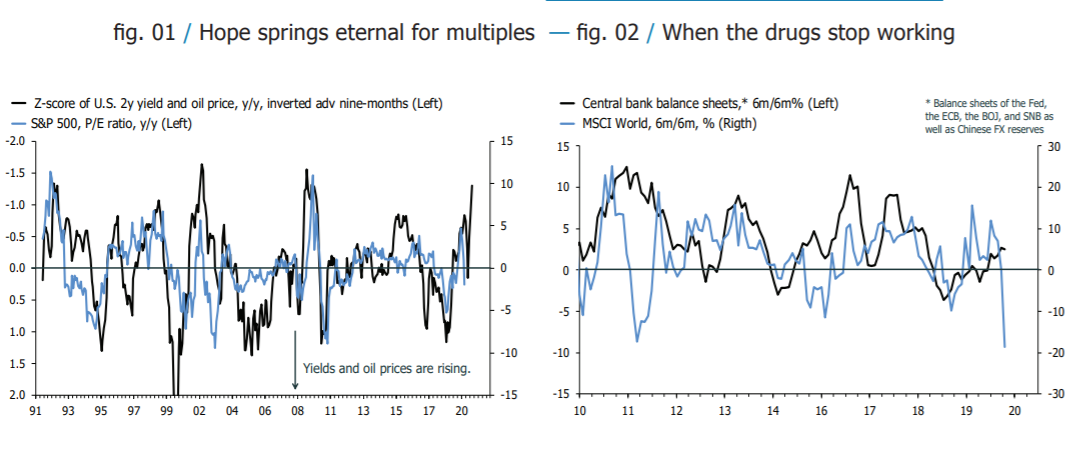

The Fed’s actions on Sunday evening are teasing investors with the idea that it’s time to fade the bearish price action in equities. Only a fool would make a big bet on either side at this point. The outlook for equities requires a view on earnings and the multiple applied to said earnings. The fact that the policy put seems to be alive and well is good news for valuations, eventually, but if the economy literally stops functioning, will it be enough to offset the gut wrenching fall in nominal earnings?

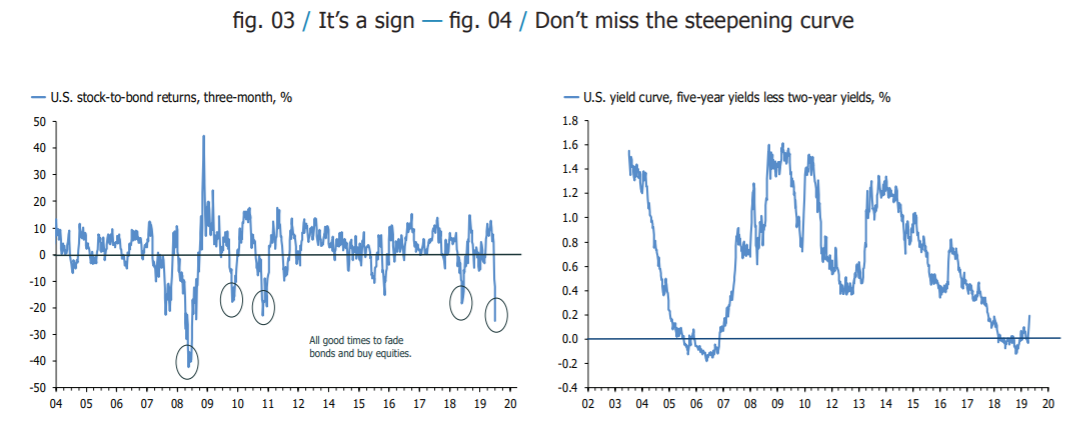

I can’t answer that question, but I am getting interested in the relative performance between stocks and bonds. U.S. bond yields rose last week, even as equity market volatility remained elevated. When I look at the charts, it seems as if they’ve made a bottom, though the response to the Fed’s recent move will be key in the next few weeks.

My penultimate chart below shows that the trailing three-month stock-to bond return is now as low as during the darkest period in 2008. That doesn’t mean the low in stocks is in, but it is a start. The second chart shows that the yield curve is now steepening slightly, another subtle and important shift, signalling that the light in the darkness might not be an oncoming train after all. The point I am getting as is simple; we are not out of the woods yet, Covid-19 probably isn’t fully priced by equities, but it might be in bonds.

Disclosure: None

It may be too soon to bet on stocks. But I have accumulated some proof that the virus is weak. Somehow the Republicans know it is overblown.