What Is Tax Loss Harvesting?

All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties.Investors seeking tax advice should consult an independent tax advisor.

How an Investment Loss Can Become a Tax Win

Did you know that you can use an investment loss to help you improve your tax situation? It’s true. Through a strategy called tax-loss harvesting, you may be able to use your loss to your advantage.

It’s a fairly simple idea. By selling the investment, you can realize or “harvest” the loss and use it to offset your capital gains, reduce your taxable income, and maybe even improve your portfolio returns.

Using Your Loss to Offset Gains

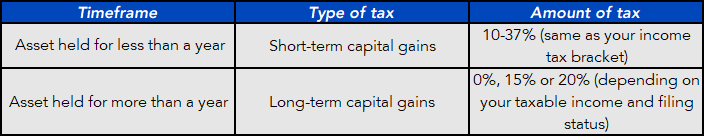

Every time you sell an investment for more than you paid for it, you create a capital gain. And as you probably know, the government likes to tax those. Generally speaking, the amount of the tax will depend on your tax bracket and how long you’ve held the investment.

And you may not realize it, but some investments can create capital gains even when you don’t sell them. These gains are generated by the manager’s trading or from the actions of other shareholders. When this happens, you might owe capital gains taxes on fund shares that you haven’t sold.

Capital Gains Overview

But what if you have something in your portfolio, like a stock or a fund, that has lost value during the year? If you decide to use tax-loss harvesting, you would sell this investment and take the “loss”. The loss offsets your portfolio’s short- or long-term capital gains, lowering the amount you will be taxed on. And, of course, you have the option of reinvesting the cash from the sale in some other way.

How a Loss Can Reduce Ordinary Taxable Income

If your losses are more than enough to offset your capital gains, you may also be able to use them to reduce your ordinary taxable income by as much as $3,000. Let’s take a look at how that could work.

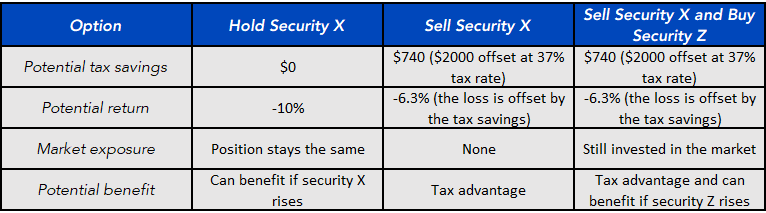

Imagine you invested $20,000 at the beginning of the year in security X. But toward the end of the year, security X is down by 10% and is worth $18,000. What can you do?

First, you could just hold on to the security. Second, you could sell the security, take the $2,000 loss, deduct that loss from your taxable income, and pocket the remaining cash. Third, you could sell the security, take the loss and the deduction, while reinvesting your proceeds in a different security.

Here’s a breakdown of the potential outcomes of these three options if you’re in the 37% tax bracket:

Hold, Sell, or Sell-And-Reinvest?

What Is the Wash-Sale Rule?

With tax-loss harvesting, there’s a key rule you should be aware of: the “wash-sale rule.” This IRS regulation says you cannot buy an investment that is “substantially identical” to the one you’ve sold within 30 days of the sale or you risk losing the ability to claim the loss and any tax benefits that came with it.

It’s worth noting that ETFs are not currently considered substantially identical to mutual funds. You may be able to use this fact to maintain your investment exposure, while still capturing losses for tax purposes.

The bottom line is that tax-loss harvesting can help you manage your investment losses.

Disclosure: Neither WisdomTree Investments, Inc. nor its affiliates, nor Foreside Fund Services, LLC., or its affiliates provide tax advice. All references to tax matters or information ...

more