Vector Group: Overlooked Growth, Value And Income, On Sale

Summary

- Once a year, I try to share an article I have written exclusively for members of my Investors Edge (Marketplace) community.

- This will always be a company I feel represents value to a wider base: those who invest for value, growth or income.

- Sometimes you get all three.

- Vector is just this kind of company at a fair price. I can't imagine it will remain at these levels for very long.

rivermartin/iStock via Getty Images

We seldom find a company that combines value, growth and income in relatively equal parts. In this case, it is a Real Estate and Consumer Staples selection.

The real estate division, New Valley, owns Douglas Elliman LLC, the largest residential real estate brokerage in the New York City metropolitan area and the 6th-largest nationwide.

The consumer staples division is in the (gasp, shudder) tobacco industry. Before you think this is a dying industry, read on!

Let's get this out of the way first: I do not personally smoke, vape, chew, inhale or rub tobacco on my manly chest.

But other people do. And while there is no shortage of Aunt Pittypats reaching for their smelling salts at the scent of smoke or other busybodies who just want to tell you how you should live your life, smoking is not illegal.

Two thoughts: First, am I the only person who has noticed the hypocrisy of protestors railing against tobacco while they toke up behind their "No Tobacco!" signs? The same people who say "Smoking BAD" are often the same ones touting the benefits of smoking, baking and otherwise ingesting marijuana, often from sources far less regulated and less safe than tobacco?

Second, while the various nanny states may say they want to stop their citizens from smoking... they cannot afford to. The 1998 Tobacco Master Settlement Agreement was designed to punish (only some!) tobacco companies by aggressively taxing their product. Those taxes were supposed to go to smoking cessation programs. Where has it really gone? Welfare, urban transportation, unemployment compensation, and any other place their budgets need gap-filling.

The income these states collectively receive from the taxes they levy on tobacco companies is the only thing keeping many of them afloat. They are, in fact, in bed with Big Tobacco. Further, by making it virtually impossible for a new tobacco company to form, they have effectively granted monopoly power to the existing tobacco companies. The Big Three, Philip Morris Intl (PM), Altria (NYSE:MO), and British American Tobacco plc (BTI) dwarf my current selection.

Long-time subscribers will recall that I have owned all three and sold all three at a profit. What I like about my current choice, the 4th largest tobacco company in the US, is that the Vector Group (NYSE:VGR) was too small to include in the draconian money-grab from the Big Three. Founded as a tobacco company in 1873, it is especially interesting to me because of its diversification between tobacco and real estate. The Liggett Group is Vector's best-known name, though they sell many different brands.

Because Vector was not forced to become a signatory to the 1998 Tobacco Master Settlement Agreement, as long as the Liggett subsidiary does not exceed 1.65% of the total cigarettes sold in the United States, they do not have any Federal or state bad-boy payments. (They do have separate agreements with 4 states.) This arrangement gives them a serious pricing advantages of 60 to 80 cents a pack over the Big Three. Are most smokers going to give up their Marlboros for the 70-cent a pack difference? Maybe not at these prices, but later, who knows...

VGR would not even think about increasing that pricing advantage. It is in VGR's interest to keep that 1.65% cap for tobacco sales since, if they exceed it they pop up on the radar of the states that piously proclaim their hatred of smoking at the front door while scooping in all those unearned-by-the-state taxes they can use for other purposes.

Does this limit Vector Group's growth? Not at all. The company can use its steady cash flow to enter any other business they like for future growth!

One other thought on all tobacco companies, large and small. Even if cigarettes were to be regulated so heavily as to become unprofitable, the groundswell of marijuana legislation will allow the tobacco companies to be in a position to own the entire cannabis arena.

Many more US states, and likely the Feds as well, will decriminalize marijuana for the same reason they created the tobacco monopoly: taxes. You can fill your lungs with burning weed as long as the state gets their fair or unfair share. Already the black market for dope has collapsed. "Knowledgeable sources" tell me that erstwhile unregulated growers have seen prices fall 60-90%. Many of them had no other marketable skills and are now hitting the unemployment rolls. Maybe that is why there are so many new unemployment claims - the illegal dope market was way bigger than we knew.

Once everyone can walk into a 7-11 and buy their Bruce Banner, Orange Sherbet, AK47 or Blue Dream weed in nice pretty packaging, who better to grow, process, and distribute marijuana products once they are legal than the tobacco companies?

They already have the retail relationships, the most coveted shelf space, and the deep pockets it will take to put it all in place. Finally, they are also used to being ripped off by sacrosanct politicians who are more than happy to underwrite their latest boondoggle with the tax money they extract from the workers at tobacco firms.

I predict the tobacco companies will own the marijuana market within a few short years. Dope is expensive to grow indoors. You need rich soil, sunshine and rain to grow it most efficiently and at the lowest cost. Let's see... who has all those massive outdoor fields seen in the photo above? Can't sell tobacco at a profit? Plant dope.

On to Real Estate

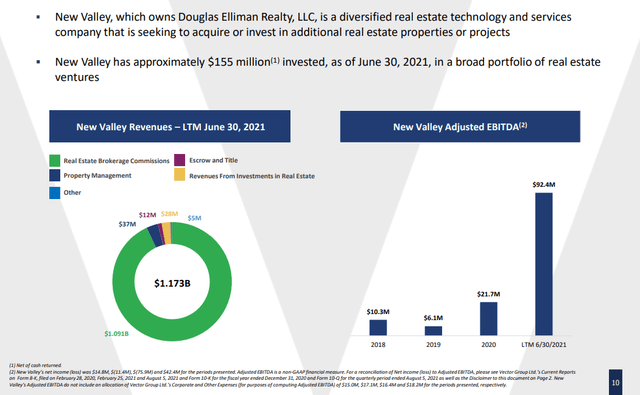

The New Valley subsidiary (100% owner of Douglas Elliman) contributed revenues of $1.14 billion in the 12 months ended June 30, 2021, is a fine example of using cash flow to enter new businesses.

Source: VGR August 2021 Investor Presentation

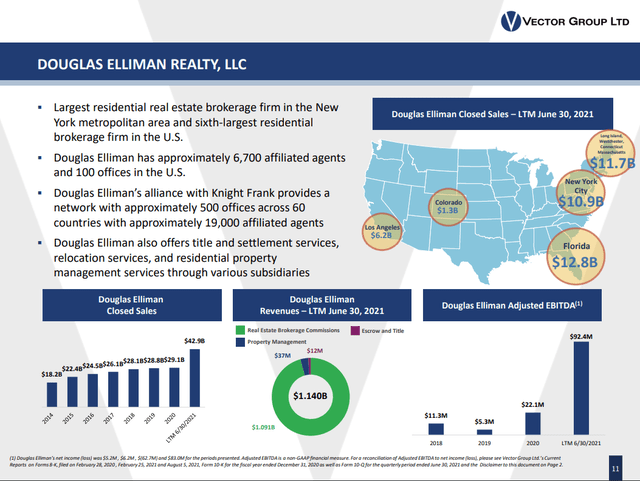

Here is more granularity into the real estate side of the business, all from the same source noted directly above:

Source: VGR August 2021 Investor Presentation

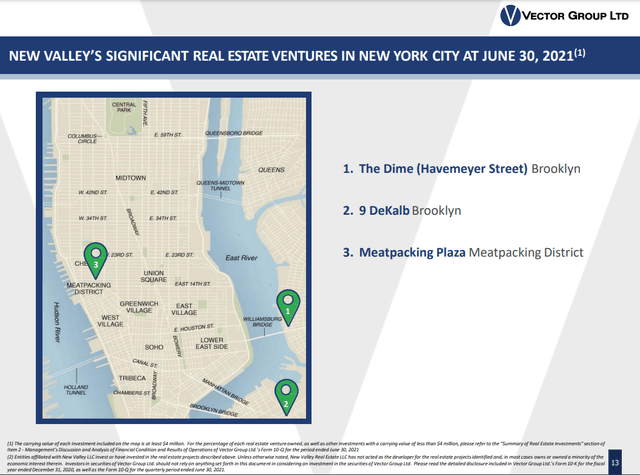

While the bulk of Elliman's earnings today come from brokerage commissions, the company is branching into land development, apartments and other real estate investments of its own. Here are just three in NYC alone:

Source: VGR August 2021 Investor Presentation

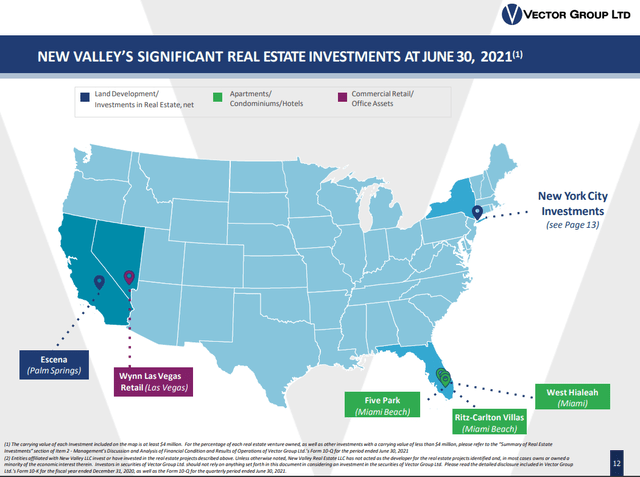

And around the country:

Source: VGR August 2021 Investor Presentation

Elliman is a very profitable firm, capable of producing significant cash flow on the scale of the Liggett Group. Will other acquisitions follow? Remember, this is a company founded in 1873. They do not rush into anything to assuage management egos. They move slowly but steadily. I look forward to seeing what comes next.

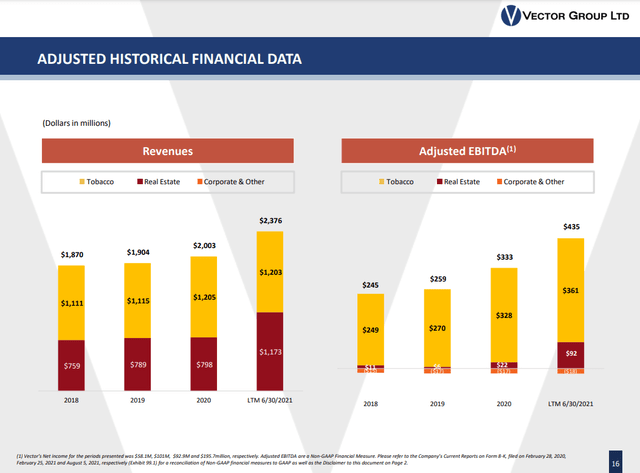

Finally, some numbers for the group as a whole, showing good growth even through the pandemic.

Vector is no hand to mouth company. It enjoys excellent liquidity. Cash, marketable securities and long-term investments of $703 million (with cash of $108 million at Liggett and $155 million at Douglas Elliman) were reported for the company's most recent quarter ending June.

The average tenure of the senior management team (CEO, COO, CFO and General Counsel) is 27 years with Vector Group. This team and its board of directors collectively own some 7% of the equity of the company. Their interests are aligned with shareholders.

VGR is not thinly traded (700,000 shares today,) but neither is it Altria or Philip Morris. The company has been hovering just below the radar for some time. I don't believe that will last.

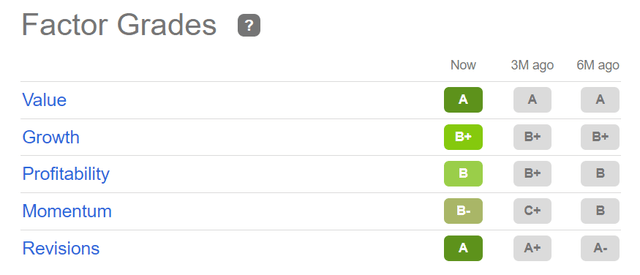

Vector Group has shown steady growth in two segments normally thought of as "value" or "defensive" sectors - real estate and consumer staples. In addition, the shares currently yield 5.9% and enjoy the following "Factor Grades" from Seeking Alpha Premium:

Value. Growth. Income. That's Vector Group.

Good investing.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they ...

more