In Like A Lion, Out Like A Lamb: Sibanye Stillwater And Anglo American Platinum

Summary

- The old proverb about the Month of March refers to the often harsh and unpleasant weather in early March.

- Then comes, most years, the more desirable and milder weather that most often characterizes the end of March.

- We have ample reason to hope we can escape the unpleasantness of the first two months of 2022 as early as we can this March!

- Here are two ideas that might ensure a solid final month of this quarter whatever the weather.

mathieukor/iStock via Getty Images

While I'm using the proverb about March weather as a metaphor for the stock market in the summary above, there's an even greater urgency for the "real" weather to be mild in March this year.

April is just around the corner. The milder the remaining few weeks of winter in the Northern Hemisphere are, the less Europe and North America will need to consume large quantities of oil and natural gas for heating and, as the days grow longer, for lighting as well.

The less oil and gas we need, the lower the price of these two key commodities and the concomitant lowering of the level of inflation. Even better: the less Europe will need Russian oil and gas going forward.

Those readers who sometimes read my national and world affairs essays on Substack saw my analysis, pre-invasion, of what would likely happen in Ukraine and how Vladimir Putin, Russia and the rest of the world would fare in the aftermath. This is a site for investors so I will not discuss further how this is all likely to unfold - but I will mention a couple of ways I believe investors can best profit from the sanctions on Russian miners.

For Your Due Diligence

Premise: Mr. Putin's demented need to extract maximum bloodshed to punish the Ukrainians for their arrogance in defending their country will make him a pariah. He will drag Russia into that same vortex.

Suggestion for your due diligence: Russia is the world's top producer of palladium and the world's second-largest producer of platinum. South Africa is the world's top dog in platinum mining and the world's second in palladium. Two of the biggest companies in South Africa producing platinum group metals (PGMs, which include palladium, platinum, and rhodium) are:

1.) Sibanye Stillwater Ltd. (SBSW). SBSW also produces gold, always popular in times of inflation, and also mines by-products like iridium, ruthenium, nickel, copper, and chrome. This company, formed as a result of combining with US-based Stillwater, also has all those Stillwater mines in Montana. SBSW has various interests as well in the Marathon PGM project in Ontario, Canada, the Altar and Rio Grande copper gold projects in north-west Argentina, and many other properties in the southern cone of Africa.

2.) Anglo American Platinum (OTCPK:ANGPY) is the PGM arm of the behemoth mining conglomerate Anglo American plc (OTCQX:NGLOY). No one-trick pony, ANGPY also produces base metals, not just in South Africa but, like SBSW above, internationally on three continents. Among its products: Platinum, palladium, rhodium, ruthenium, iridium, gold, nickel, copper, cobalt sulphate, and chrome.

Both companies have already begun their ascent. However, SBSW, even after a 10% rise on Monday, trading below its 52-week high.

Seeking Alpha

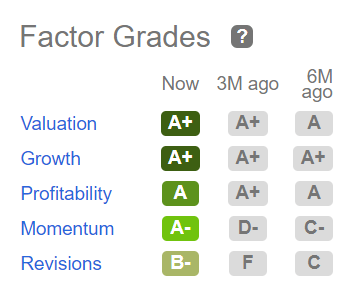

You will also note that it's trading at a forward projected PE of 3.66. Do not presume the yield to be accurate, however. These are trailing 12-month figures and subject to change based upon revenue and earnings. Please also note the unusually high standing given to the current outlook for the company:

Seeking Alpha

The situation is currently quite similar for ANGPY. Unlike SBSW, it's selling at its high for the year. However, that high still places it at a trailing 12-month PE of just 7.55. And this is not an estimate - it's the prior 12 months. It's difficult to imagine the company will be less successful this year, given the geopolitical winds and crosswinds.

Seeking Alpha

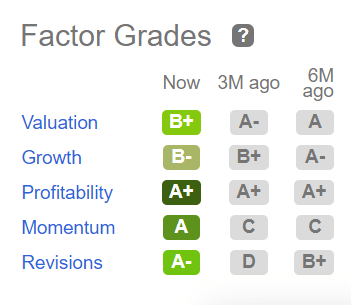

As an ADR, ANGPY is not afforded Factor Graves, but the common shares (OTCPK:AGPPF) have been accorded equally high grades...

Seeking Alpha

Because I would like to see many investors have time to review this information, I won't do the deep dive I normally provide. I believe both ANGPY and SBSW are strong contenders for success as a result of Mr. Putin's bull in a china shop blunder.

Do your homework and see if you don't agree.

Good investing,

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they ...

more