Bitcoin Gives Investors A Break During The Bear Market

Crypto Market Musings

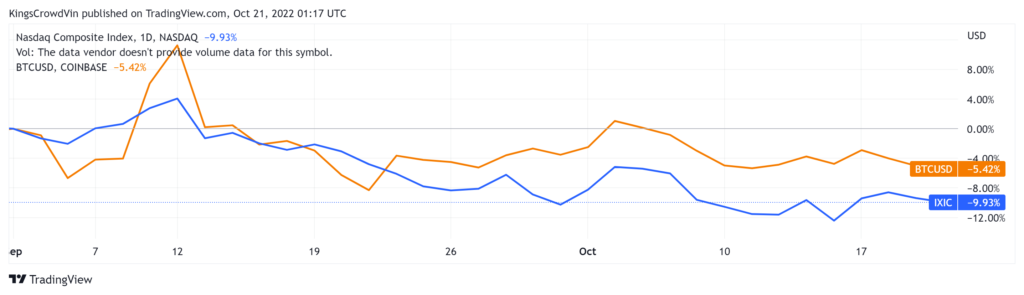

Bitcoin (BTC) is traditionally an extremely volatile asset. But not right now. Bitcoin volatility (.BVOL) is at a 100-day low. Since September 1, bitcoin has largely been trading in a narrow range between $18,400 and $20,000. And BTC has outperformed the Nasdaq during that same time period.

The lack of volatility is a welcome relief for crypto investors. In an extended bear market, low volatility periods give investors a chance to catch their breathe. It’s also a bit of a surprise. The correlation between bitcoin and the broader equities markets has fallen to its lowest point since January.

Right now, it looks like bitcoin (and crypto) trading patterns are more tied to larger macro issues — inflation, interest rates, dollar strength, etc. — than to the stock market itself. Individual coin dynamics will also affect trading just as earnings reports affect individual stocks. The next big picture event to keep an eye on is a likely 75 basis-point interest rate hike in early November.

If you’re actively trading in and out of positions, be prepared to take advantage of some market volatility (and a likely market dip) at the beginning of the month.

What We're Thinking About

The reasons why people adopt crypto — and which coins they adopt — vary from nation to nation. We’ve written extensively about how people in Argentina, Venezuela and other countries impacted by runaway inflation have turned to bitcoin to preserve wealth and purchasing power. And new data from Chainalysis shows just how varied the uses of crypto throughout the world are.

The U.S. and Western Europe tend to be early crypto adopters, according to Chainalysis.

Between July 2021 and June 2022, DeFi has accounted for 37% of all North American cryptocurrency transaction volume — more than any other region. Western Europe is second at 31%, while other regions like Sub-Saharan Africa have as little as 13% of activity coming from DeFi.

In Latin America, beating inflation AND payments drive crypto usage.

“More than 31% of Argentina’s small retail-sized crypto transaction volume comes from the sale of stablecoins,” Chainalysis reported.

Argentina isn’t the only country using crypto for payments.

Remittance payments are also common throughout Latin America. “El Salvador’s government-backed payment app Chivo processed $52 million in bitcoin remittances from January to May this year,” Chainalysis reported. “Bitso alone has already processed more than $1 billion in U.S.-to-Mexico remittances in 2022.”

Chainalysis also found that in sub-Saharan Africa, “the number of small retail transfers actually grew starting at the onset of the bear market in May, while the number of transfers of other sizes fell.”

So as we think about crypto moving forward, one thing to keep in mind is that the way we perceive crypto varies from region to region. And understanding how crypto is used throughout the world should help shape our approach to investing in this asset class.

And Finally…

I have no idea whether the Halloween effect — where my second favorite day of the year (behind Thanksgiving) sends crypto prices soaring — is real. But investing should be fun. And reading about the Halloween effect was fun. So if you’re into spooky signs (or just having fun), it’s an additional data point to consider.

Editor’s note: KingsCrowd Investment Research Manager Oliva Strobl contributed to this report.

More By This Author:

It’s Time To Retire The “Bitcoin As Digital Gold” AnalogyRegulators Try to Tighten Their Grip on Crypto

Ethereum Merge Signals A Bright Future For Crypto