Interest Rates And Central Banks

Image Source: Pexels

There has been a worrying spread of monetary tightening around the world, particularly among the large, international trade-oriented economies.

Monetary tightening can be thought of as occurring through two major channels.

The clearest channel is the increase in central bank interest rates which results in all sorts of new interest rate charges.

The other major channel occurs via the reduction of financial liquidity of businesses and households as central banks shrink their balance sheets by liquidating their government bonds. Of course, monetary tightening also affects equity markets, currency markets, and the flow of international trade.

The negative effect of monetary tightening via the liquidity squeeze is not as easily understood as the increase in interest rates, and of course, the two effects are linked.

Liquidity is usually thought of in terms of the financial squeeze that falls on financial institutions and other debtor groups in terms of their ability to meet their future financial obligations.

The international financial crisis of 2007-2008 was a classic liquidity crisis because a number of banks and other financial entities experienced significant losses related to mortgage finance that were caused by the US subprime housing crisis. In the US the subprime mortgage crisis had more to do with poor regulations and shoddy banking practices than with tight monetary policy on its own.

The global banking crisis which began in the summer of 2007 created the “Great Recession” that began in 2008

The financial crisis and its negative global economic effects were felt well beyond 2010. The financial crisis also underscored how important proper regulation of banks and near banks is for the growth and prosperity of the entire economy.

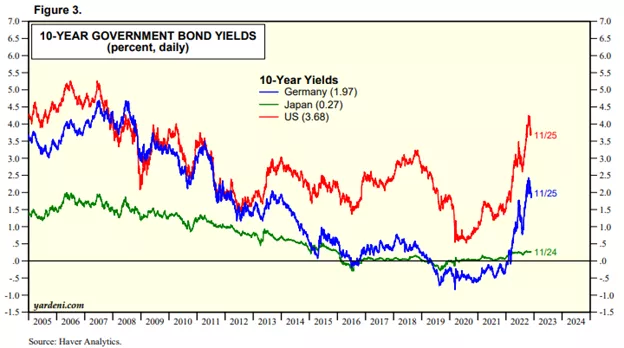

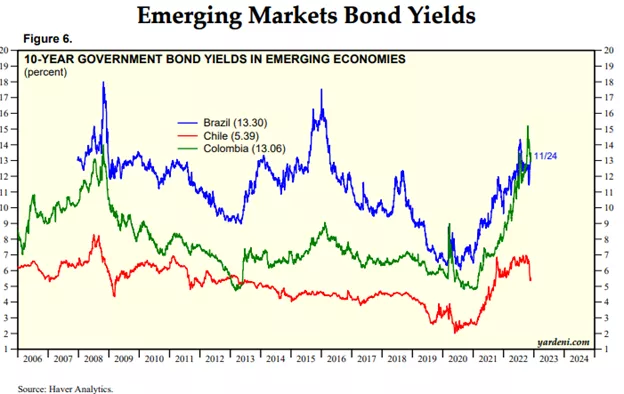

The following two charts underscore the recent large-scale increases in 10-year government bond yields, and also illustrate that the escalation in these rates has been far more severe for emerging market countries than for industrial economies.

For example, Brazil and Columbia’s ten-year bond yields were both above 13%, while Chile’s was 5.4%.

In terms of the large industrial economies, the recent interest rate hikes have been more severe in the US than in Germany. As well, Japan’s 10-year bonds are currently only modestly positive, indicating that Japan’s monetary tightening has not been as significant as in the other G7 countries.

Of course, the balance sheet changes at the major central banks are the key to the recent tightening of monetary policy.

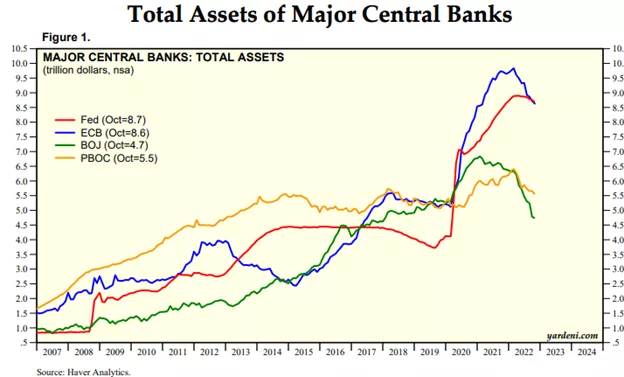

The third chart below compares the asset holdings of the Fed and the three other large central banks, the ECB, PBOC, and BOJ.

A minor bit of history here. The US Fed employed massive quantitative easing (i.e., expanding the balance sheet) coming off the 2008-09 financial crisis and flooded the financial markets with liquidity that supported a slow, gradual recovery. The three other central banks also rapidly expanded their balance sheets at the same time.

In the United States, the Fed’s balance sheet began to shrink in 2017 after it appeared that the economy had recovered sufficiently from the 2008-2009 financial crisis. That mild shrinking pattern ended when the Fed was forced to resume major quantitative easing in 2020 in response to the COVID-19 pandemic recession and malfunctioning money markets.

As the third chart highlights, we are once again in a quantitative tightening phase. The Fed has been engaged in quantitative tightening at the rate of about $95bn a month, i.e., by not pumping the proceeds of maturing Treasuries back into the bond market.

Some economists are now concerned that because of the interest rate hikes and the shrinking balance sheet we could see a repeat of a 2019 kind of liquidity crunch.

After all, the US economy is already showing signs of weakness and the US dollar has escalated sharply in global markets. The financial markets and equity markets are also understandably very edgy.

Knowing that monetary policy operates with long- and variable-time lags, the Fed could already be engaged in monetary policy overkill to regain control of inflation.

The key unknown is whether the Fed is inviting a global financial crisis by continuing to raise interest rates.