Initial Jobless Claims Confine To Forecast Benign Employment Conditions

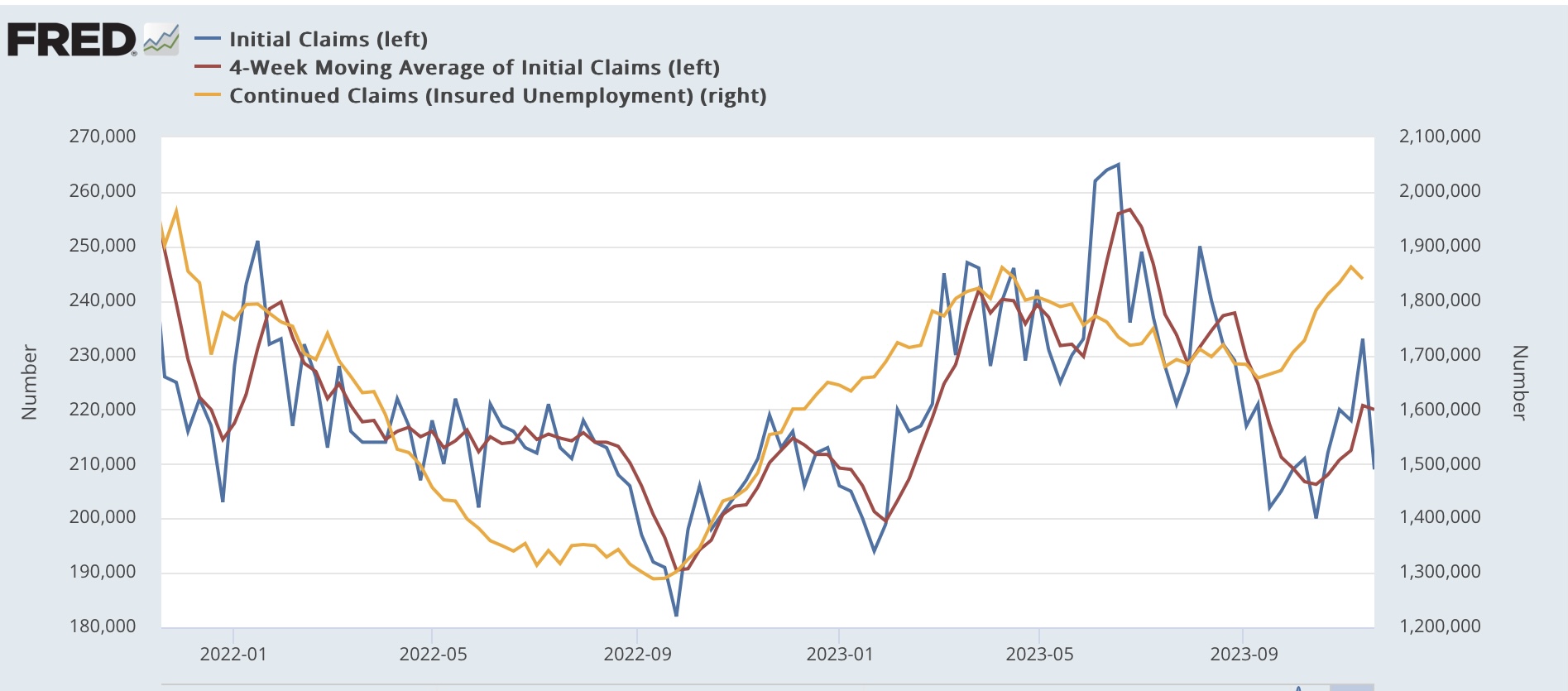

Initial claims declined from -14,000 to 209,000 last week, and the four-week moving average declined -750 to 220,000. With the usual one-week lag, continuing claims declined from -22,000 to 1.840 million:

(Click on image to enlarge)

On a YoY basis, both weekly claims and their four-week average were up only 4.6%. Continuing claims, which have been much more elevated YoY, were up 24.0%:

(Click on image to enlarge)

This is well below the 10% cautionary level.

There has been some commentary that continuing claims mean a recession is imminent or may even be underway. I am discounting that because initial claims have always signaled first, and also because continuing claims have been in the range of 25%-30% higher YoY for the last 6 months without worsening.

Turning to the update for the Sahm rule, on a monthly basis claims in November so far are up 3.5%. Since initial claims lead the unemployment rate by several months, that suggests an unemployment rate declining to about 3.6% in a few months (i.e., 3.5%*1.035=3.6%) from a more elevated 3.8%-4.0% level:

(Click on image to enlarge)

In short, claims are forecasting continued economic expansion.

More By This Author:

Existing homeowners with 3% mortgages remain frozen in placeWhy Has Residential Building Construction Remained So Strong?

Housing Construction Continues To Support Subdued Expansion

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.