Initial Claims Continue To Forecast Expansion

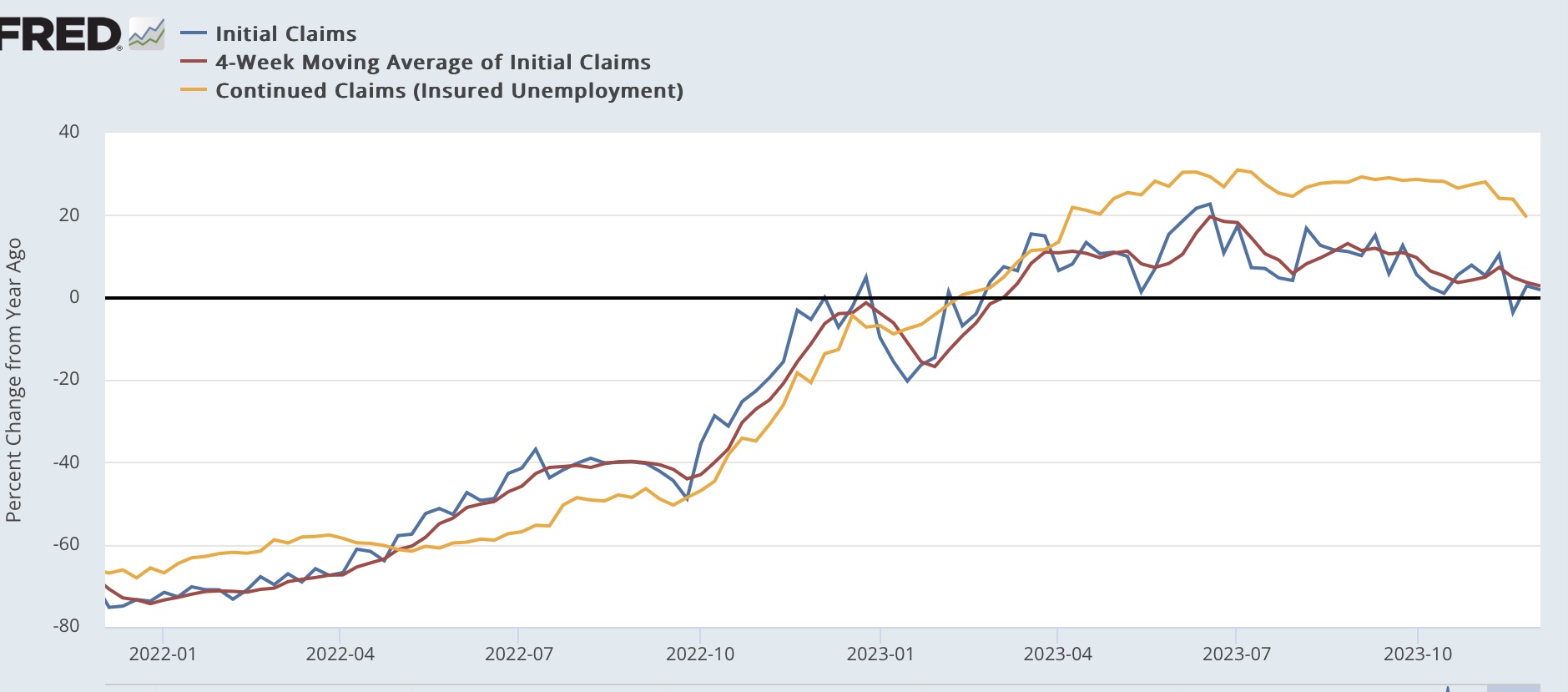

This morning we had our last look at initial jobless claims before tomorrow’s November jobs report. On a weekly basis, claims rose 1,000 to 221,000. The four-week average rose 500 to 220,750. With a one-week delay, continuing cliams declined 64,000 from last week’s 2 year high to 1.861 million:

(Click on image to enlarge)

While continuing claims have continued to be elevated, initial claims are right in the middle of their values for the past 2 years.

For forecasting purposes, the YoY% changes are what is most important, and there, initial claims were up only 1.9%, and the four-week average was up 2.8%, while continuing claims were up a much higher 19.4% (which is nevertheless the lowest YoY% increase in the past 6 months):

(Click on image to enlarge)

Since even the yellow flag warning is a 10% increase in initial claims YoY, this forecasts continued economic expansion in the immediate months ahead.

Since the first lead the second, this is confirmed by updating the comparison of monthly new jobless claims, up 3.6% YoY in November, with the unemployment rate forecast for the months ahead, which is likely to top out at 3.9%-4.0% (3.5%*1.10) and seems likely to decline from there to about 3.7%-3.8% (3.5%*1.03 to 1.05):

(Click on image to enlarge)

Remember that initial claims have historically always signaled recession before the Sahm rule, which constitutes confirmation.

In tomorrow’s jobs report, my focus will be on whether the data is most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration has been continuing. My expectation, based on the above analysis as well as real consumer spending, is that there is likely to be further deceleration in jobs gains compared with the last 6-month average of 205,000, and either a steady unemployment rate of 3.9% with a possible 0.1% increase to 4.0%. Additionally, based on the leading relationship of the quits rate to average hourly earnings, I expect YoY wage growth to remain steady at 4.4%, or to decline slightly further to 4.3%.

More By This Author:

Real Consumer Spending Forecasts Continuing Jobs DecelerationOctober JOLTS Report: Yet One More Month In The Ongoing Decelerating Trend

Construction Spending Is Holding Up The Economy

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.