Inflation: The Dow Is Down 36 Percent In Gold Terms Since 1929

Most people define inflation as rising consumer prices. Price inflation is part of the inflationary equation, but inflation also manifests in other ways, for instance, in asset inflation.

Keep in mind that inflation, properly defined, isn’t about prices. It is an increase in the supply of money and credit. Rising prices are symptomatic of monetary inflation.

When the Federal Reserve slashed interest rates to zero and launched quantitative easing for the first time in the wake of the 2008 financial crisis, many predicted there would be a spike in consumer prices. That never happened, leading some Keynesian economists to declare that money printing is harmless.

However, the monetary inflation created during the Great Recession did manifest, just not in consumer prices. It fed a major surge in asset prices that was clearly visible in the stock market. The S&P 500 rose by over 130 percent between 2010 and 2019.

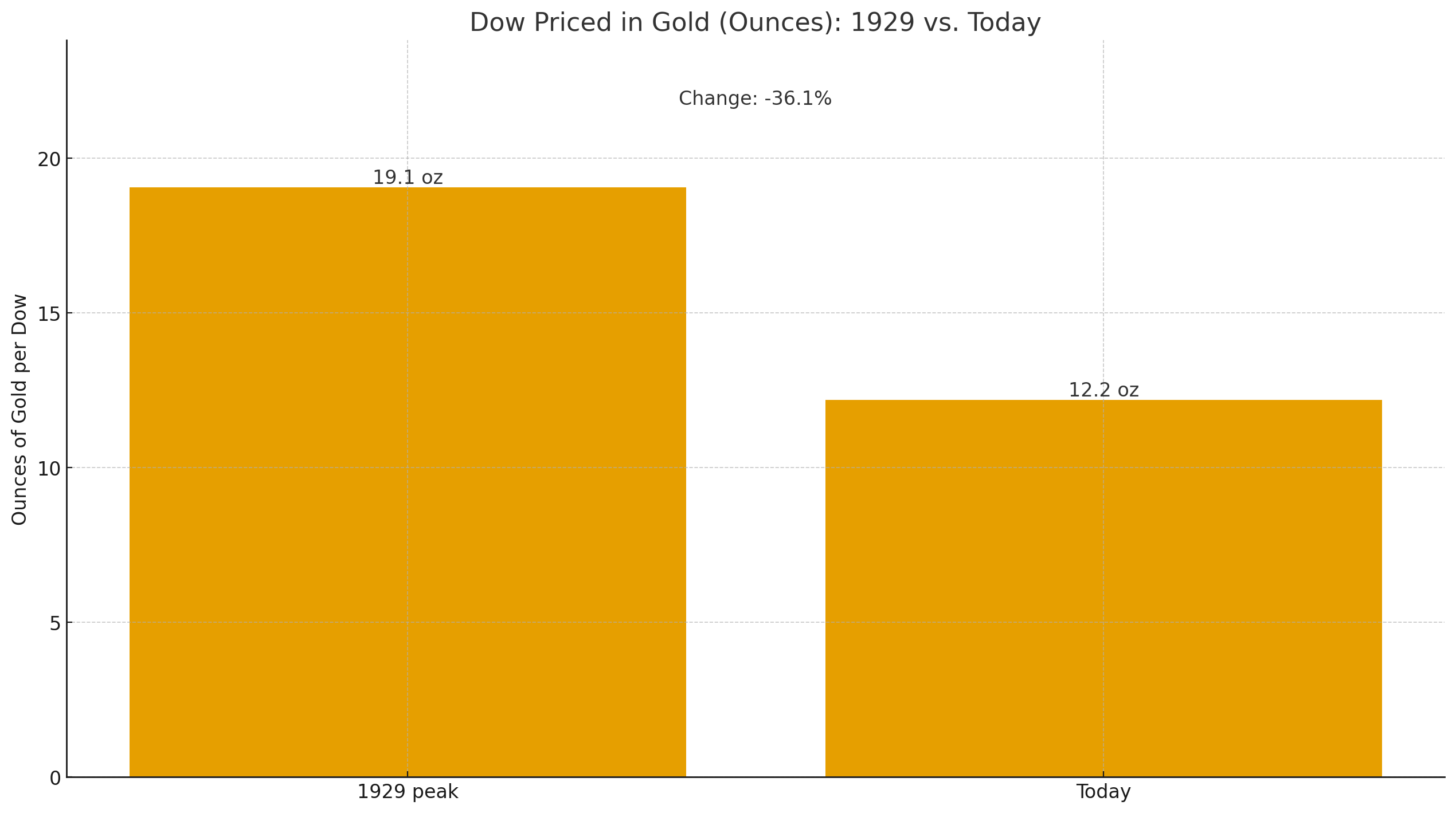

We can see the inflationary pressure on the stock market even more clearly when we price the Dow Jones in gold.

At its peak in 1929, before the crash, the Dow was 381.17, and the price of gold was $20 an ounce. Priced in gold, the Dow was around 19 ounces.

Today, the Dow is just over 46,300, while gold is around $3,800 an ounce. That means priced in gold, the Dow is just over 12 ounces.

That represents a 37 percent decline in the Dow in gold terms over the last 96 years.

Since gold is real, stable money, pricing the Dow in the yellow metal reveals that the appreciation of the stock market over the last century was predominantly driven by inflation.

Don’t be fooled. Inflation is pernicious and ever-present.

More By This Author:

Nothing Stops This TrainDespite Record Prices, Indians Are Holding On To Their Gold

Shocker: Inflation Is Worse Than The Government Data Reveals