Industrial Production Heats Up In July

If the news in the housing sector this morning was bad, the news from the King of Coincident Indicators, industrial production, was quite good.

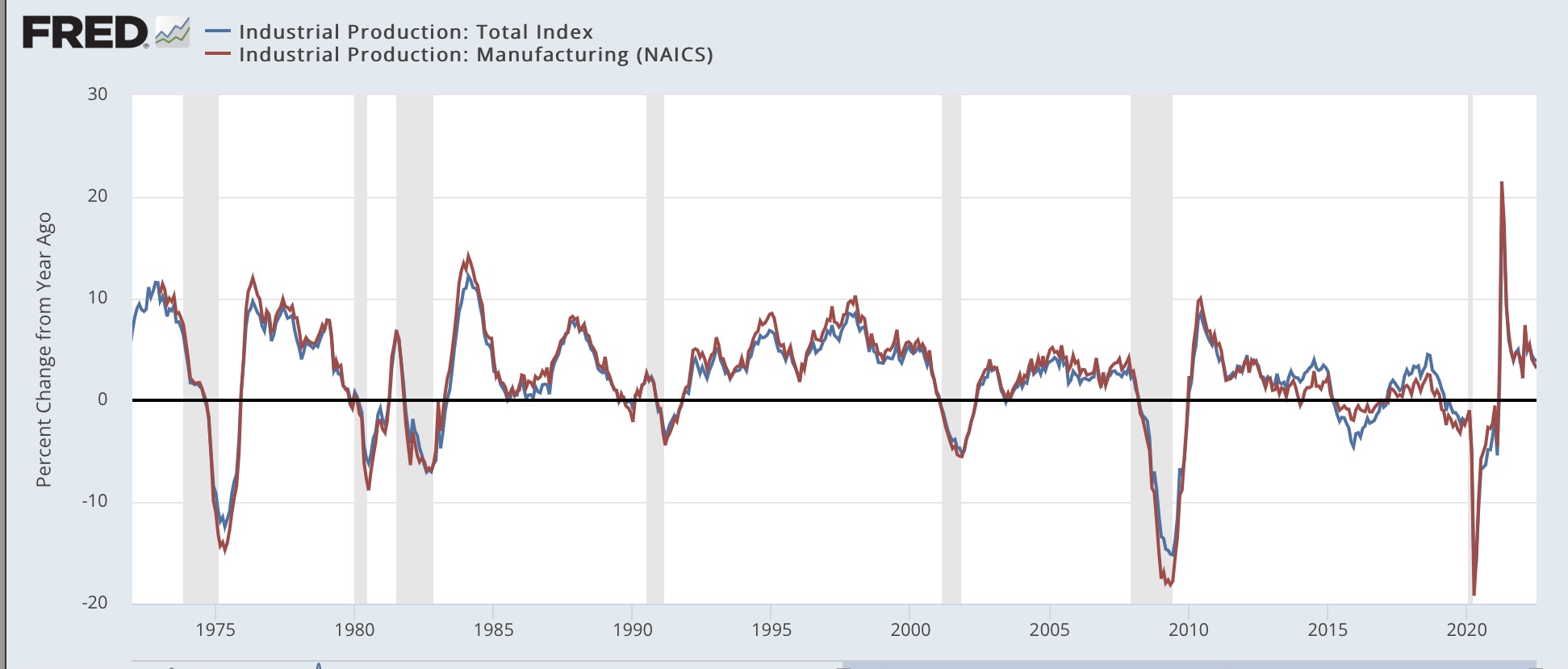

Total production rose 0.6% to a new all-time high. Manufacturing production rose 0.7%, and is below its April peak by only -0.1%:

(Click on image to enlarge)

Barring downward revisions, this, together with the latest blockbuster employment report, makes it *very* unlikely that the US was in recession as of July.

This is further shown by the YoY% changes in each. Currently, total production is up 3.9% and manufacturing production is up 3.2%. Typically recessions have started from much weaker comparisons, although 1973 (oil embargo) and 2008 (housing collapse) did start from similar YoY comparisons:

(Click on image to enlarge)

With oil and gas prices continued to decline in the past few weeks, I do not see any such sudden downdraft in the immediate present.

More By This Author:

Housing Affordability: At Or Near The Worst This MillenniumJuly Consumer Inflation: A Tale Of Two Disparate Trends

Previewing July CPI: Good News And Bad News About Gas, Housing, And Vehicle Prices

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.