In-Sample And Out-Of-Sample Recession Probabilities

Image Source: Pixabay

No apparent recession as of August 2024 data (my interpretation – see the opposing views here). Using year-ago financial data, what would have probit regressions have indicated? It matters which variables you use, and whether you include the 2020 recession.

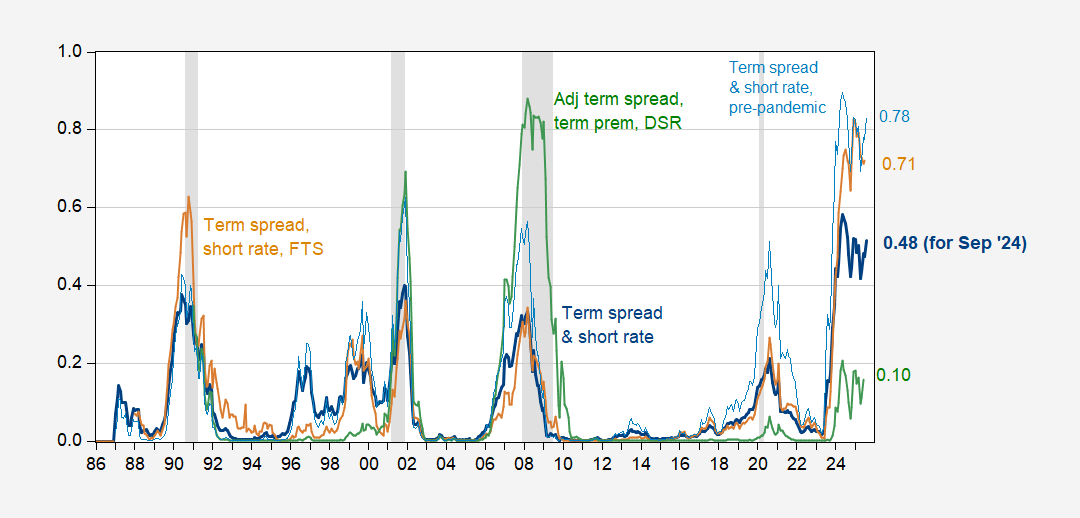

Figure 1: Year ahead probit regression estimated probabilities, using 10yr-3mo term spread and short rate (bold dark blue), same using sample ending before pandemic (light blue), term spread, short rate and foreign term spread (tan), term-premium adjusted 10yr-3mo term spread and term premium and debt-service ratio (green). Sample 1986-2024M08, assuming no recession has begun by 2024M08. NBER defined peak-to-trough recession dates shaded gray. Numbers indicate estimated probabilities for September 2024. Source: author’s calculations.

Discussion of use of foreign term spread, a la Ahmed-Chinn (JMCB, 2024) here; and use of debt-service ratio a la Chinn-Ferrara (2024) here. Breaking out the term premium discussed here.

Note that the probabilities associated with the term spread/short rate specification depend critically on the sample used, in particular whether the 2020 recession is included in the term spread & short rate specification. Using only term spread data up to 2018M12 (so recession/no recession dummies up to 2019M12) and predicting out-of-sample yields a recession probability of 78% in September (this month). Incorporating the 2020 recession into the sample results in only a 48% probability for this month (peak at 58% in May). If one thinks the 2020 recession would not have occurred without the pandemic, then one could reasonably argue for throwing that data out.

So… the recession may still come (or has already come and we don’t know it).

More By This Author:

EJ Antoni: Newly Released Data From The Commerce Department Shows The Nation Is In RecessionNowcasts Rising

State Employment Report For August