Immigration, Recovery And Inflation

Image Source: Pixabay

In the Fed’s recent examination of the differential recovery in the US as compared to the Euro area, UK and Canada, I was surprised that immigration did not make a bigger appearance, given my views.

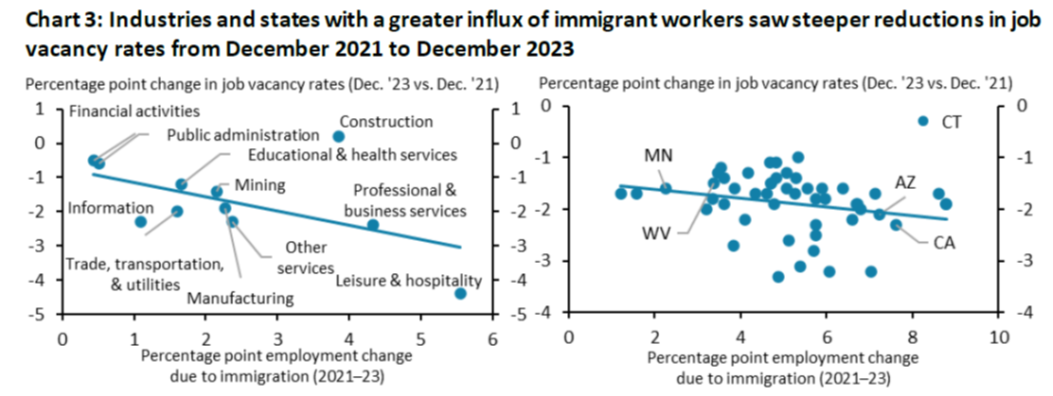

The KC Fed has just provided some insights into how immigration helped increase slack in the labor market (h/t Torsten Slok).

Source: Cohen/KC Fed (2024).

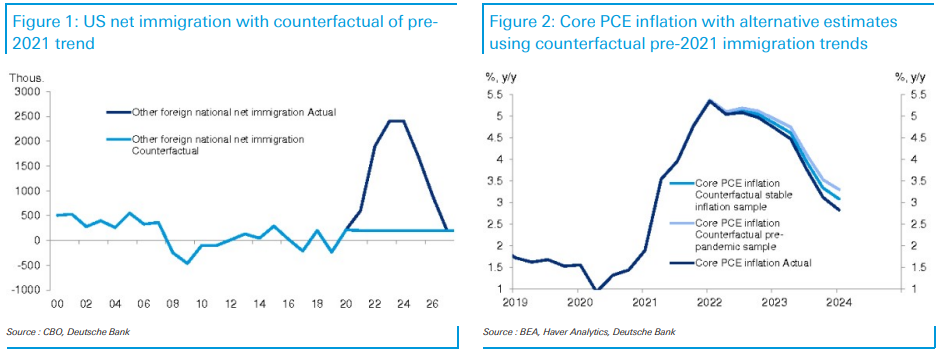

Deutsche Bank has taken a stab at assessing the impact of immigration on inflation by reference to a counterfactual.

Jim Reid at DB writes:

The conclusion [of Justin Weidner’s piece]: the labor market would have been substantially tighter if not for the uptick in immigration. A tighter labor market in the absence of immigration would have led to higher inflation. Using two inflation models, our economists find that core PCE inflation likely would have been 25-50bps higher (see second chart below), though they admit to meaningful uncertainty around these estimates. Immigration was clearly not the only disinflationary force for the US economy over the past year – to be sure, core PCE inflation fell 200bps in 2023 – but it was an important contributing factor

For an earlier discussion of labor force dynamics and immigration, see Edelberg and Watson (March 2024), and the longer term implications in CBO (2024).

More By This Author:

Confidence, News And Sentiment In MayOne Year Ahead Inflation Expectations For May

How Are Households Holding Up, Debtwise?