Housing Permits And Starts Stabilize, But Construction Comes Close To Generating Yellow Recession Caution Signal

There was good news and bad news in this morning’s report on housing permits, starts, and construction. The good news is that both permits and starts stabilized after last month’s initially reported multi-year lows. The bad news is that single family permits declined further, and even worse the metric best showing the actual economic impact of new housing, building units under construction, declined to a new 2+ year low, only slightly above the level where it gives a recession caution signal.

Let’s start with the good news. the longest leading signal in the data - permits (black in the graph below) - rose 47,000 or 3.4% on an annualized basis to 1.446 million. Starts (light blue), which are slightly less leading and much more noisy, rose 39,000 or 3.0% to 1.353 million annualized. Further, last month’s abysmal readings for permits and starts were both revised higher.

Now the bad news. Single family permits, which are the least noisy of all the leading data (red, right scale) declined a further -22,000 or 2.3% to 934,000 units annualized:

In other words, the rebound in permits was all about the much noisier multi-family unit sector (gold in the graph below), which increased sharply but not in any way breaking its general downtrend:

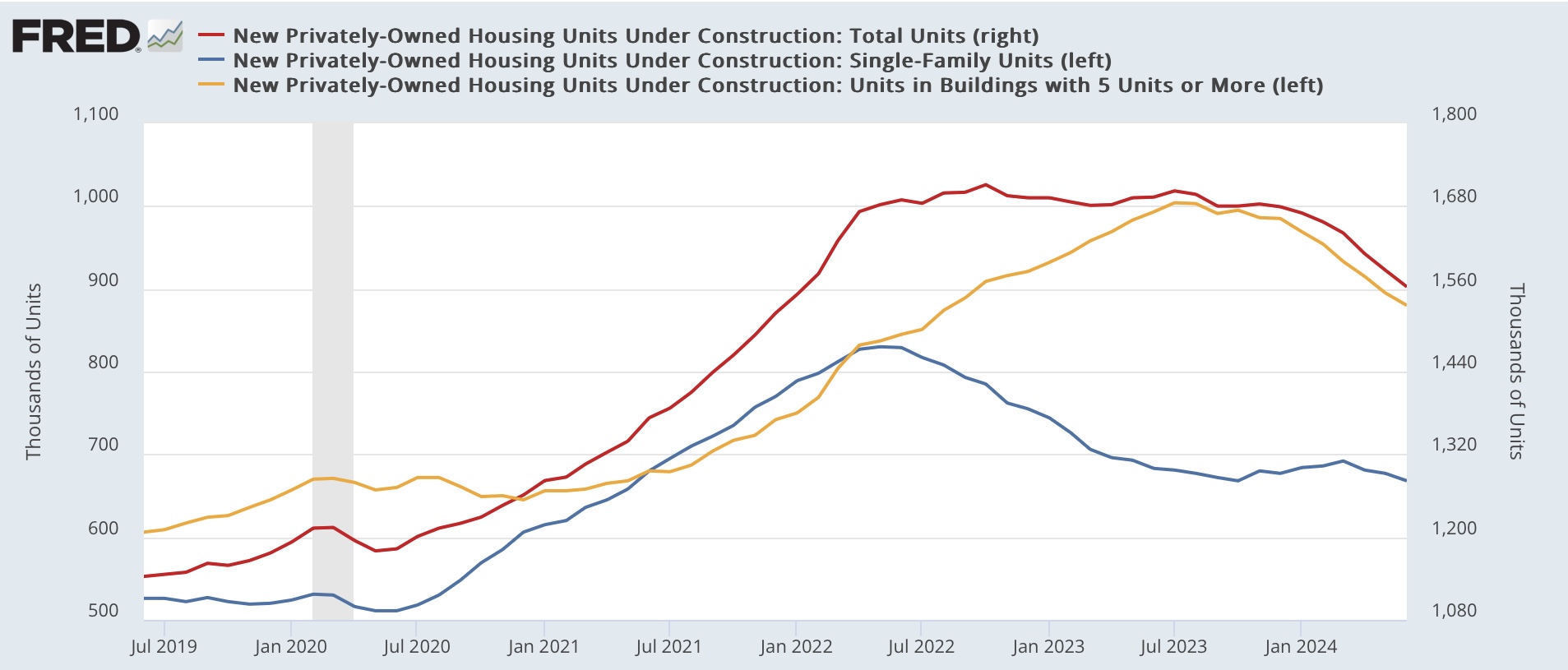

Now let’s turn to the bigger bad news. Ill spare you the long term graph this month, but usually it has taken more than a 10% decline in units under construction to be consistent with a recession. In 1970 and 2001, the declines were less than that. But in the late 1980s and 2000s, it took almost a 25% decline before a recession occurred.

With this morning's further decline, total units under construction (red, right scale) are now -8.6% below peak (vs. permits, black, left scale):

In the past few months I have commented that I did not expect this decline to exceed the -10% level, mainly because mortgage rates had stabilized, and mortgage rates lead permits and starts, which I also expected to stabilize. While obviously the situation is more dicey, I still believe we are getting close to, if not at, a stabilization point for units under construction, because mortgage rates are only slightly higher than they were one year ago, and depending on how you measure, are either generally flat or Elise in a slight uptrend (red, vs. permits, blue, right scale):

At the moment both single family units and multi-family units under construction are both in downtrends, but I expect single family units in particular to stabilize shortly, since that portion of the market was the first to turn down:

Earlier this month, I wrote that the economically weighted average of the ISM indexes was very close to generating a recession caution yellow flag. Yesterday I wrote that consumer spending as measured by retail sales already warranted such a flag. With this morning’s residential construction report, that sector too has gotten close to generating a yellow caution flag. The next big data I will be watching is whether personal spending on goods follows retail sales into cautionary territory, and whether employment in manufacturing and construction (the latter of which typically shortly lags, but follows, building units under construction), neither of which has turned down, change direction in the next few jobs report.

More By This Author:

The Yellow Caution Flag On Retail Consumption Is UpThe Inverted Treasury Yield Curve: We Are In Uncharted Territory

Real Average Nonsupervisory Wages Near, Real Aggregate Nonsupervisory Payrolls At All-Time Highs